Chipotle Mexican Grill Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | April 26, 2024 12:31pm

Financial giants have made a conspicuous bearish move on Chipotle Mexican Grill. Our analysis of options history for Chipotle Mexican Grill (NYSE:CMG) revealed 61 unusual trades.

Delving into the details, we found 34% of traders were bullish, while 39% showed bearish tendencies. Out of all the trades we spotted, 19 were puts, with a value of $778,701, and 42 were calls, valued at $4,170,820.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1690.0 to $4400.0 for Chipotle Mexican Grill over the recent three months.

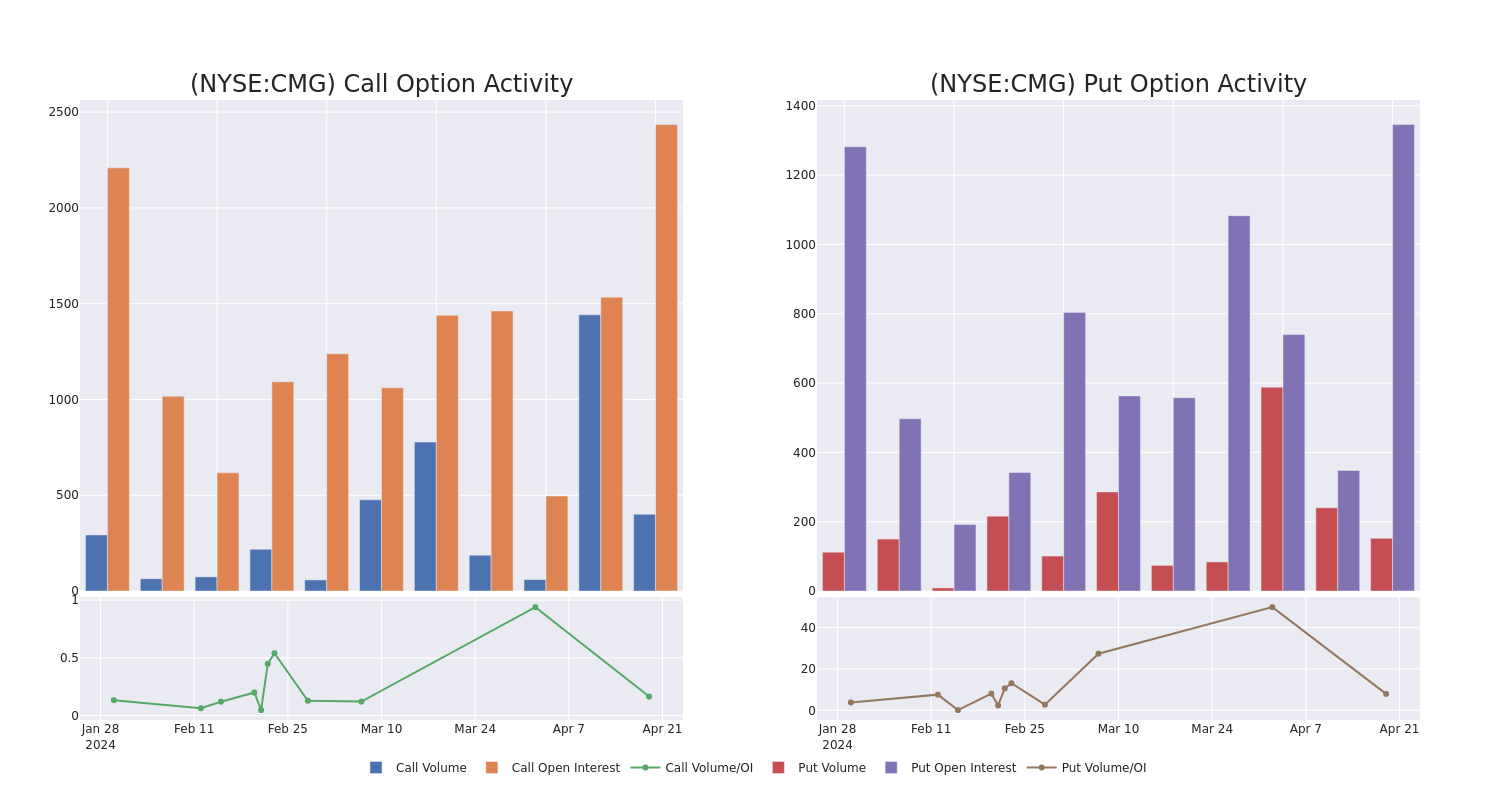

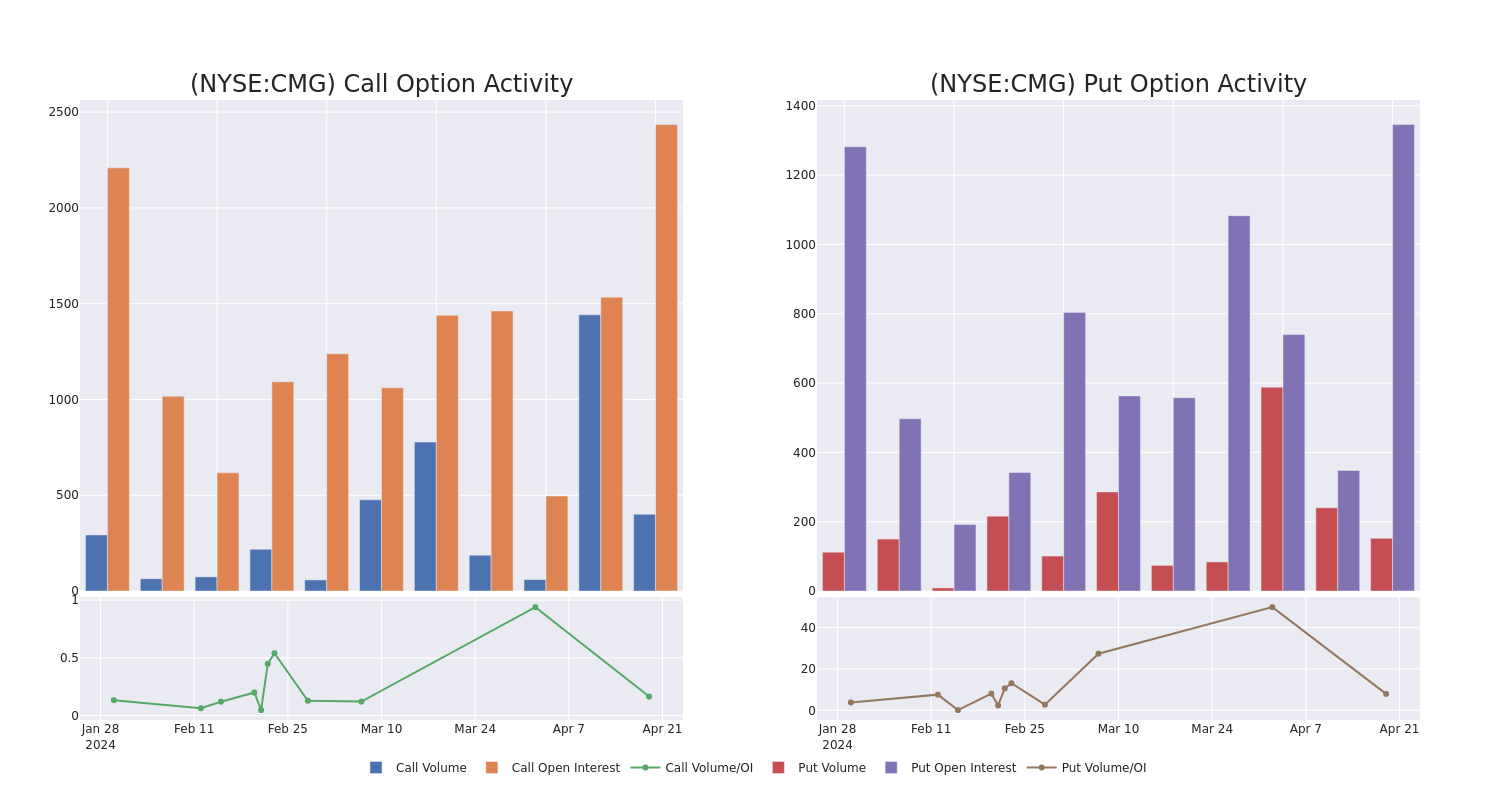

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Chipotle Mexican Grill's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chipotle Mexican Grill's whale activity within a strike price range from $1690.0 to $4400.0 in the last 30 days.

Chipotle Mexican Grill Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CMG |

CALL |

TRADE |

BEARISH |

06/21/24 |

$277.1 |

$272.0 |

$272.0 |

$2950.00 |

$1.0M |

147 |

50 |

| CMG |

CALL |

TRADE |

BEARISH |

12/20/24 |

$128.3 |

$126.2 |

$126.2 |

$3700.00 |

$189.3K |

1 |

15 |

| CMG |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$427.9 |

$424.0 |

$424.0 |

$2765.00 |

$169.6K |

8 |

2 |

| CMG |

CALL |

SWEEP |

BULLISH |

07/19/24 |

$159.9 |

$151.9 |

$156.74 |

$3175.00 |

$159.6K |

0 |

11 |

| CMG |

CALL |

TRADE |

BEARISH |

09/20/24 |

$310.7 |

$299.7 |

$304.0 |

$3050.00 |

$152.0K |

16 |

1 |

About Chipotle Mexican Grill

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is predominately company-owned (it recently inked a development agreement with Alshaya Group in the Middle East), with a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although the firm maintains a small presence in Canada, the U.K., France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

Following our analysis of the options activities associated with Chipotle Mexican Grill, we pivot to a closer look at the company's own performance.

Present Market Standing of Chipotle Mexican Grill

- Trading volume stands at 134,005, with CMG's price up by 1.99%, positioned at $3173.83.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 89 days.

What Analysts Are Saying About Chipotle Mexican Grill

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $3049.2.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Chipotle Mexican Grill, targeting a price of $2750.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Chipotle Mexican Grill, which currently sits at a price target of $2986.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Chipotle Mexican Grill, targeting a price of $3600.

- An analyst from TD Cowen has revised its rating downward to Buy, adjusting the price target to $2900.

- Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Equal-Weight with a new price target of $3010.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chipotle Mexican Grill options trades with real-time alerts from Benzinga Pro.

Posted In: CMG