Assessing Arhaus: Insights From 11 Financial Analysts

Author: Benzinga Insights | April 26, 2024 08:01am

In the last three months, 11 analysts have published ratings on Arhaus (NASDAQ:ARHS), offering a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

7 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

4 |

6 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

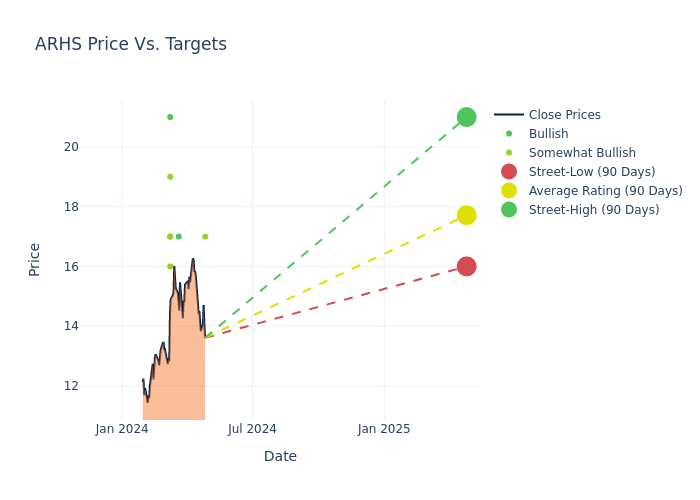

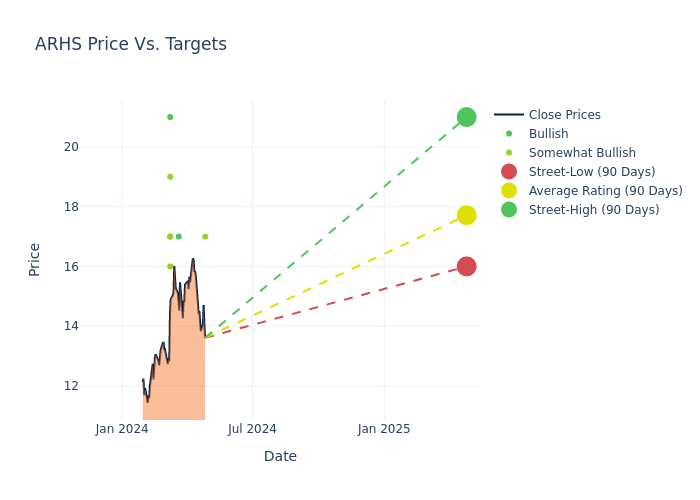

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $16.86, with a high estimate of $21.00 and a low estimate of $14.50. Witnessing a positive shift, the current average has risen by 19.57% from the previous average price target of $14.10.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive Arhaus. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joseph Feldman |

Telsey Advisory Group |

Maintains |

Outperform |

$17.00 |

$17.00 |

| Curtis Nagle |

B of A Securities |

Raises |

Buy |

$17.00 |

$14.50 |

| Jeremy Hamblin |

Craig-Hallum |

Raises |

Buy |

$21.00 |

$14.00 |

| Peter Keith |

Piper Sandler |

Raises |

Overweight |

$19.00 |

$15.00 |

| Jonathan Matuszewski |

Jefferies |

Raises |

Buy |

$17.00 |

$12.00 |

| Peter Benedict |

Baird |

Raises |

Outperform |

$16.00 |

$13.00 |

| Seth Sigman |

Barclays |

Raises |

Overweight |

$17.00 |

$14.00 |

| Joseph Feldman |

Telsey Advisory Group |

Raises |

Outperform |

$17.00 |

$15.00 |

| Joseph Feldman |

Telsey Advisory Group |

Maintains |

Outperform |

$15.00 |

- |

| Curtis Nagle |

B of A Securities |

Raises |

Buy |

$14.50 |

$13.50 |

| Joseph Feldman |

Telsey Advisory Group |

Raises |

Outperform |

$15.00 |

$13.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Arhaus. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Arhaus compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Arhaus's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Arhaus's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Arhaus analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Arhaus

Arhaus Inc is a growing lifestyle brand and omnichannel retailer of premium home furniture. The company offers merchandise in a number of categories, including furniture, outdoor, lighting, textiles, and decor through its Retail and eCommerce sales channels.

Financial Insights: Arhaus

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Arhaus faced challenges, resulting in a decline of approximately -3.46% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Arhaus's net margin excels beyond industry benchmarks, reaching 9.07%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Arhaus's ROE stands out, surpassing industry averages. With an impressive ROE of 9.62%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Arhaus's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.8% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.36, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ARHS