Netflix Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | April 26, 2024 10:46am

Deep-pocketed investors have adopted a bullish approach towards Netflix (NASDAQ:NFLX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NFLX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 19 extraordinary options activities for Netflix. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 36% bearish. Among these notable options, 6 are puts, totaling $431,148, and 13 are calls, amounting to $544,308.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $270.0 and $645.0 for Netflix, spanning the last three months.

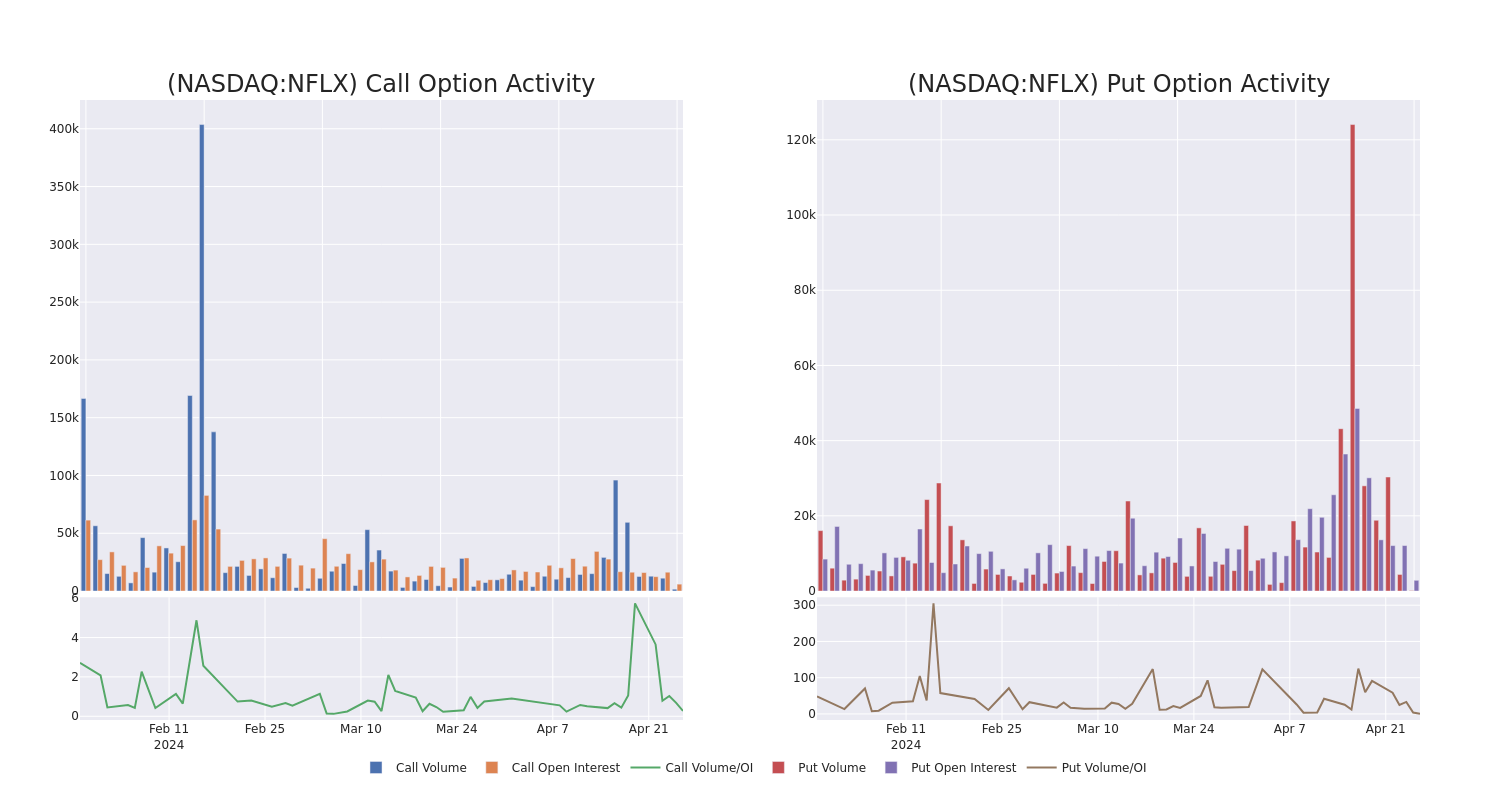

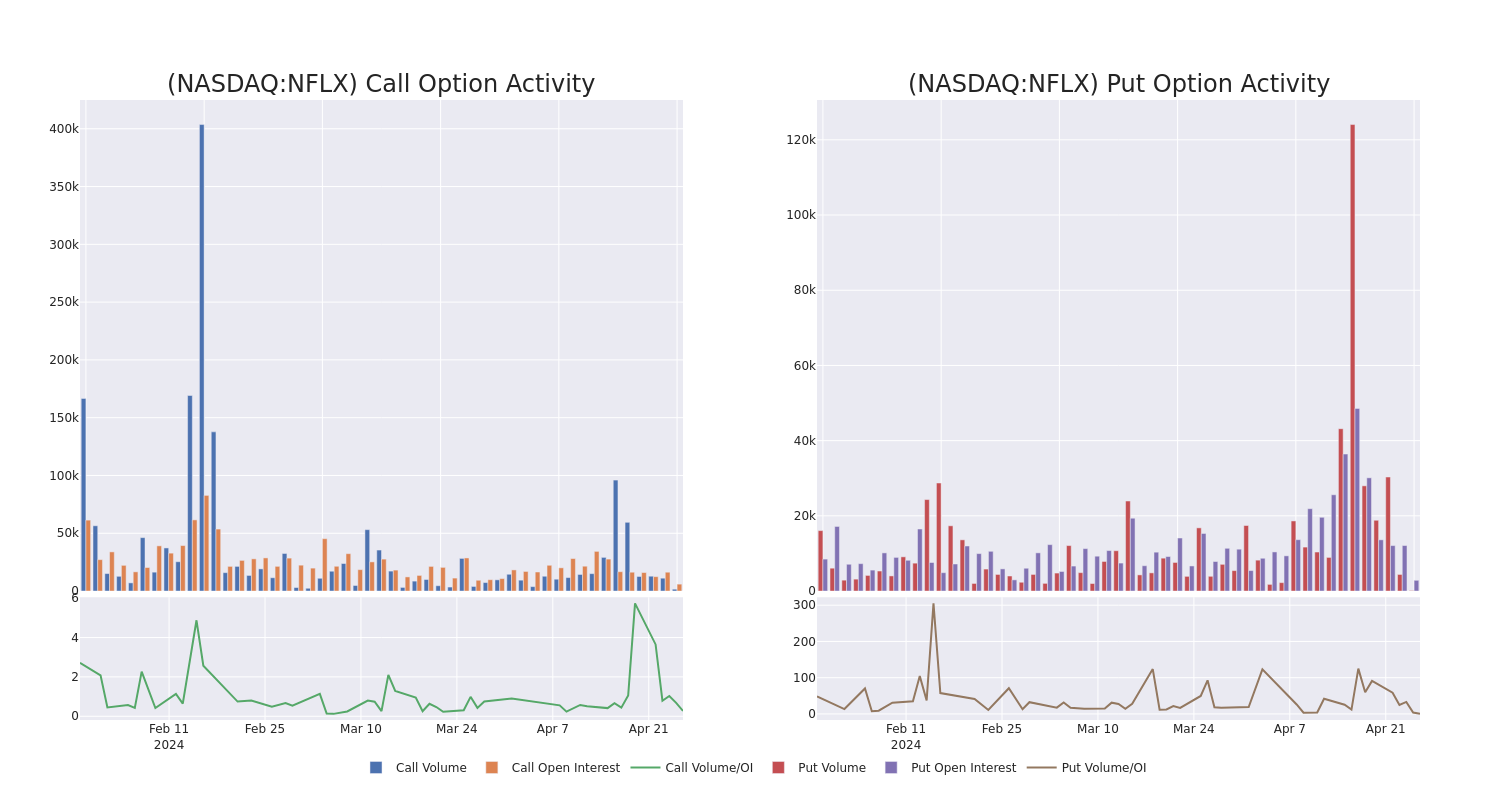

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Netflix's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Netflix's substantial trades, within a strike price spectrum from $270.0 to $645.0 over the preceding 30 days.

Netflix Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NFLX |

PUT |

TRADE |

BULLISH |

04/26/24 |

$92.2 |

$87.2 |

$87.2 |

$645.00 |

$261.6K |

30 |

0 |

| NFLX |

CALL |

SWEEP |

NEUTRAL |

06/20/25 |

$110.85 |

$107.45 |

$108.94 |

$540.00 |

$76.2K |

49 |

13 |

| NFLX |

CALL |

TRADE |

BEARISH |

09/20/24 |

$34.85 |

$34.3 |

$34.3 |

$600.00 |

$68.6K |

1.4K |

20 |

| NFLX |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$3.25 |

$3.0 |

$3.0 |

$580.00 |

$60.0K |

1.2K |

215 |

| NFLX |

CALL |

SWEEP |

NEUTRAL |

06/20/25 |

$111.55 |

$108.0 |

$109.49 |

$540.00 |

$54.7K |

49 |

47 |

About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with almost 250 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

After a thorough review of the options trading surrounding Netflix, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Netflix

- With a volume of 1,132,806, the price of NFLX is down -1.7% at $555.22.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 82 days.

Expert Opinions on Netflix

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $680.2.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Netflix, which currently sits at a price target of $650.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Netflix, targeting a price of $700.

- Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Netflix, targeting a price of $725.

- An analyst from Bernstein has decided to maintain their Market Perform rating on Netflix, which currently sits at a price target of $600.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Netflix with a target price of $726.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Netflix options trades with real-time alerts from Benzinga Pro.

Posted In: NFLX