Analyst Ratings For Compass Minerals Intl

Author: Benzinga Insights | April 26, 2024 03:00pm

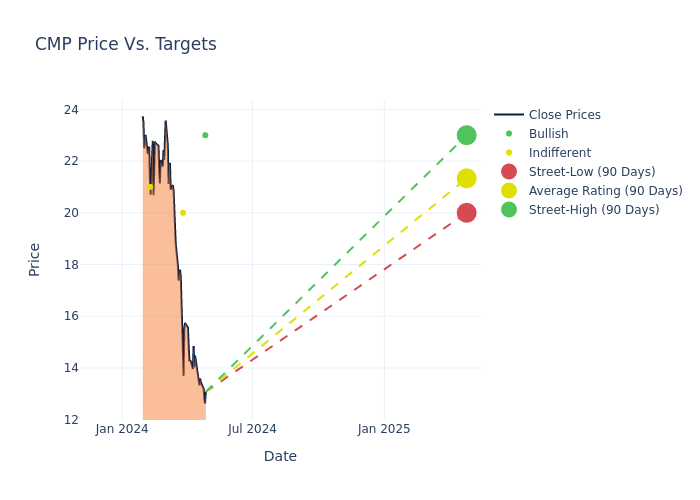

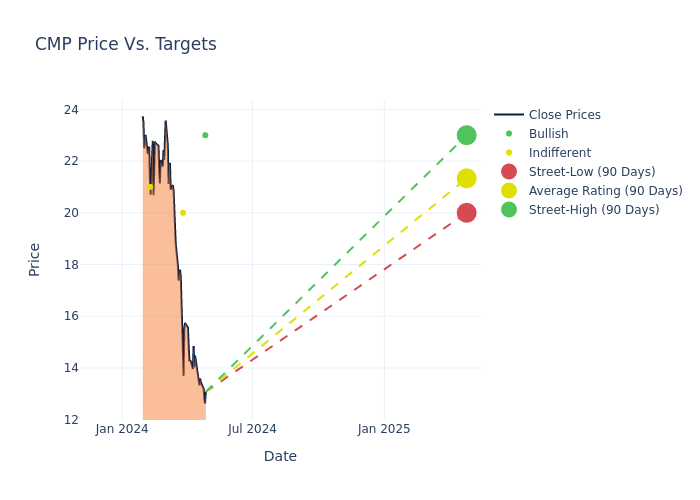

Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Compass Minerals Intl (NYSE:CMP) in the last three months.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

0 |

3 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

2 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

Insights from analysts' 12-month price targets are revealed, presenting an average target of $22.5, a high estimate of $26.00, and a low estimate of $20.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 13.46%.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Compass Minerals Intl. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Chris Kapsch |

Loop Capital |

Lowers |

Buy |

$23.00 |

$26.00 |

| Joel Jackson |

BMO Capital |

Lowers |

Market Perform |

$20.00 |

$25.00 |

| Chris Kapsch |

Loop Capital |

Lowers |

Hold |

$26.00 |

$29.00 |

| Jeffrey Zekauskas |

JP Morgan |

Lowers |

Neutral |

$21.00 |

$24.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Compass Minerals Intl. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Compass Minerals Intl compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Compass Minerals Intl's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Compass Minerals Intl's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Compass Minerals Intl analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Compass Minerals Intl: A Closer Look

Compass Minerals currently produces two primary products: salt and specialty potash fertilizer. The company's main assets include rock salt mines in Ontario, Canada, the us state of Louisiana, and the United Kingdom. The fertilizer is produced from a brine operation at the Great Salt Lake in Utah that produces sulfate of potash and magnesium chloride. Compass' salt products are used for deicing and also by industrial and consumer end markets. The firm's sulfate of potash is used by growers of high-value crops that are sensitive to standard potash.

Compass Minerals Intl: A Financial Overview

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Negative Revenue Trend: Examining Compass Minerals Intl's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -3.04% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: Compass Minerals Intl's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -22.04% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Compass Minerals Intl's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -15.41%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Compass Minerals Intl's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -4.16%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.99, caution is advised due to increased financial risk.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CMP