Smart Money Is Betting Big In MARA Options

Author: Benzinga Insights | April 26, 2024 11:00am

High-rolling investors have positioned themselves bearish on Marathon Digital Holdings (NASDAQ:MARA), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in MARA often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 17 options trades for Marathon Digital Holdings. This is not a typical pattern.

The sentiment among these major traders is split, with 35% bullish and 47% bearish. Among all the options we identified, there was one put, amounting to $35,250, and 16 calls, totaling $588,404.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $11.0 and $50.0 for Marathon Digital Holdings, spanning the last three months.

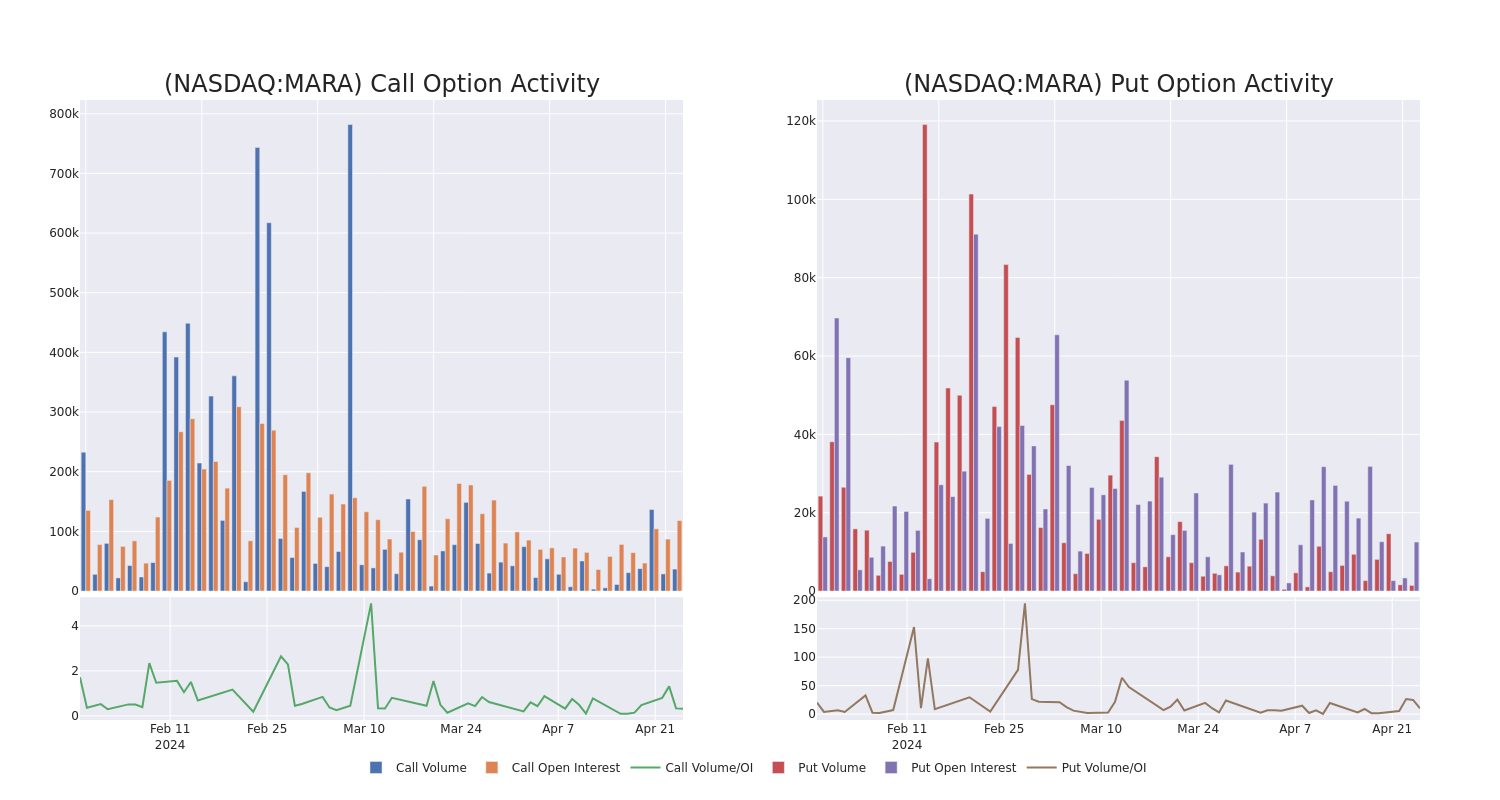

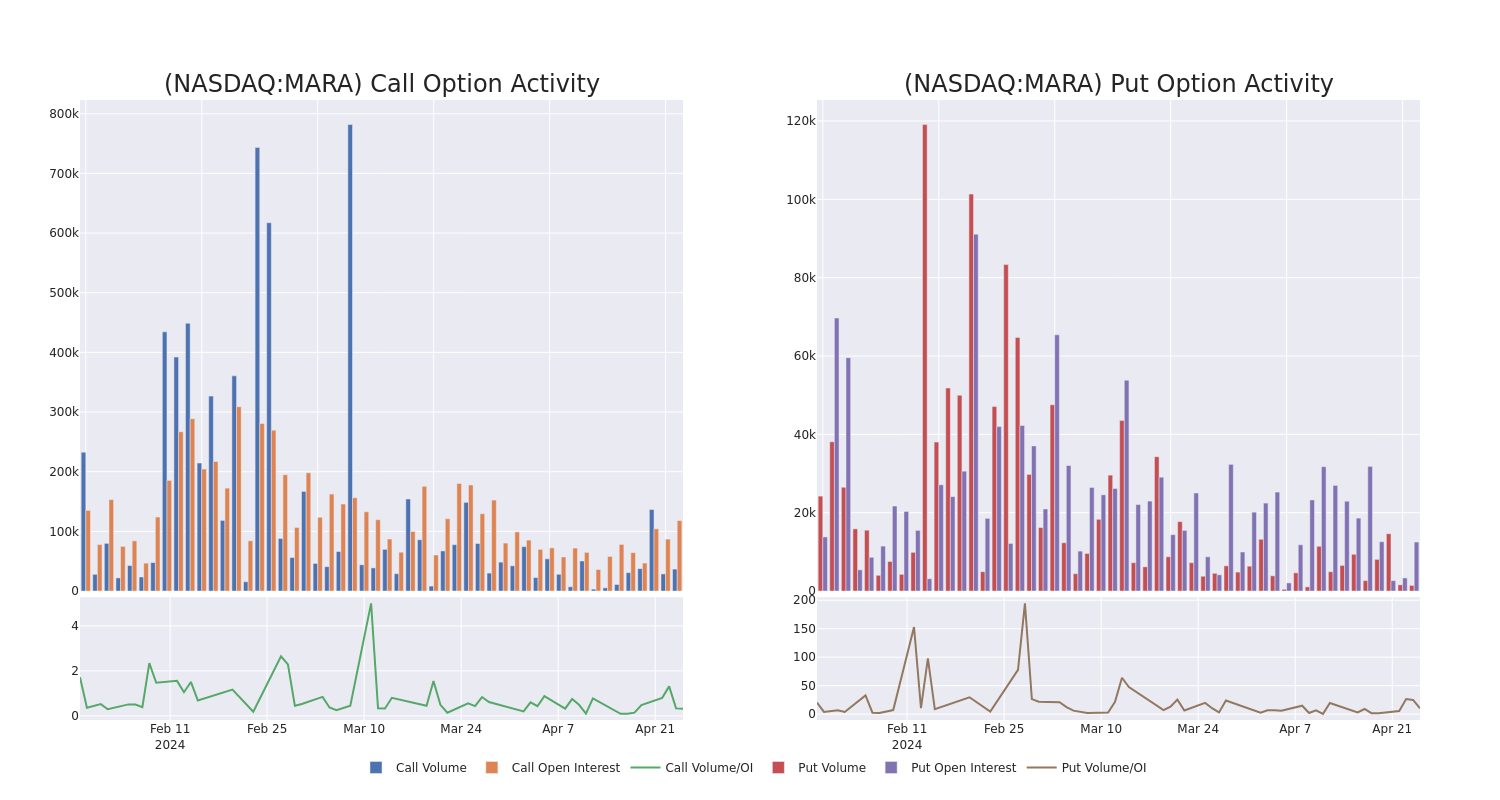

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Marathon Digital Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Marathon Digital Holdings's substantial trades, within a strike price spectrum from $11.0 to $50.0 over the preceding 30 days.

Marathon Digital Holdings 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MARA |

CALL |

SWEEP |

BEARISH |

05/24/24 |

$0.98 |

$0.93 |

$0.94 |

$25.00 |

$119.8K |

603 |

1.3K |

| MARA |

CALL |

TRADE |

BULLISH |

01/17/25 |

$7.4 |

$7.25 |

$7.37 |

$20.00 |

$36.8K |

12.5K |

