Check Out What Whales Are Doing With GE Aero

Author: Benzinga Insights | April 26, 2024 10:46am

Investors with a lot of money to spend have taken a bullish stance on GE Aero (NYSE:GE).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GE, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for GE Aero.

This isn't normal.

The overall sentiment of these big-money traders is split between 33% bullish and 33%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $90,245, and 8, calls, for a total amount of $487,769.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $148.0 to $160.0 for GE Aero over the last 3 months.

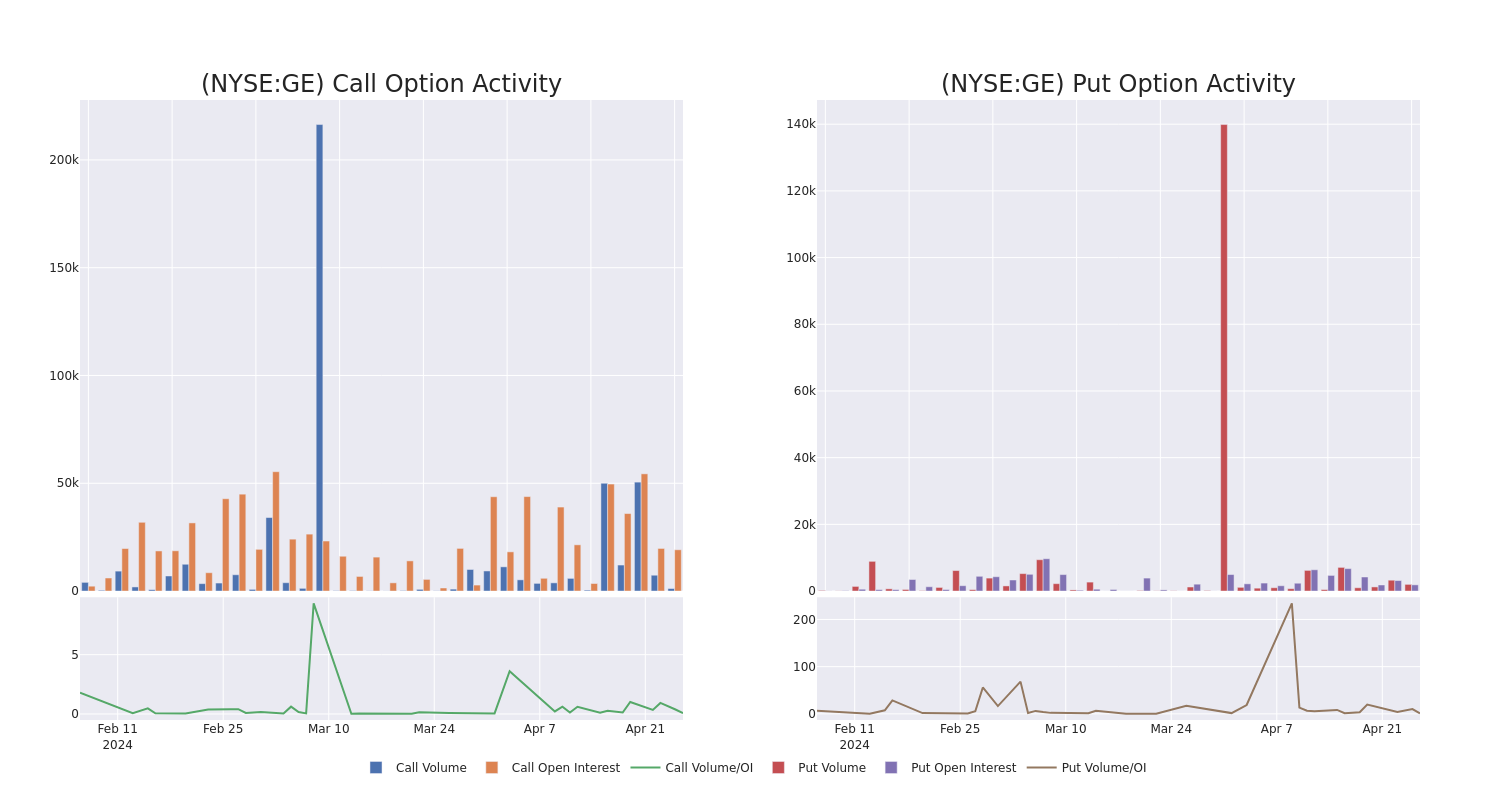

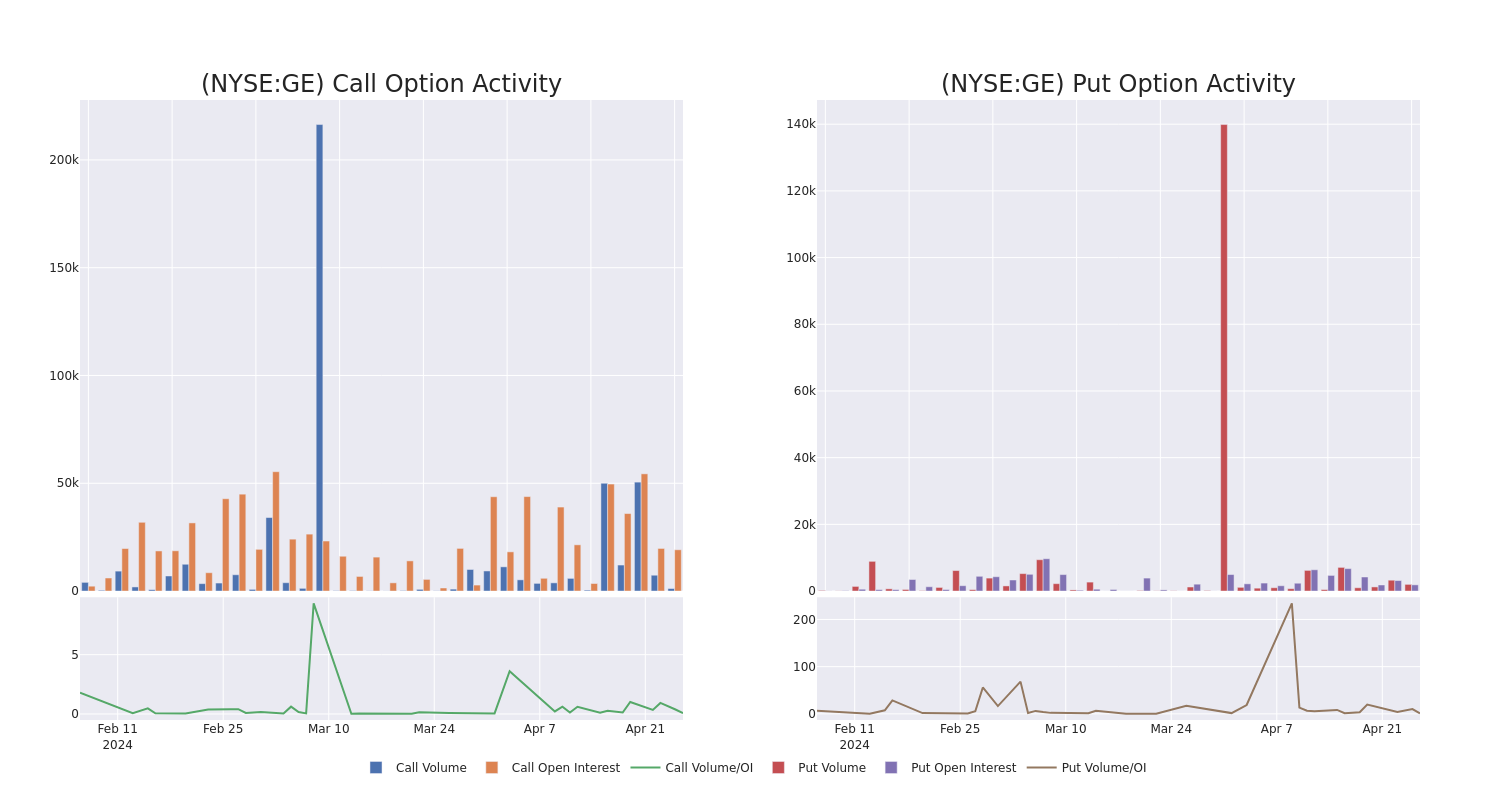

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for GE Aero's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across GE Aero's significant trades, within a strike price range of $148.0 to $160.0, over the past month.

GE Aero Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| GE |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$13.9 |

$13.4 |

$13.41 |

$150.00 |

$134.0K |

13.2K |

219 |

| GE |

CALL |

SWEEP |

BULLISH |

09/20/24 |

$14.7 |

$13.15 |

$14.43 |

$160.00 |

$120.6K |

1.1K |

0 |

| GE |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$0.47 |

$0.45 |

$0.45 |

$148.00 |

$90.2K |

1.8K |

2.0K |

| GE |

CALL |

SWEEP |

NEUTRAL |

05/03/24 |

$4.1 |

$4.05 |

$4.1 |

$160.00 |

$62.3K |

2.2K |

267 |

| GE |

CALL |

TRADE |

NEUTRAL |

07/19/24 |

$14.65 |

$13.45 |

$14.1 |

$155.00 |

$42.3K |

377 |

19 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

Following our analysis of the options activities associated with GE Aero, we pivot to a closer look at the company's own performance.

Where Is GE Aero Standing Right Now?

- With a volume of 1,226,684, the price of GE is up 0.01% at $161.28.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 88 days.

Professional Analyst Ratings for GE Aero

5 market experts have recently issued ratings for this stock, with a consensus target price of $174.8.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on GE Aero with a target price of $211.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for GE Aero, targeting a price of $180.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on GE Aero with a target price of $160.

- An analyst from JP Morgan persists with their Overweight rating on GE Aero, maintaining a target price of $148.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on GE Aero with a target price of $175.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for GE Aero, Benzinga Pro gives you real-time options trades alerts.

Posted In: GE