Decoding Edwards Lifesciences's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 25, 2024 03:33pm

Financial giants have made a conspicuous bullish move on Edwards Lifesciences. Our analysis of options history for Edwards Lifesciences (NYSE:EW) revealed 11 unusual trades.

Delving into the details, we found 54% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $271,805, and 6 were calls, valued at $465,700.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $82.5 and $97.5 for Edwards Lifesciences, spanning the last three months.

Analyzing Volume & Open Interest

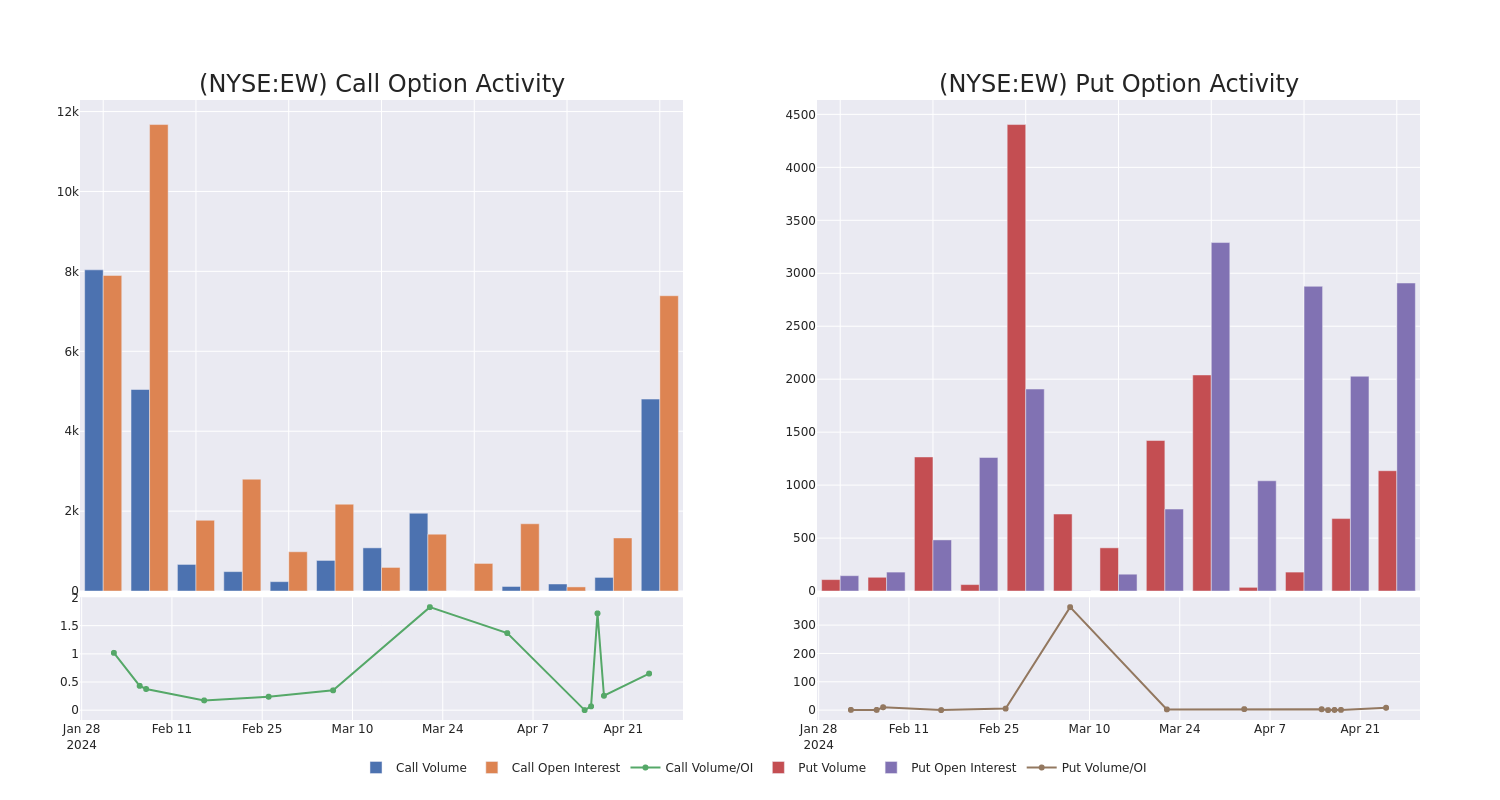

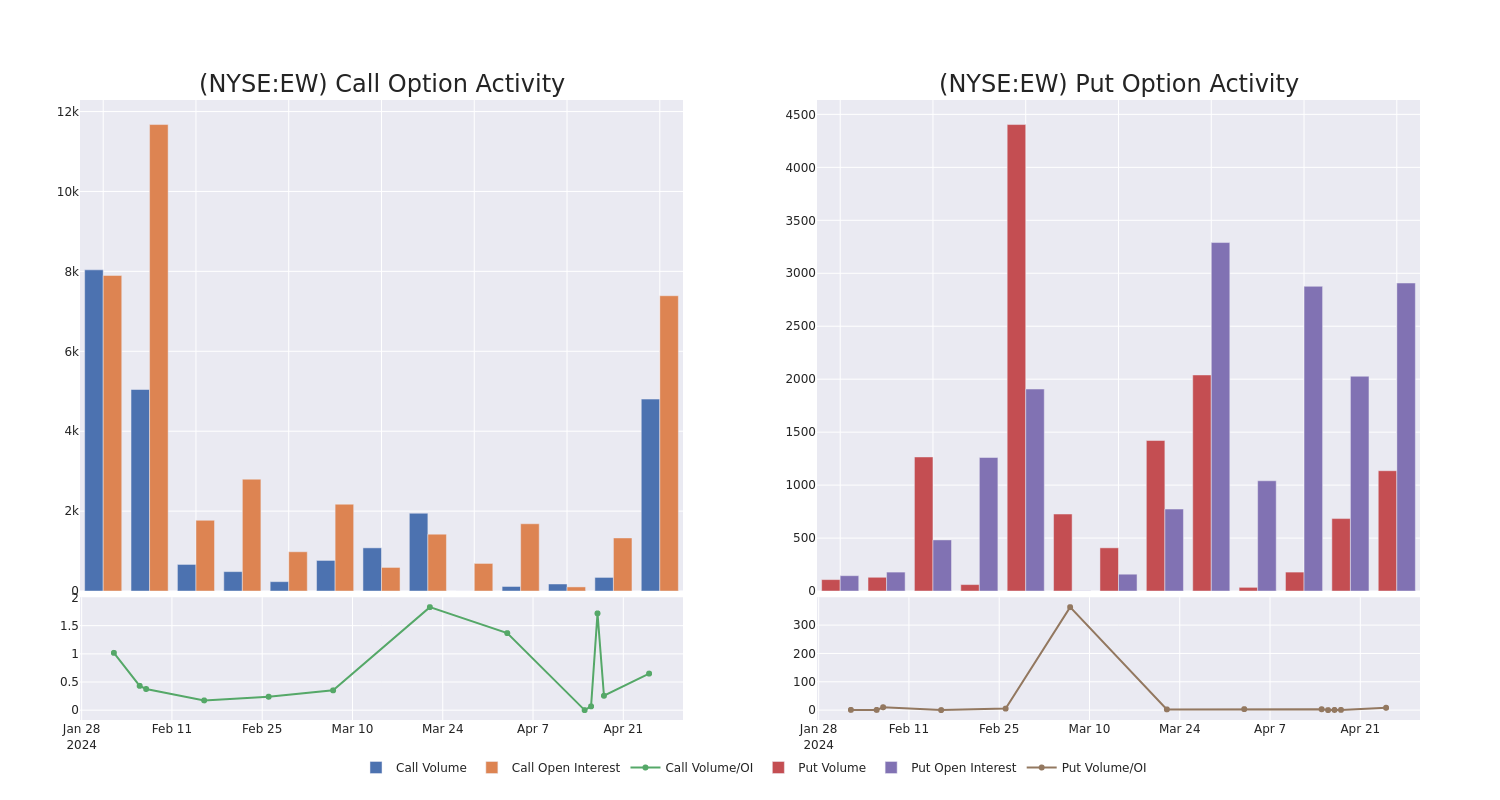

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Edwards Lifesciences's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Edwards Lifesciences's substantial trades, within a strike price spectrum from $82.5 to $97.5 over the preceding 30 days.

Edwards Lifesciences Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| EW |

CALL |

TRADE |

BULLISH |

01/17/25 |

$9.0 |

$8.4 |

$9.0 |

$92.50 |

$270.0K |

14 |

300 |

| EW |

PUT |

SWEEP |

BULLISH |

08/16/24 |

$11.4 |

$11.3 |

$11.4 |

$97.50 |

$76.3K |

15 |

68 |

| EW |

PUT |

SWEEP |

BEARISH |

06/21/24 |

$7.4 |

$7.3 |

$7.4 |

$92.50 |

$73.2K |

102 |

50 |

| EW |

PUT |

TRADE |

BEARISH |

01/17/25 |

$7.3 |

$6.9 |

$7.3 |

$87.50 |

$73.0K |

36 |

100 |

| EW |

CALL |

TRADE |

BEARISH |

05/17/24 |

$1.1 |

$0.95 |

$0.96 |

$95.00 |

$72.0K |

5.0K |

751 |

About Edwards Lifesciences

Spun off from Baxter International in 2000, Edwards Lifesciences designs, manufactures, and markets a range of medical devices and equipment for advanced stages of structural heart disease. It has established itself as a leader across key products, including surgical tissue heart valves, transcatheter valve technologies, surgical clips, and catheters. The firm derives about 55% of its total sales from outside the US.

After a thorough review of the options trading surrounding Edwards Lifesciences, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Edwards Lifesciences Standing Right Now?

- Currently trading with a volume of 2,670,327, the EW's price is down by -0.41%, now at $88.25.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 0 days.

Expert Opinions on Edwards Lifesciences

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $99.0.

- Maintaining their stance, an analyst from Mizuho continues to hold a Buy rating for Edwards Lifesciences, targeting a price of $105.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Edwards Lifesciences with a target price of $92.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Edwards Lifesciences, targeting a price of $98.

- An analyst from RBC Capital persists with their Outperform rating on Edwards Lifesciences, maintaining a target price of $101.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Edwards Lifesciences, Benzinga Pro gives you real-time options trades alerts.

Posted In: EW