Taiwan Semiconductor's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 26, 2024 12:00pm

Financial giants have made a conspicuous bullish move on Taiwan Semiconductor. Our analysis of options history for Taiwan Semiconductor (NYSE:TSM) revealed 31 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $268,516, and 23 were calls, valued at $3,753,617.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $140.0 for Taiwan Semiconductor, spanning the last three months.

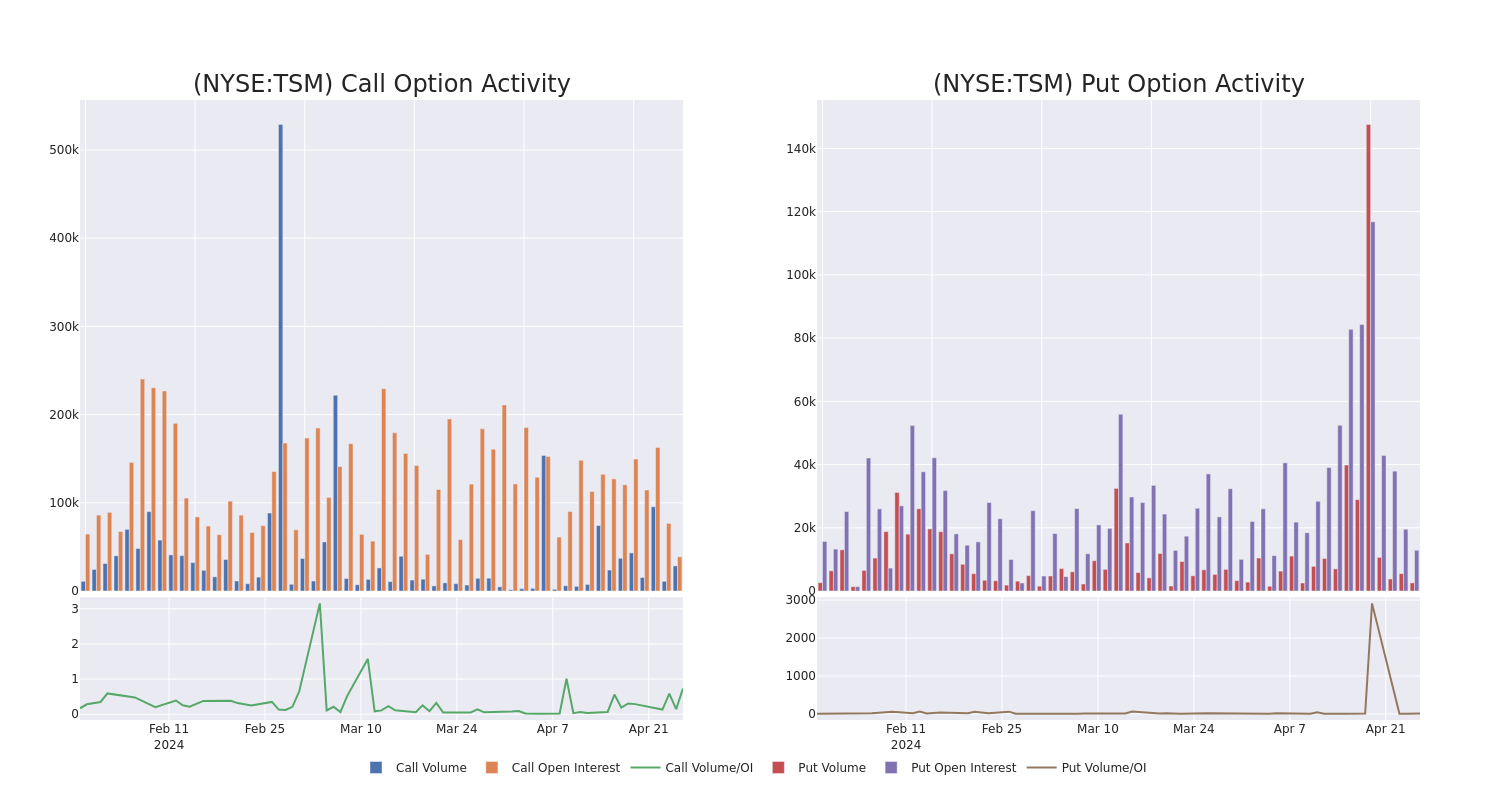

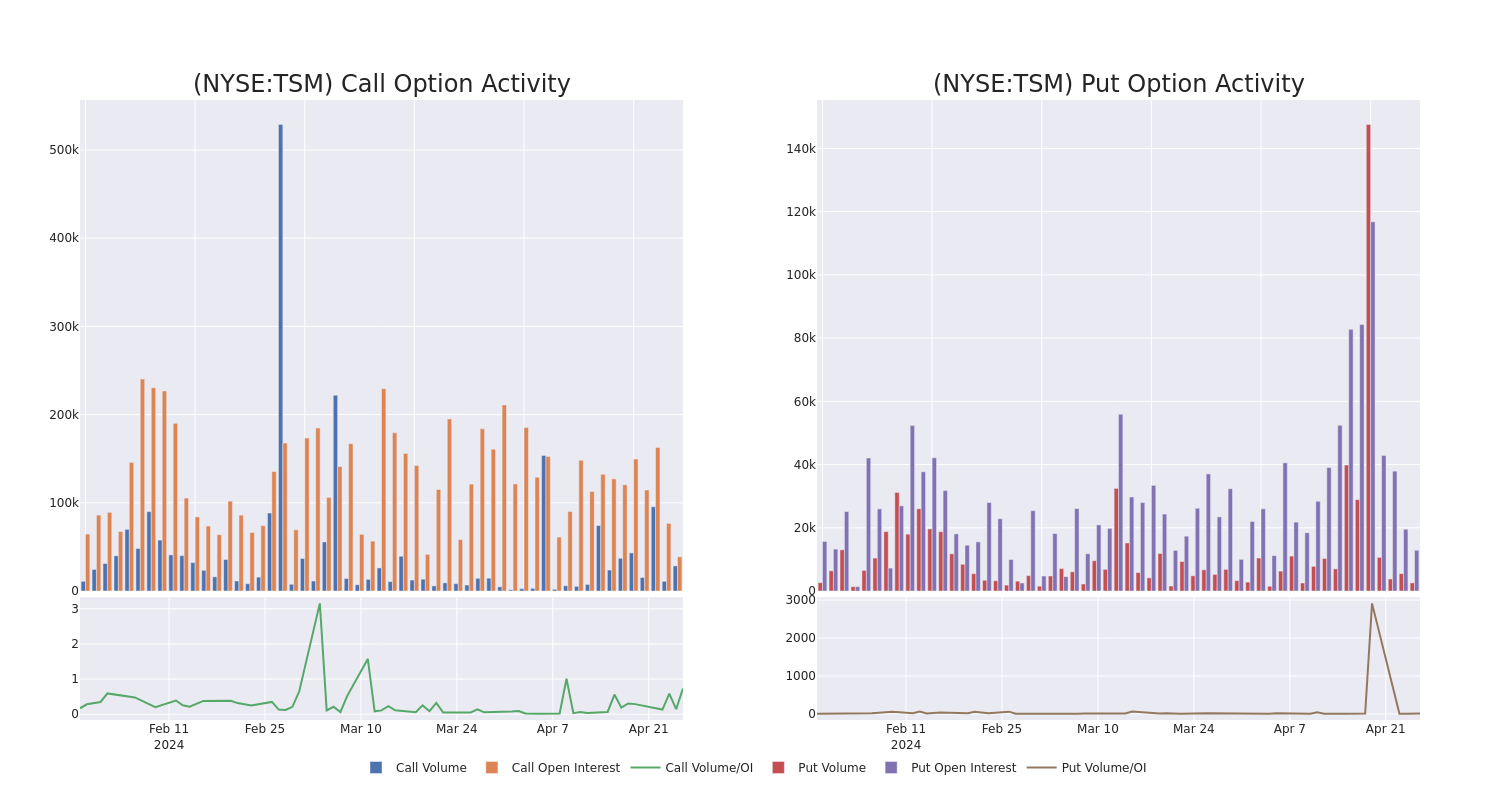

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Taiwan Semiconductor options trades today is 3446.93 with a total volume of 31,055.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Taiwan Semiconductor's big money trades within a strike price range of $80.0 to $140.0 over the last 30 days.

Taiwan Semiconductor Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TSM |

CALL |

SWEEP |

NEUTRAL |

07/19/24 |

$14.05 |

$13.85 |

$13.95 |

$130.00 |

$659.5K |

9.1K |

4.0K |

| TSM |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$14.2 |

$14.15 |

$14.15 |

$130.00 |

$557.5K |

9.1K |

866 |

| TSM |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$14.1 |

$13.95 |

$14.01 |

$130.00 |

$326.1K |

9.1K |

2.0K |

| TSM |

CALL |

SWEEP |

NEUTRAL |

06/21/24 |

$6.45 |

$6.4 |

$6.44 |

$140.00 |

$304.2K |

22.7K |

3.5K |

| TSM |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$14.1 |

$13.95 |

$14.04 |

$130.00 |

$187.8K |

9.1K |

1.7K |

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with almost 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the U.S. in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Having examined the options trading patterns of Taiwan Semiconductor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Taiwan Semiconductor

- Trading volume stands at 4,476,603, with TSM's price up by 0.96%, positioned at $137.89.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 83 days.

Professional Analyst Ratings for Taiwan Semiconductor

In the last month, 5 experts released ratings on this stock with an average target price of $162.2.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Taiwan Semiconductor, targeting a price of $180.

- Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Taiwan Semiconductor, targeting a price of $168.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $168.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Taiwan Semiconductor, targeting a price of $150.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Taiwan Semiconductor, targeting a price of $145.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Taiwan Semiconductor, Benzinga Pro gives you real-time options trades alerts.

Posted In: TSM