Smart Money Is Betting Big In HOOD Options

Author: Benzinga Insights | April 26, 2024 01:31pm

Investors with a lot of money to spend have taken a bullish stance on Robinhood Markets (NASDAQ:HOOD).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with HOOD, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Robinhood Markets.

This isn't normal.

The overall sentiment of these big-money traders is split between 62% bullish and 37%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $89,504, and 6 are calls, for a total amount of $202,775.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $17.5 to $20.5 for Robinhood Markets during the past quarter.

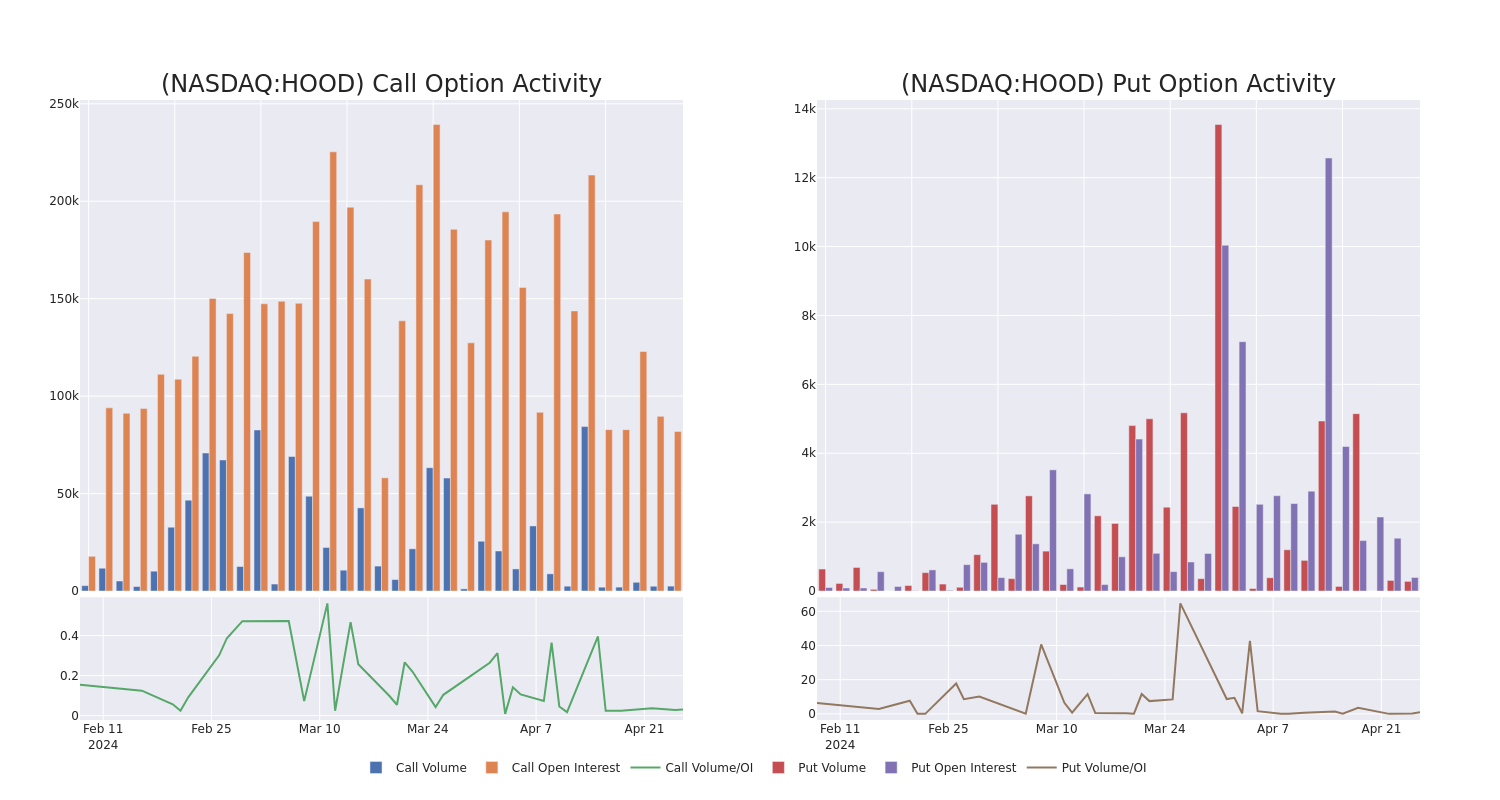

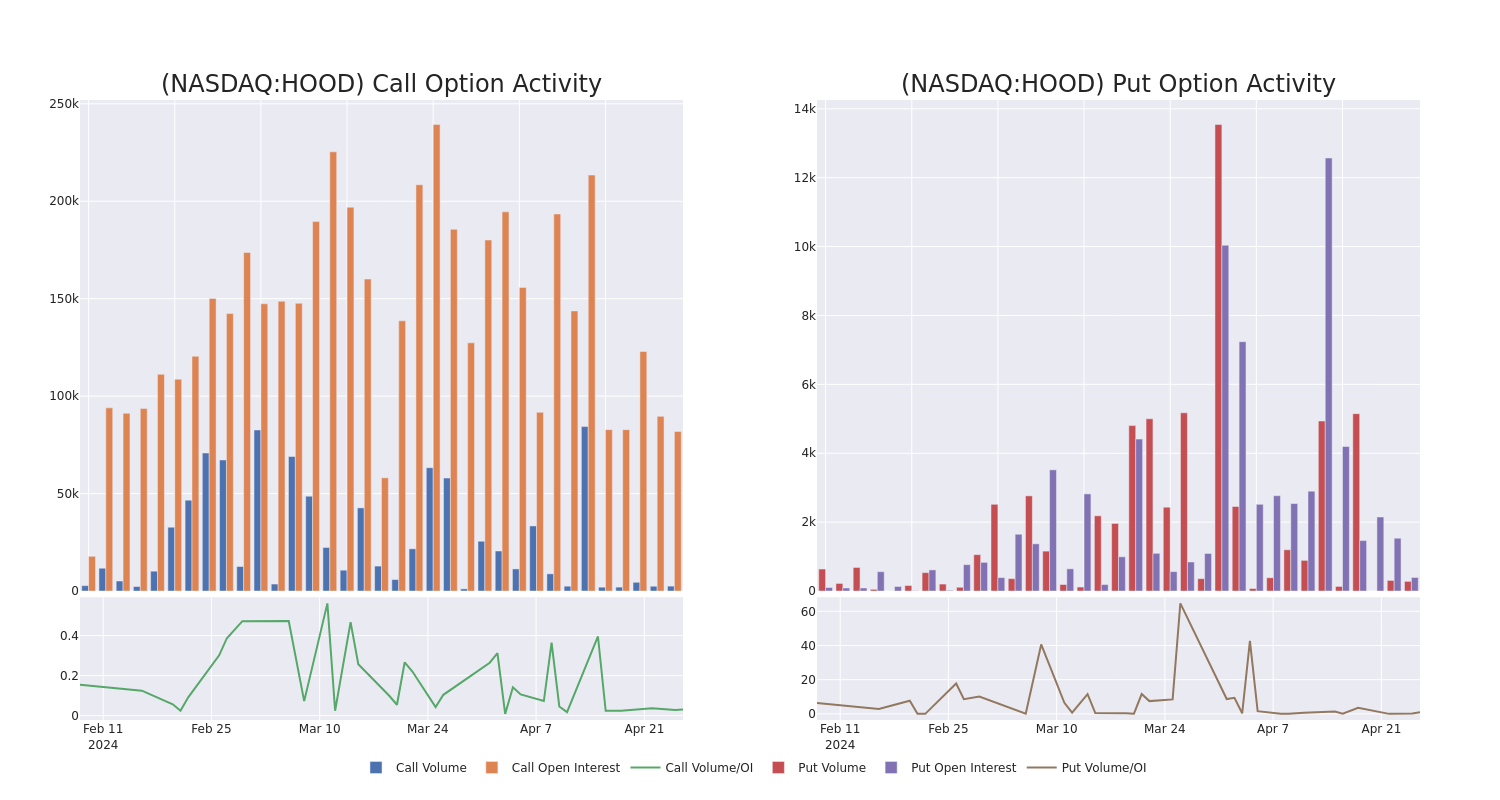

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Robinhood Markets's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Robinhood Markets's significant trades, within a strike price range of $17.5 to $20.5, over the past month.

Robinhood Markets 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| HOOD |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$3.7 |

$3.65 |

$3.7 |

$20.50 |

$57.7K |

4 |

1 |

| HOOD |

CALL |

TRADE |

BULLISH |

01/16/26 |

$5.35 |

$5.25 |

$5.35 |

$20.00 |

$52.9K |

31.0K |

181 |

| HOOD |

CALL |

TRADE |

BULLISH |

06/21/24 |

$1.05 |

$1.03 |

$1.05 |

$20.00 |

$35.4K |

36.4K |

934 |

| HOOD |

PUT |

SWEEP |

BULLISH |

05/10/24 |

$1.2 |

$1.16 |

$1.16 |

$17.50 |

$31.7K |

390 |

279 |

| HOOD |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$1.18 |

$1.16 |

$1.18 |

$18.00 |

$29.5K |

10.6K |

577 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

After a thorough review of the options trading surrounding Robinhood Markets, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Robinhood Markets's Current Market Status

- With a volume of 4,247,856, the price of HOOD is up 3.65% at $17.75.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 12 days.

Professional Analyst Ratings for Robinhood Markets

In the last month, 5 experts released ratings on this stock with an average target price of $19.6.

- An analyst from Keybanc persists with their Overweight rating on Robinhood Markets, maintaining a target price of $23.

- Reflecting concerns, an analyst from Citigroup lowers its rating to Sell with a new price target of $16.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Robinhood Markets, targeting a price of $18.

- An analyst from Barclays persists with their Underweight rating on Robinhood Markets, maintaining a target price of $16.

- An analyst from JMP Securities has revised its rating downward to Market Outperform, adjusting the price target to $25.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Robinhood Markets with Benzinga Pro for real-time alerts.

Posted In: HOOD