The Analyst Verdict: Tradeweb Markets In The Eyes Of 8 Experts

Author: Benzinga Insights | April 26, 2024 11:01am

In the last three months, 8 analysts have published ratings on Tradeweb Markets (NASDAQ:TW), offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

4 |

2 |

0 |

0 |

| Last 30D |

0 |

1 |

1 |

0 |

0 |

| 1M Ago |

1 |

2 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

1 |

0 |

0 |

0 |

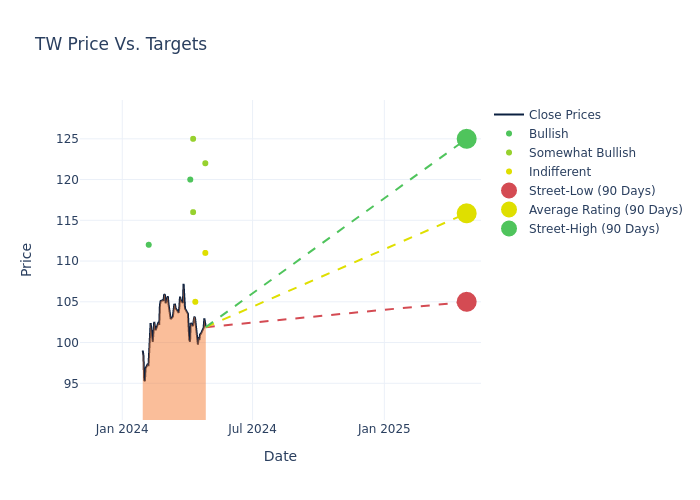

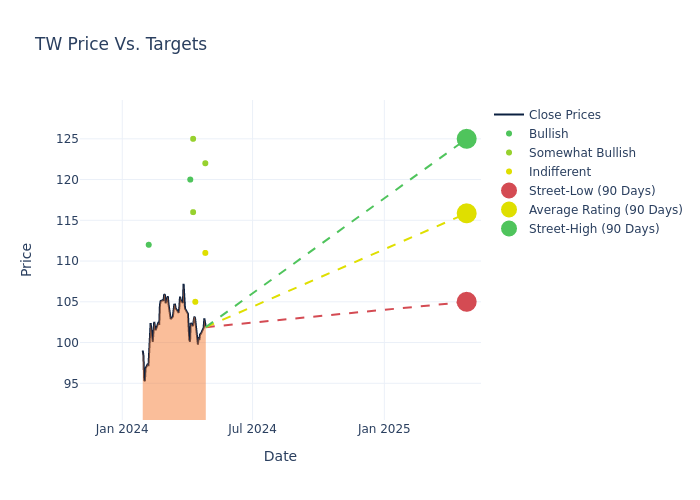

Insights from analysts' 12-month price targets are revealed, presenting an average target of $116.62, a high estimate of $125.00, and a low estimate of $105.00. This current average has increased by 4.48% from the previous average price target of $111.62.

Interpreting Analyst Ratings: A Closer Look

The standing of Tradeweb Markets among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jeremy Campbell |

Barclays |

Raises |

Overweight |

$122.00 |

$118.00 |

| Kyle Voigt |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$111.00 |

$110.00 |

| Patrick Moley |

Piper Sandler |

Raises |

Neutral |

$105.00 |

$100.00 |

| Michael Cyprys |

Morgan Stanley |

Raises |

Overweight |

$125.00 |

$122.00 |

| Kenneth Worthington |

JP Morgan |

Raises |

Overweight |

$116.00 |

$113.00 |

| Christopher Allen |

Citigroup |

Raises |

Buy |

$120.00 |

$115.00 |

| Michael Cyprys |

Morgan Stanley |

Raises |

Overweight |

$122.00 |

$112.00 |

| Andrew Bond |

Rosenblatt |

Raises |

Buy |

$112.00 |

$103.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Tradeweb Markets. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Tradeweb Markets compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Tradeweb Markets's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Tradeweb Markets's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Tradeweb Markets analyst ratings.

All You Need to Know About Tradeweb Markets

Founded in 1998 and headquartered in New York City, Tradeweb Markets is a leading fixed-income trading platform. While it does offer electronic processing for some voice-negotiated trades, the company focuses primarily on providing electronic trading networks that connect broker/dealers, institutional clients, and retail customers. While the company offers trading in a wide variety of products, the bulk of its business is in U.S. and European government debt, mortgage-backed securities, interest-rate swaps, and U.S. and international corporate bonds. The firm also sells fixed-income trading and price data, primarily through a deal with Refinitiv's Eikon service.

Breaking Down Tradeweb Markets's Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, Tradeweb Markets showcased positive performance, achieving a revenue growth rate of 26.26% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Tradeweb Markets's net margin excels beyond industry benchmarks, reaching 24.11%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Tradeweb Markets's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.68%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Tradeweb Markets's ROA excels beyond industry benchmarks, reaching 1.32%. This signifies efficient management of assets and strong financial health.

Debt Management: Tradeweb Markets's debt-to-equity ratio is below the industry average at 0.01, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TW