231 |

| MARA |

CALL |

TRADE |

BULLISH |

06/21/24 |

$8.5 |

$8.5 |

$8.5 |

$11.00 |

$36.5K |

660 |

0 |

| MARA |

PUT |

TRADE |

BEARISH |

01/17/25 |

$7.05 |

$6.95 |

$7.05 |

$20.00 |

$35.2K |

8.6K |

0 |

| MARA |

CALL |

TRADE |

NEUTRAL |

04/26/24 |

$3.65 |

$3.55 |

$3.6 |

$16.00 |

$33.1K |

3.2K |

394 |

About Marathon Digital Holdings

Marathon Digital Holdings Inc focuses on mining digital assets. It owns crypto-currency mining machines and a data center to mine digital assets. The company currently operates in the Digital Currency Blockchain segment. The Crypto-currency Machines are located in the United States.

In light of the recent options history for Marathon Digital Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Marathon Digital Holdings's Current Market Status

- Trading volume stands at 15,464,089, with MARA's price up by 0.84%, positioned at $19.17.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 13 days.

What Analysts Are Saying About Marathon Digital Holdings

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $16.5.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Underweight rating for Marathon Digital Holdings, targeting a price of $16.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marathon Digital Holdings with Benzinga Pro for real-time alerts.

Posted In: MARA