Pfizer's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 26, 2024 10:02am

Deep-pocketed investors have adopted a bullish approach towards Pfizer (NYSE:PFE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PFE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Pfizer. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 44% bearish. Among these notable options, 5 are puts, totaling $273,893, and 4 are calls, amounting to $302,325.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.5 to $35.0 for Pfizer over the last 3 months.

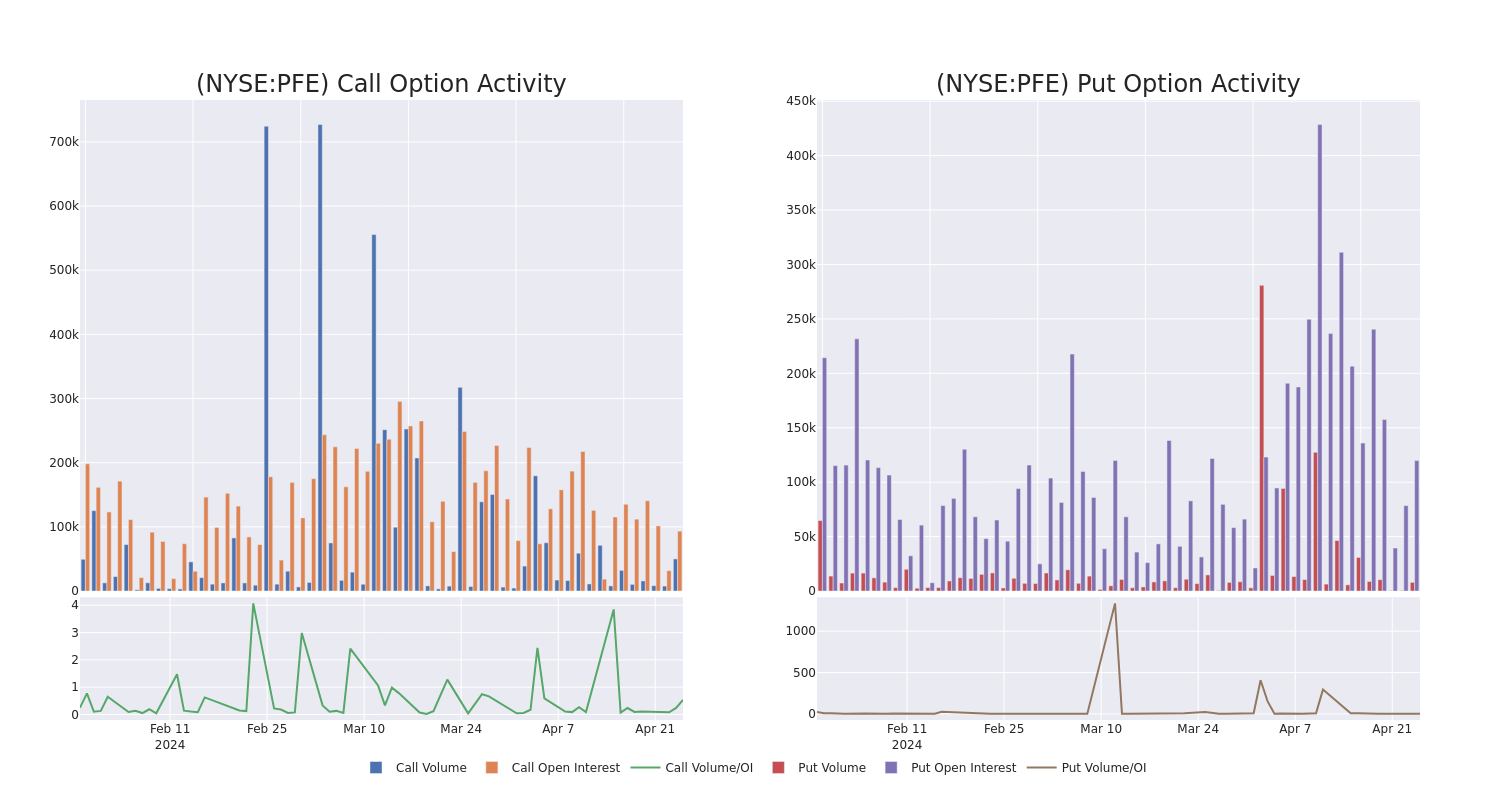

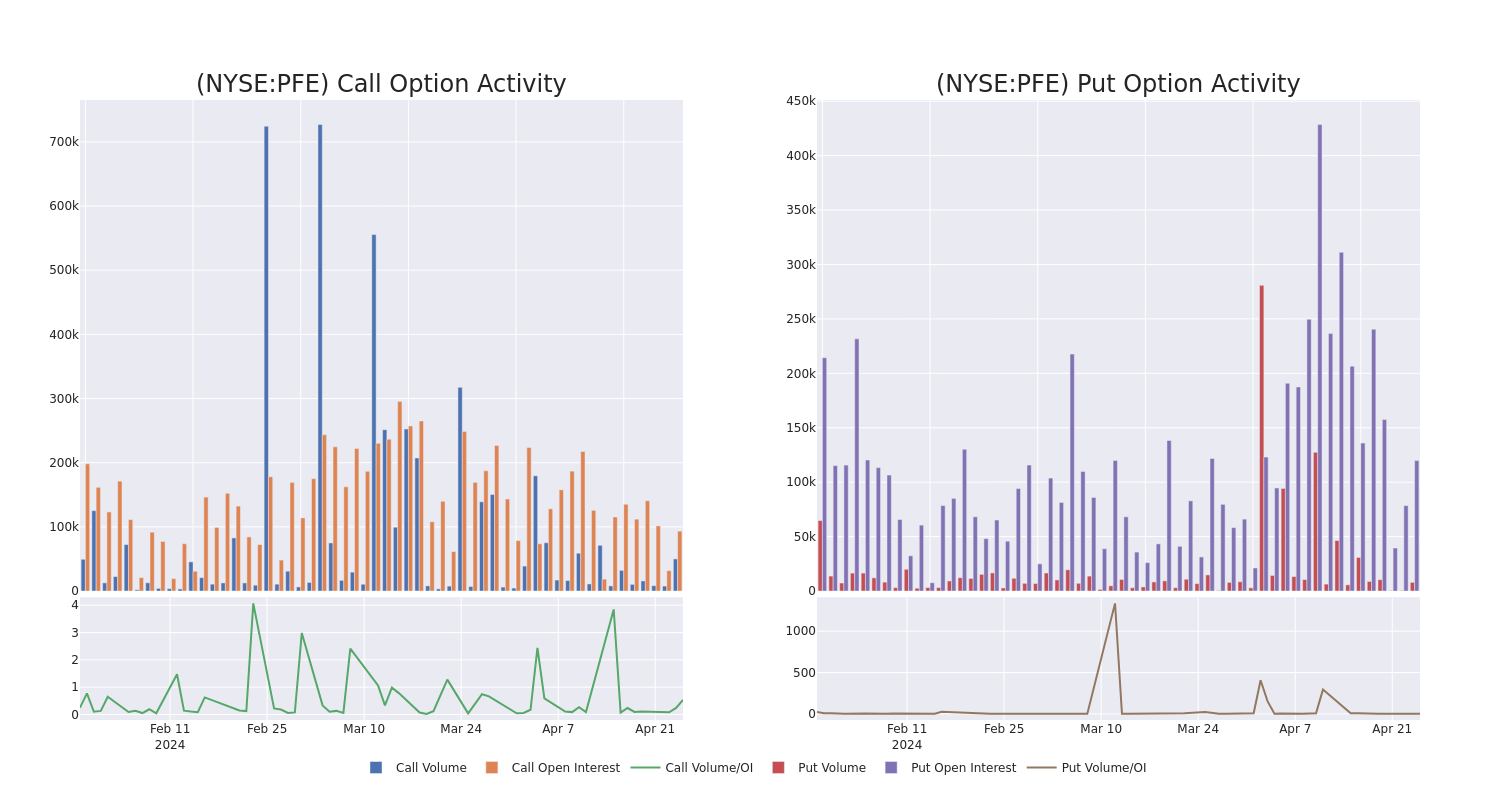

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Pfizer's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Pfizer's substantial trades, within a strike price spectrum from $17.5 to $35.0 over the preceding 30 days.

Pfizer Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PFE |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$8.25 |

$8.1 |

$8.25 |

$17.50 |

$150.1K |

443 |

182 |

| PFE |

PUT |

SWEEP |

BEARISH |

06/20/25 |

$10.2 |

$10.1 |

$10.2 |

$35.00 |

$136.6K |

343 |

0 |

| PFE |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$6.65 |

$6.45 |

$6.45 |

$20.00 |

$70.9K |

8.2K |

10 |

| PFE |

CALL |

SWEEP |

BULLISH |

12/20/24 |

$4.15 |

$4.05 |

$4.15 |

$22.00 |

$47.7K |

2 |

5 |

| PFE |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$2.4 |

$2.07 |

$2.07 |

$25.00 |

$41.3K |

59.0K |

0 |

About Pfizer

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Where Is Pfizer Standing Right Now?

- Currently trading with a volume of 3,549,737, the PFE's price is up by 0.57%, now at $25.41.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 5 days.

Expert Opinions on Pfizer

4 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.

Posted In: PFE