This Is What Whales Are Betting On Intuit

Author: Benzinga Insights | April 26, 2024 12:15pm

Investors with a lot of money to spend have taken a bullish stance on Intuit (NASDAQ:INTU).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with INTU, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Intuit.

This isn't normal.

The overall sentiment of these big-money traders is split between 37% bullish and 37%, bearish.

Out of all of the options we uncovered, 7 are puts, for a total amount of $451,035, and there was 1 call, for a total amount of $29,200.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $630.0 to $650.0 for Intuit over the last 3 months.

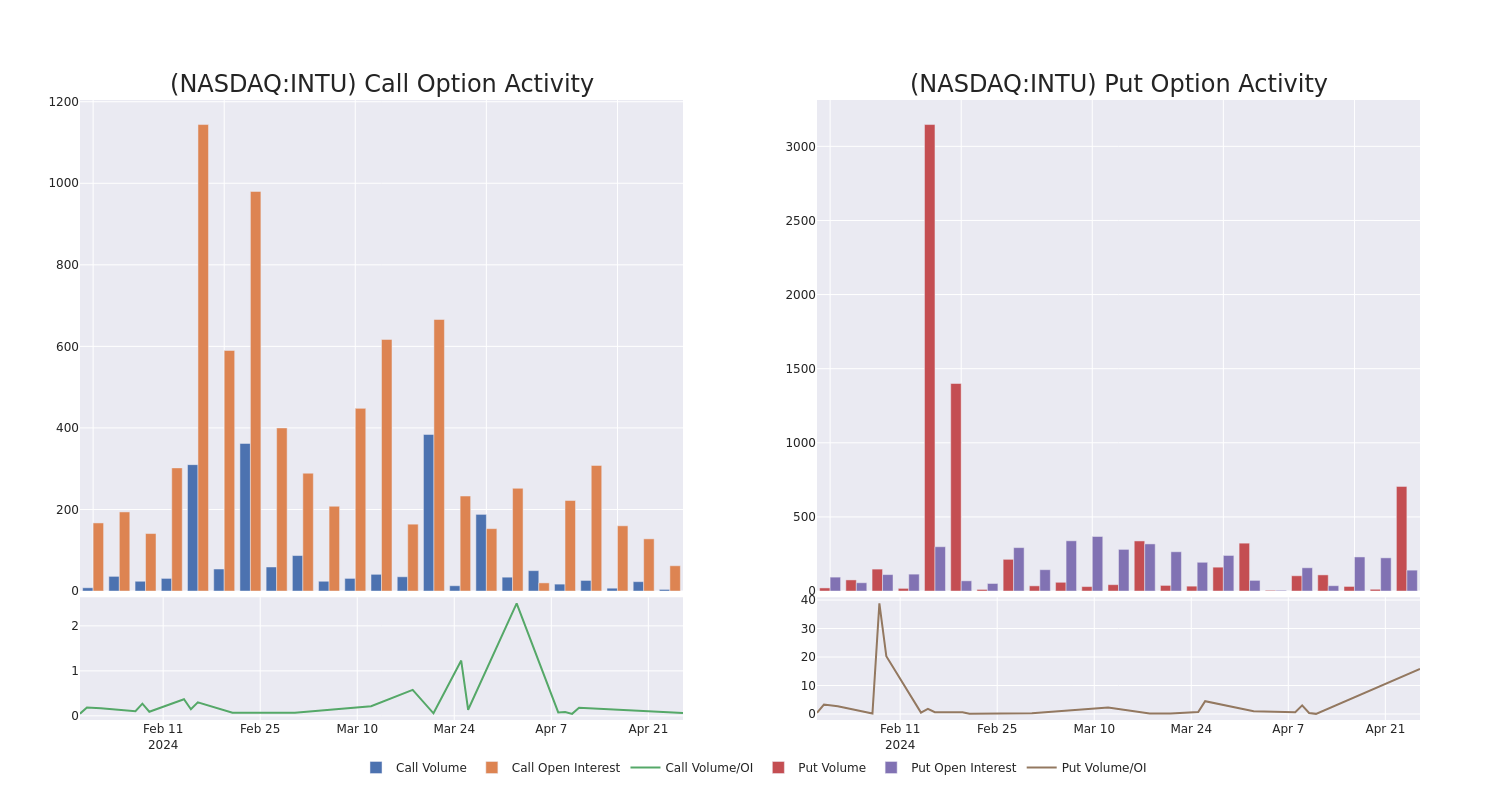

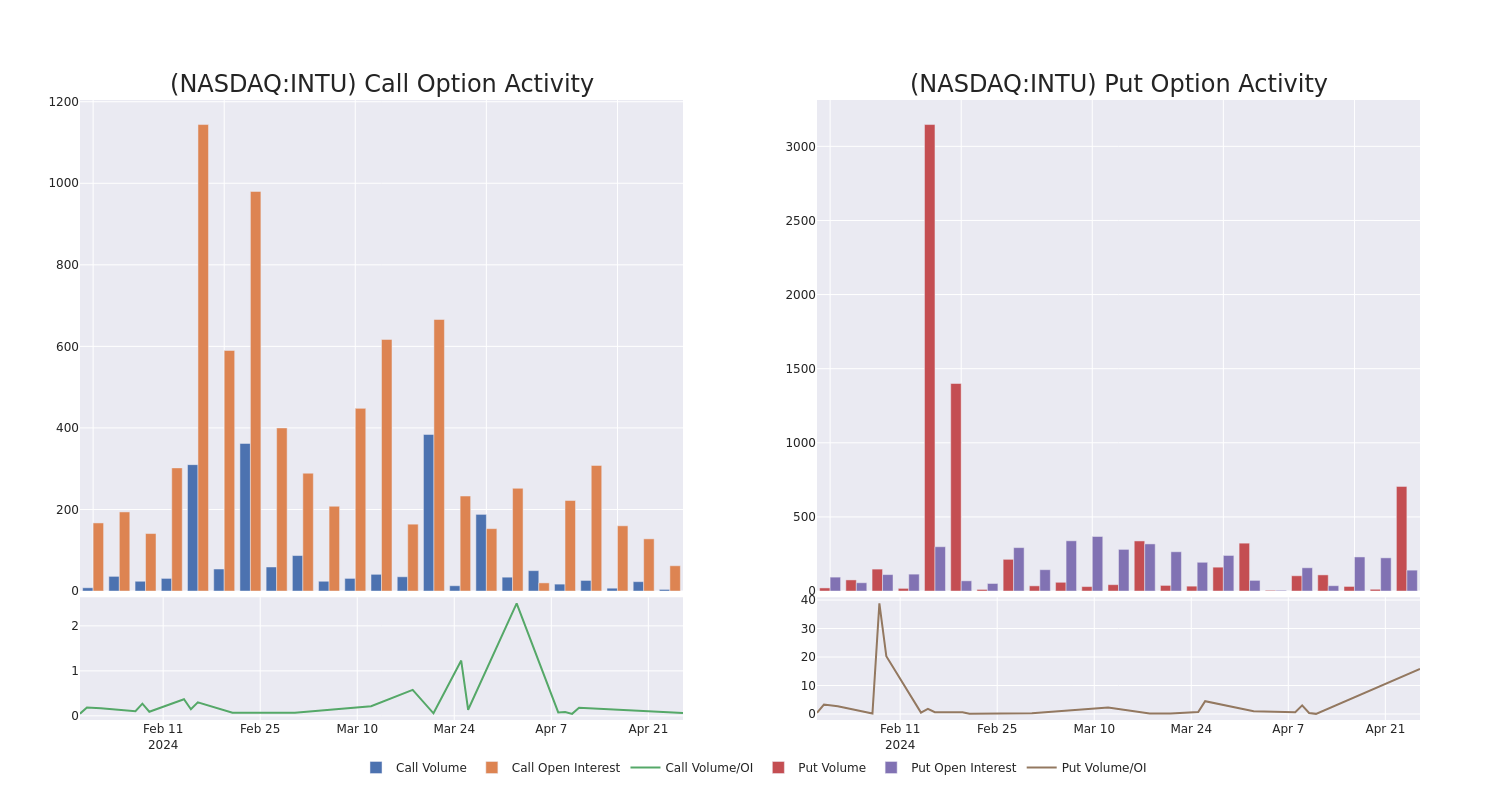

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Intuit stands at 50.75, with a total volume reaching 710.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Intuit, situated within the strike price corridor from $630.0 to $650.0, throughout the last 30 days.

Intuit Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| INTU |

PUT |

TRADE |

NEUTRAL |

09/20/24 |

$50.3 |

$49.2 |

$49.7 |

$650.00 |

$99.4K |

42 |

178 |

| INTU |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$50.9 |

$49.8 |

$50.1 |

$650.00 |

$80.1K |

42 |

74 |

| INTU |

PUT |

TRADE |

BULLISH |

09/20/24 |

$50.5 |

$49.3 |

$49.7 |

$650.00 |

$79.5K |

42 |

158 |

| INTU |

PUT |

TRADE |

NEUTRAL |

09/20/24 |

$50.5 |

$49.0 |

$49.7 |

$650.00 |

$69.5K |

42 |

122 |

| INTU |

PUT |

SWEEP |

BEARISH |

09/20/24 |

$50.1 |

$49.9 |

$50.1 |

$650.00 |

$65.1K |

42 |

14 |

About Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of U.S. market share for small-business accounting and do-it-yourself tax-filing software.

Having examined the options trading patterns of Intuit, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Intuit

- With a trading volume of 303,418, the price of INTU is up by 0.97%, reaching $632.47.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 25 days from now.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuit with Benzinga Pro for real-time alerts.

Posted In: INTU