Cracking The Code: Understanding Analyst Reviews For Wyndham Hotels & Resorts

Author: Benzinga Insights | April 26, 2024 10:00am

Throughout the last three months, 4 analysts have evaluated Wyndham Hotels & Resorts (NYSE:WH), offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

4 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

2 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

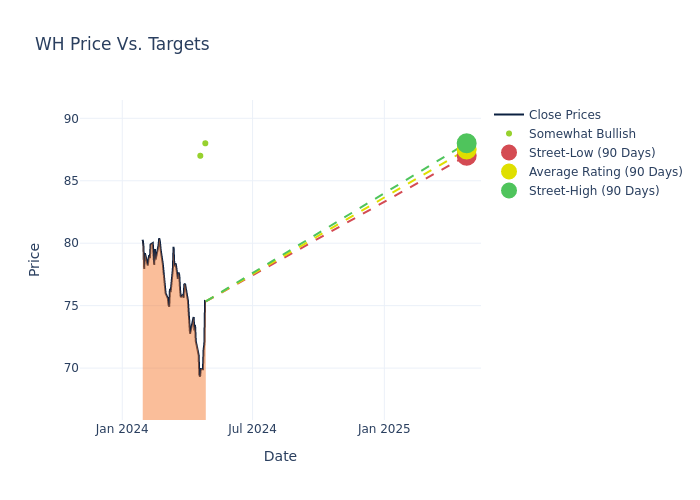

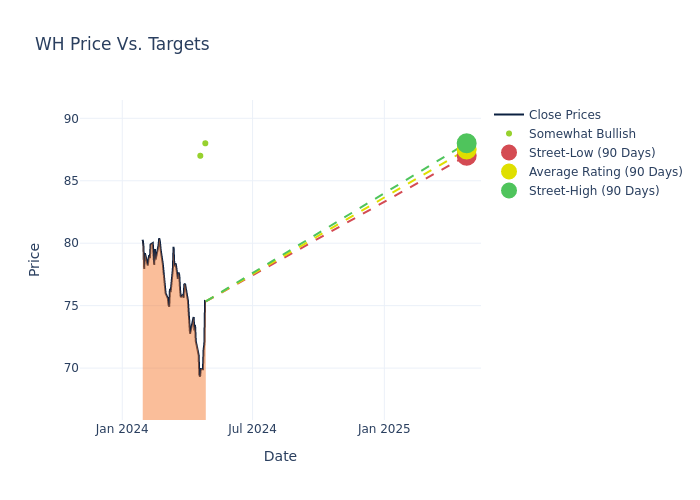

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $87.75, with a high estimate of $90.00 and a low estimate of $86.00. Observing a downward trend, the current average is 1.13% lower than the prior average price target of $88.75.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive Wyndham Hotels & Resorts. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Michael Bellisario |

Baird |

Raises |

Outperform |

$88.00 |

$86.00 |

| Brandt Montour |

Barclays |

Lowers |

Overweight |

$87.00 |

$90.00 |

| Michael Bellisario |

Baird |

Lowers |

Outperform |

$86.00 |

$87.00 |

| Brandt Montour |

Barclays |

Lowers |

Overweight |

$90.00 |

$92.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Wyndham Hotels & Resorts. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Wyndham Hotels & Resorts compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Wyndham Hotels & Resorts's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Wyndham Hotels & Resorts's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Wyndham Hotels & Resorts analyst ratings.

About Wyndham Hotels & Resorts

As of Dec. 31, 2023, Wyndham Hotels & Resorts operates 872,000 rooms across more than 20 brands predominantly in the economy and midscale segments. Super 8 is the largest brand, representing around 19% of all rooms, with Days Inn (13%) and Ramada (14%) the next two largest brands. During the past several years, the company has expanded its extended stay/lifestyle brands, which appeal to travelers seeking to experience the local culture of a given location. The company closed its La Quinta acquisition in the second quarter of 2018, adding around 90,000 rooms at the time the deal closed. Wyndham launched a new extended stay economy scale segment concept, ECHO, in the spring of 2022. The United States represents 57% of total rooms.

Wyndham Hotels & Resorts: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Wyndham Hotels & Resorts's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2023, the company experienced a revenue decline of approximately -3.89%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Wyndham Hotels & Resorts's net margin excels beyond industry benchmarks, reaching 15.26%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Wyndham Hotels & Resorts's ROE stands out, surpassing industry averages. With an impressive ROE of 6.12%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Wyndham Hotels & Resorts's ROA stands out, surpassing industry averages. With an impressive ROA of 1.21%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Wyndham Hotels & Resorts's debt-to-equity ratio is below the industry average. With a ratio of 2.96, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WH