Decoding FedEx's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 26, 2024 04:01pm

Whales with a lot of money to spend have taken a noticeably bearish stance on FedEx.

Looking at options history for FedEx (NYSE:FDX) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $305,995 and 4, calls, for a total amount of $154,569.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $260.0 to $310.0 for FedEx over the recent three months.

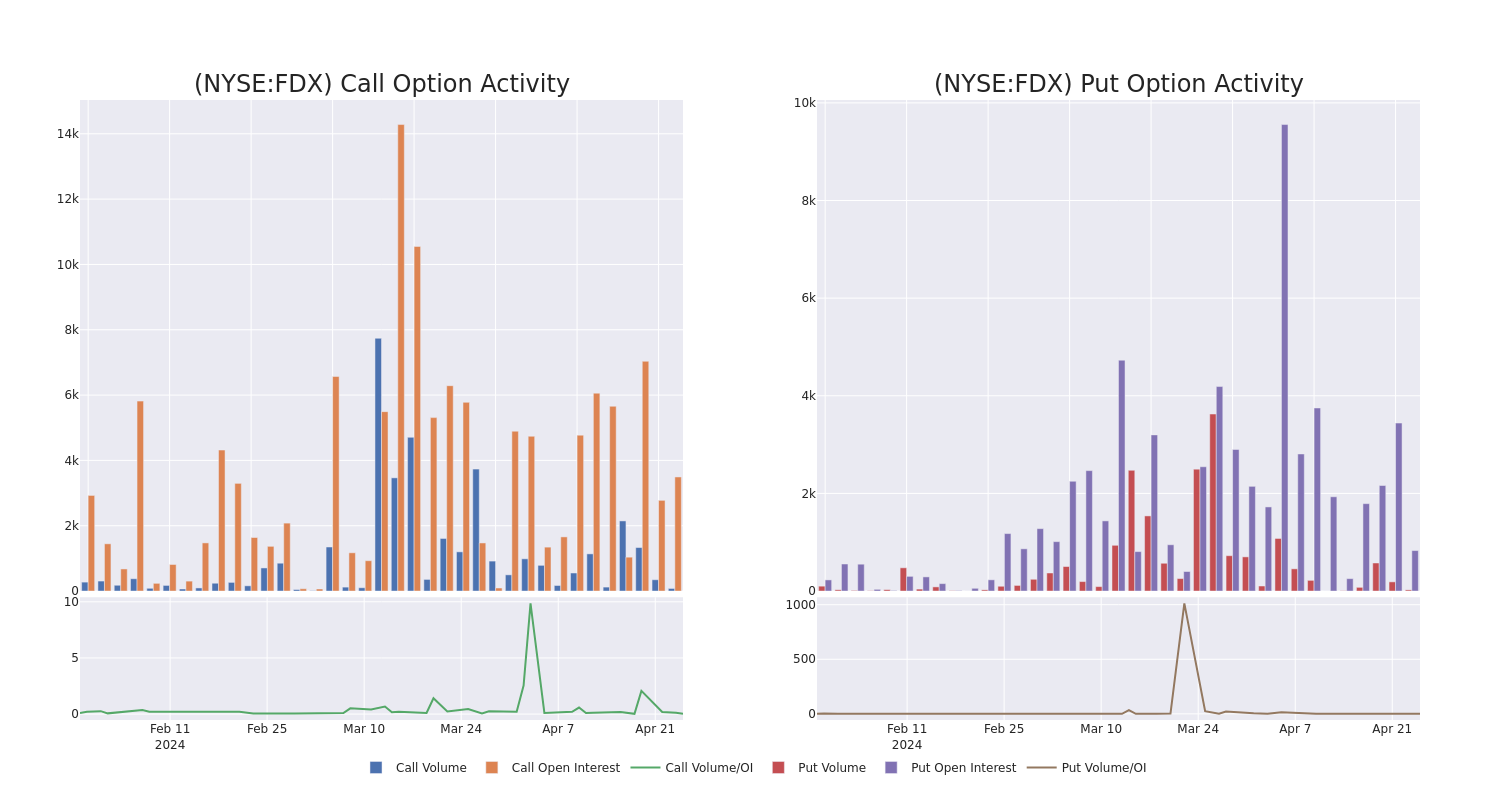

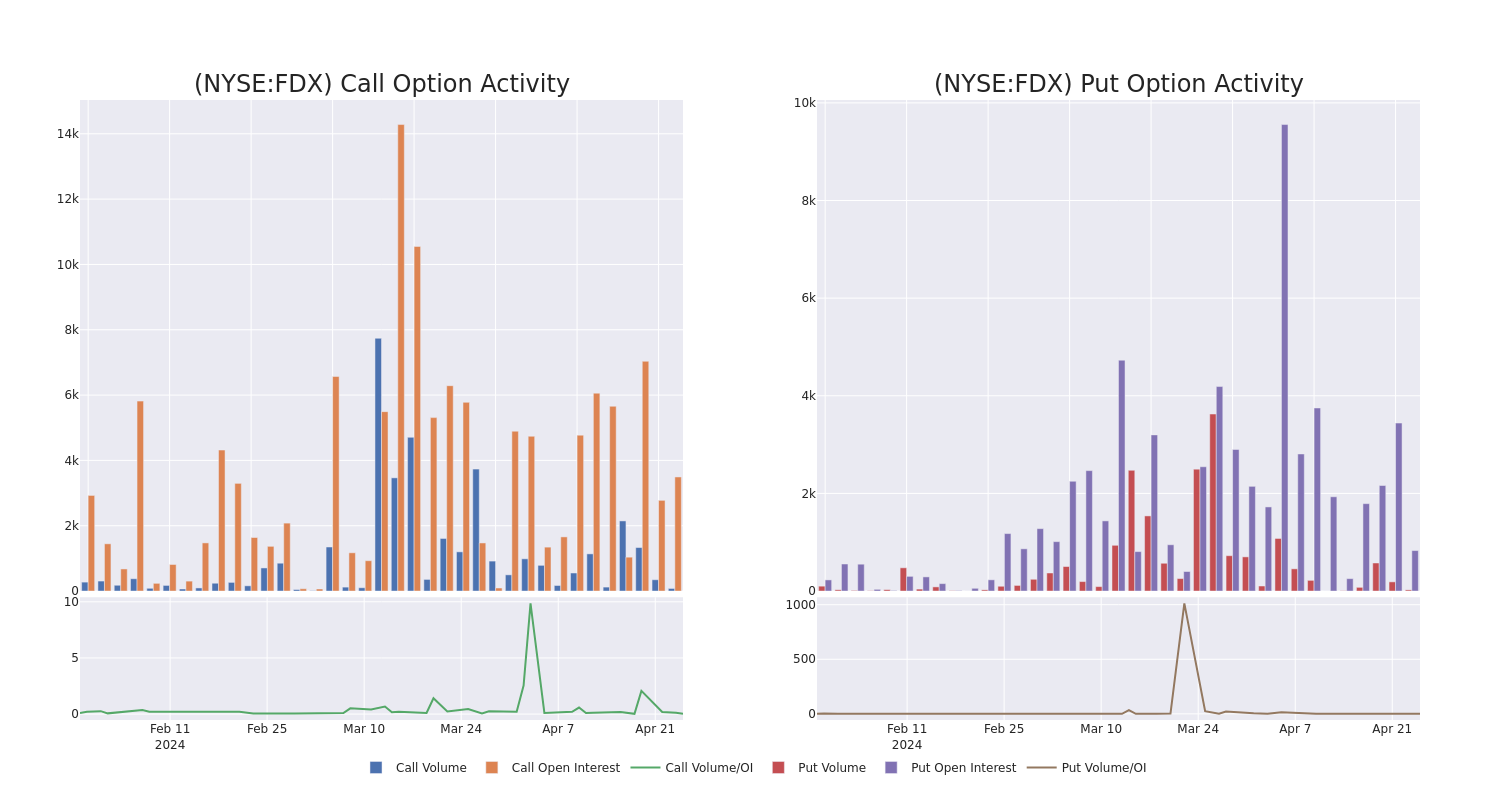

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for FedEx's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of FedEx's whale activity within a strike price range from $260.0 to $310.0 in the last 30 days.

FedEx Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| FDX |

PUT |

SWEEP |

BEARISH |

09/20/24 |

$23.45 |

$23.3 |

$23.45 |

$280.00 |

$51.6K |

281 |

43 |

| FDX |

PUT |

SWEEP |

BEARISH |

07/19/24 |

$9.2 |

$9.05 |

$9.2 |

$260.00 |

$47.8K |

663 |

71 |

| FDX |

CALL |

SWEEP |

BEARISH |

09/20/24 |

$4.6 |

$4.45 |

$4.5 |

$310.00 |

$45.0K |

100 |

100 |

| FDX |

PUT |

TRADE |

BULLISH |

05/03/24 |

$16.65 |

$15.25 |

$15.75 |

$282.50 |

$44.1K |

0 |

28 |

| FDX |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$3.75 |

$3.6 |

$3.6 |

$270.00 |

$43.2K |

870 |

137 |

About FedEx

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2023, which ended May 2023, FedEx derived 47% of revenue from its express division, 37% from ground, and 11% from freight, its asset-based less-than-truckload shipping segment. The remainder comes from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016. TNT was previously the fourth-largest global parcel delivery provider.

FedEx's Current Market Status

- With a volume of 676,250, the price of FDX is up 0.33% at $266.39.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 53 days.

Professional Analyst Ratings for FedEx

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $321.5.

- An analyst from B of A Securities persists with their Buy rating on FedEx, maintaining a target price of $340.

- An analyst from Stifel has decided to maintain their Buy rating on FedEx, which currently sits at a price target of $303.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.

Posted In: FDX