Smart Money Is Betting Big In Boeing Options

Author: Benzinga Insights | April 26, 2024 09:46am

Financial giants have made a conspicuous bearish move on Boeing. Our analysis of options history for Boeing (NYSE:BA) revealed 8 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $299,540, and 2 were calls, valued at $149,391.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $250.0 for Boeing over the recent three months.

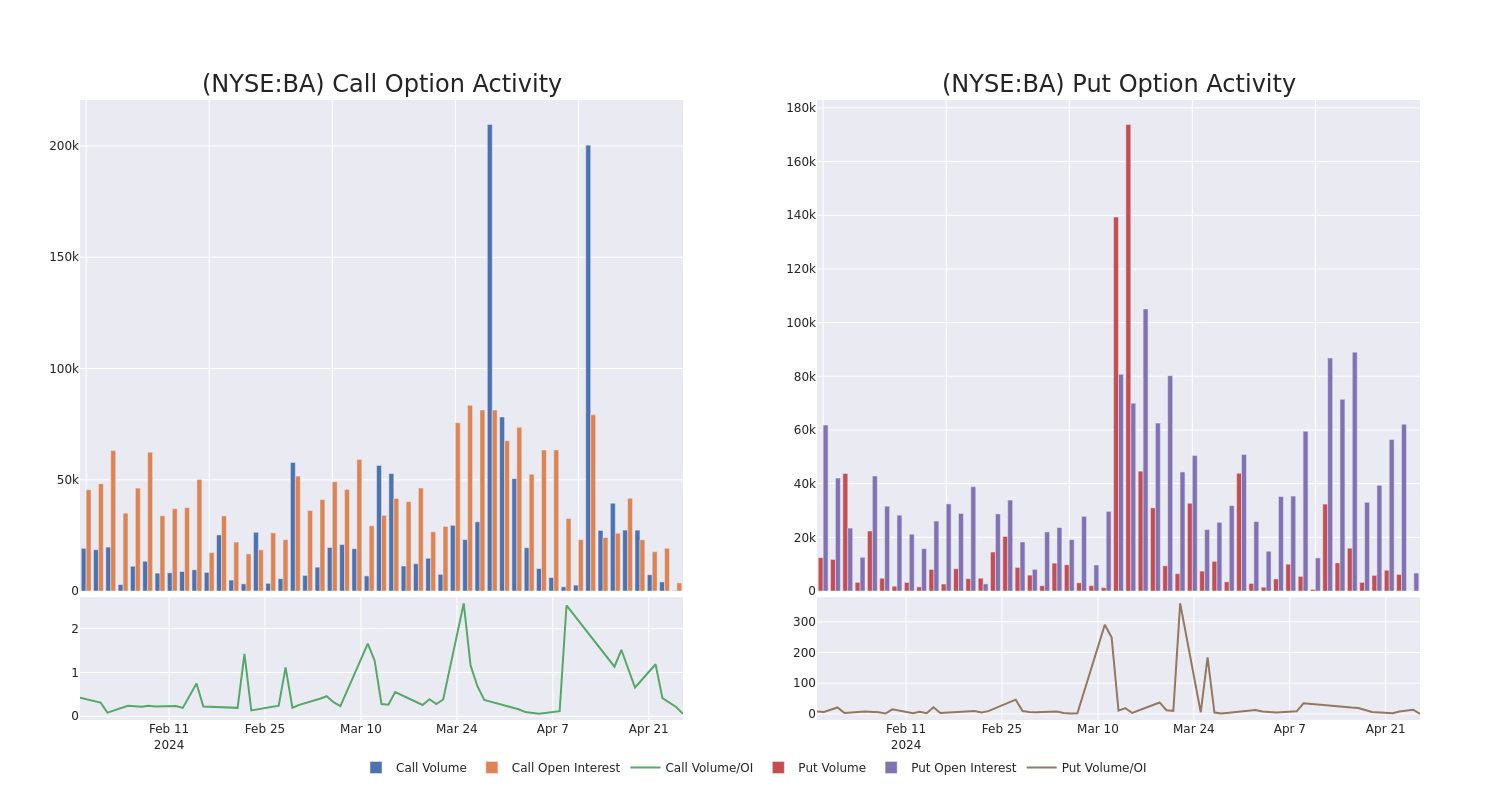

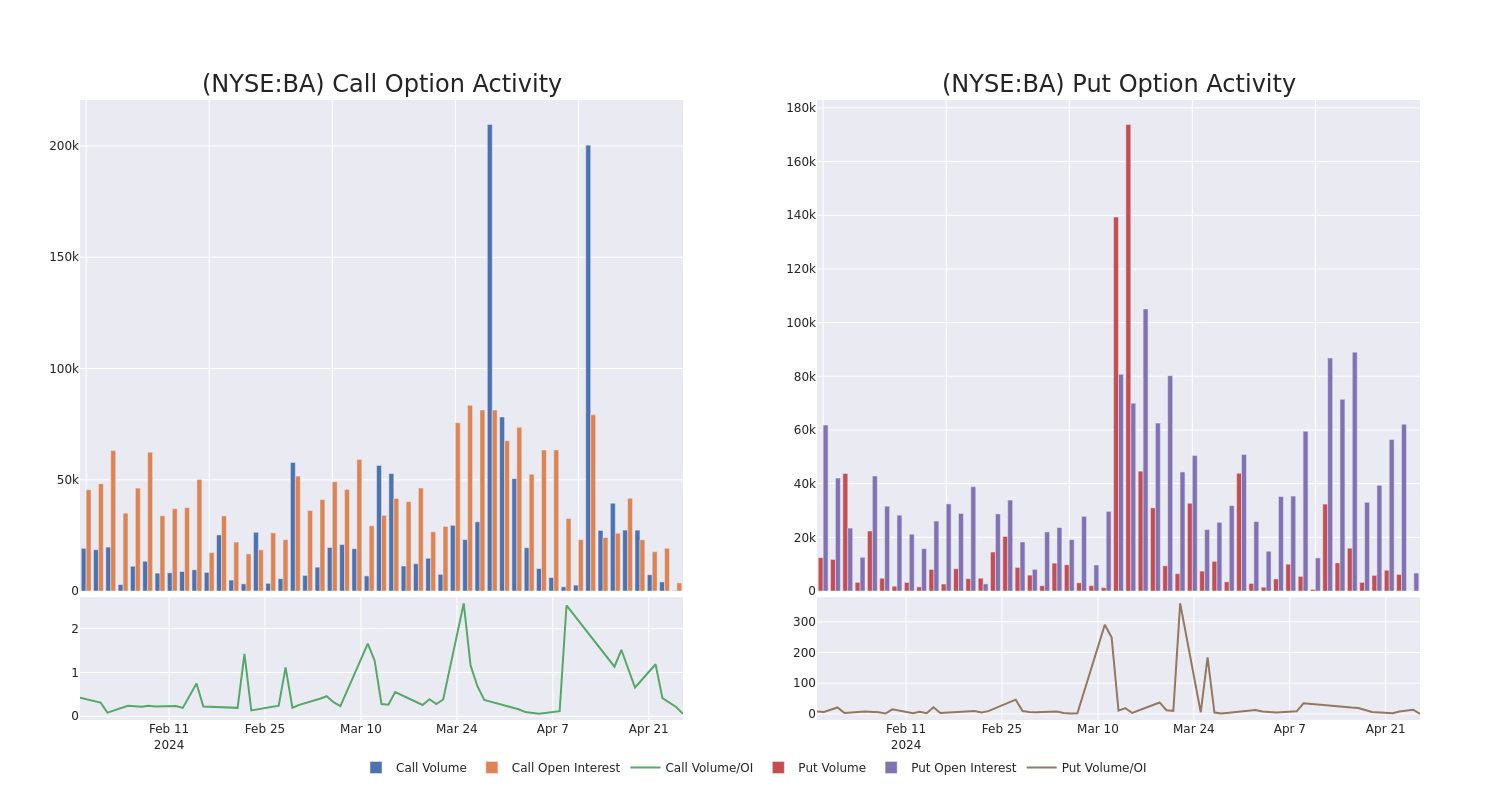

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Boeing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing's whale trades within a strike price range from $160.0 to $250.0 in the last 30 days.

Boeing Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| BA |

PUT |

TRADE |

NEUTRAL |

11/15/24 |

$50.2 |

$49.05 |

$49.65 |

$215.00 |

$99.3K |

307 |

0 |

| BA |

CALL |

TRADE |

BEARISH |

12/18/26 |

$50.2 |

$49.2 |

$49.2 |

$160.00 |

$78.7K |

107 |

1 |

| BA |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$1.16 |

$1.1 |

$1.15 |

$170.00 |

$70.6K |

3.5K |

198 |

| BA |

PUT |

TRADE |

BEARISH |

10/18/24 |

$39.0 |

$38.95 |

$39.0 |

$205.00 |

$62.4K |

79 |

0 |

| BA |

PUT |

SWEEP |

BEARISH |

08/16/24 |

$19.2 |

$18.2 |

$18.25 |

$180.00 |

$40.1K |

1.2K |

0 |

About Boeing

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft and weaponry. Global services provides aftermarket support to airlines.

Boeing's Current Market Status

- With a volume of 162,518, the price of BA is down -0.5% at $165.97.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 89 days.

What Analysts Are Saying About Boeing

5 market experts have recently issued ratings for this stock, with a consensus target price of $220.0.

- An analyst from Deutsche Bank persists with their Buy rating on Boeing, maintaining a target price of $225.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Boeing with a target price of $260.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Boeing, which currently sits at a price target of $210.

- An analyst from RBC Capital persists with their Outperform rating on Boeing, maintaining a target price of $215.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Boeing with a target price of $190.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Boeing with Benzinga Pro for real-time alerts.

Posted In: BA