Forecasting The Future: 4 Analyst Projections For Reliance

Author: Benzinga Insights | April 26, 2024 05:01pm

In the preceding three months, 4 analysts have released ratings for Reliance (NYSE:RS), presenting a wide array of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

3 |

1 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

2 |

0 |

0 |

0 |

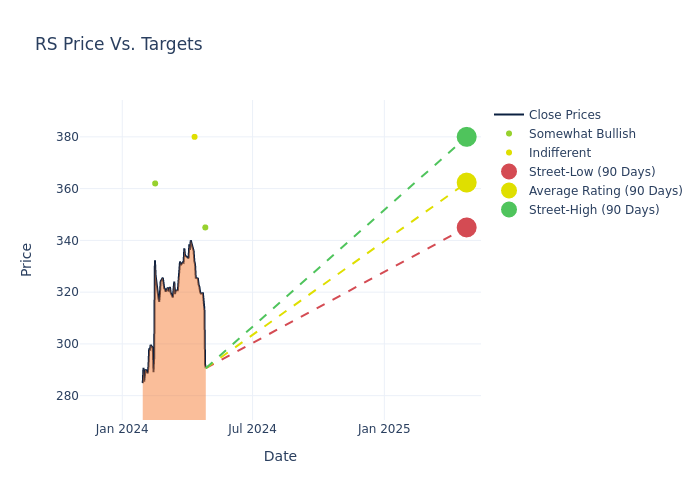

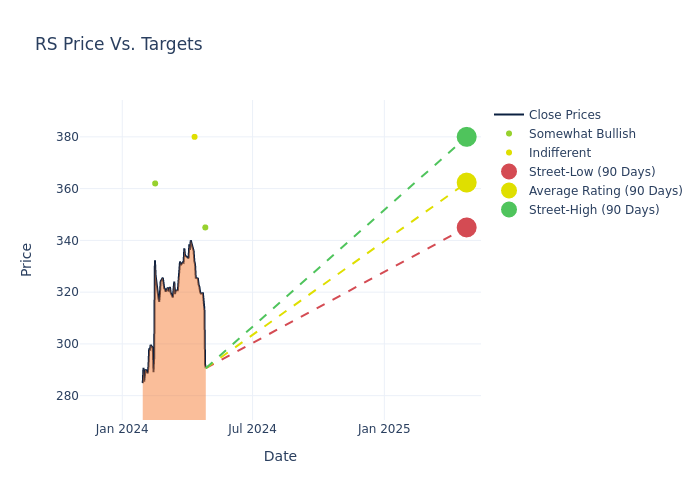

The 12-month price targets, analyzed by analysts, offer insights with an average target of $360.5, a high estimate of $380.00, and a low estimate of $345.00. This upward trend is apparent, with the current average reflecting a 17.24% increase from the previous average price target of $307.50.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Reliance. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Katja Jancic |

BMO Capital |

Lowers |

Outperform |

$345.00 |

$355.00 |

| Daniel Knauff |

Citigroup |

Raises |

Neutral |

$380.00 |

$280.00 |

| Katja Jancic |

BMO Capital |

Raises |

Outperform |

$355.00 |

$295.00 |

| Philip Gibbs |

Keybanc |

Raises |

Overweight |

$362.00 |

$300.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Reliance. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Reliance compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Reliance's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Reliance analyst ratings.

About Reliance

Reliance Inc is a diversified metal solutions provider and metals service center company. It provides value-added metals processing services and distributes.

Understanding the Numbers: Reliance's Finances

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Negative Revenue Trend: Examining Reliance's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -7.57% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Reliance's net margin excels beyond industry benchmarks, reaching 8.17%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Reliance's ROE excels beyond industry benchmarks, reaching 3.53%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Reliance's ROA excels beyond industry benchmarks, reaching 2.6%. This signifies efficient management of assets and strong financial health.

Debt Management: Reliance's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.18.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: RS