Demystifying YETI Holdings: Insights From 5 Analyst Reviews

Author: Benzinga Insights | April 25, 2024 03:01pm

Across the recent three months, 5 analysts have shared their insights on YETI Holdings (NYSE:YETI), expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

4 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

2 |

0 |

0 |

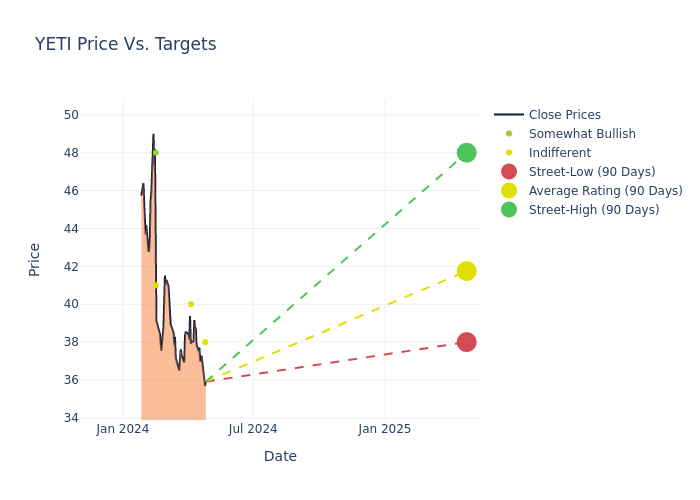

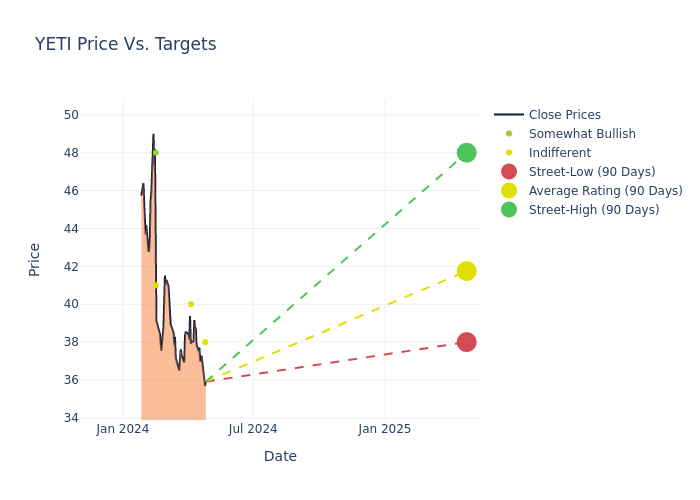

Analysts have recently evaluated YETI Holdings and provided 12-month price targets. The average target is $41.8, accompanied by a high estimate of $48.00 and a low estimate of $38.00. This current average has decreased by 7.62% from the previous average price target of $45.25.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive YETI Holdings. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Anna Glaessgen |

B. Riley Securities |

Lowers |

Neutral |

$38.00 |

$42.00 |

| Brian McNamara |

Canaccord Genuity |

Lowers |

Hold |

$40.00 |

$41.00 |

| Anna Glaessgen |

B. Riley Securities |

Maintains |

Neutral |

$42.00 |

- |

| Joseph Altobello |

Raymond James |

Lowers |

Outperform |

$48.00 |

$55.00 |

| Jim Duffy |

Stifel |

Lowers |

Hold |

$41.00 |

$43.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to YETI Holdings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of YETI Holdings compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for YETI Holdings's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of YETI Holdings's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on YETI Holdings analyst ratings.

All You Need to Know About YETI Holdings

YETI Holdings Inc is a designer, marketer, and distributor of premium products for the outdoor and recreation market sold under the YETI brand. The company offers products including coolers and equipment, drinkware, and other accessories. Its trademark products include YETI Tundra, Hopper, YETI TANK, Rambler, Colster, Rambler among others. The company distributes products through wholesale channels and through direct-to-consumer, or DTC, channels.

Understanding the Numbers: YETI Holdings's Finances

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: YETI Holdings displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 16.03%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 15.12%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 11.54%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): YETI Holdings's ROA excels beyond industry benchmarks, reaching 6.41%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.24, YETI Holdings adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: YETI