Looking At American Express's Recent Unusual Options Activity

Author: Benzinga Insights | April 25, 2024 02:16pm

Investors with a lot of money to spend have taken a bearish stance on American Express (NYSE:AXP).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AXP, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 17 uncommon options trades for American Express.

This isn't normal.

The overall sentiment of these big-money traders is split between 35% bullish and 47%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $124,002, and 14 are calls, for a total amount of $484,888.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $220.0 to $310.0 for American Express over the recent three months.

Insights into Volume & Open Interest

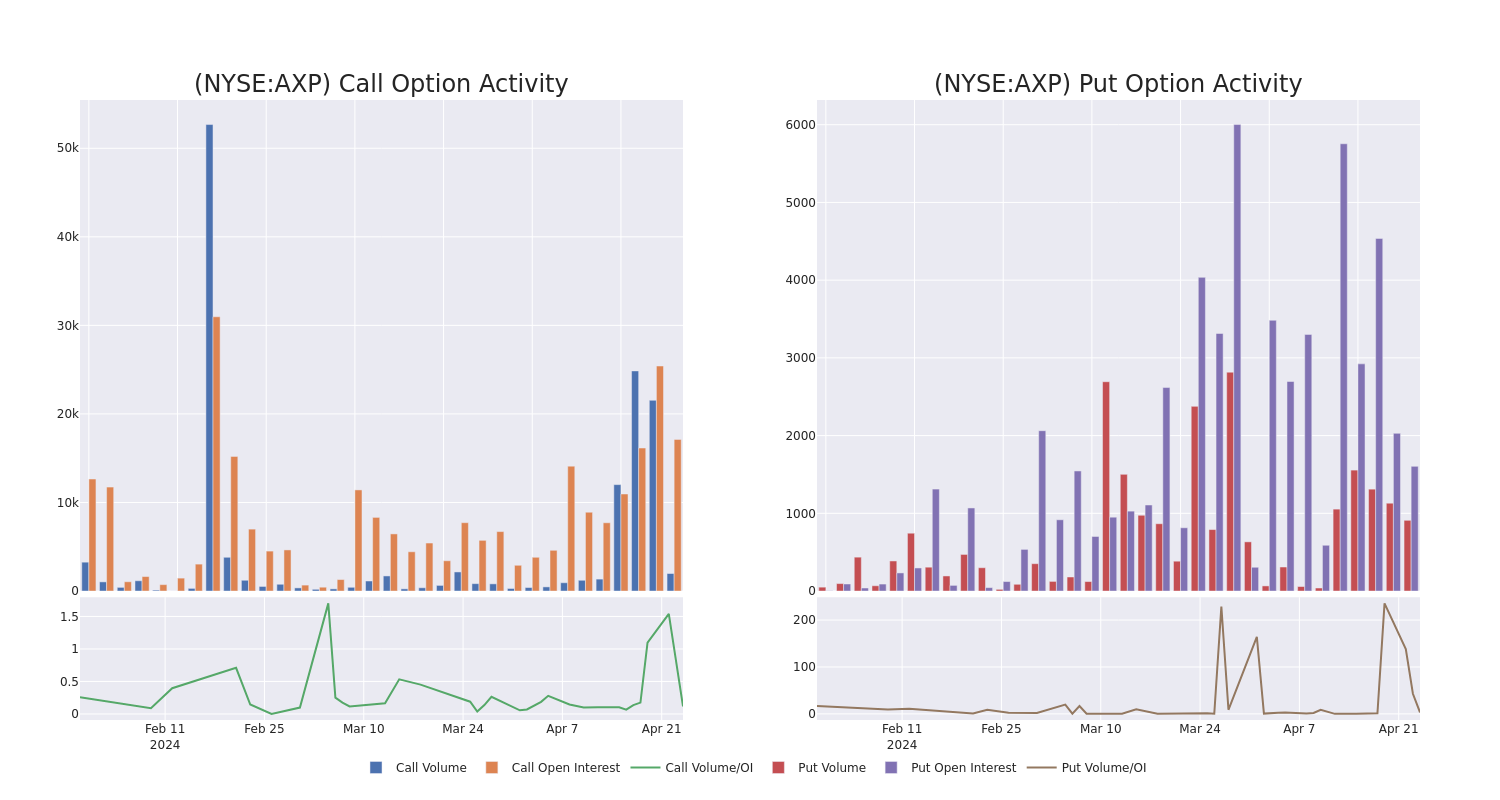

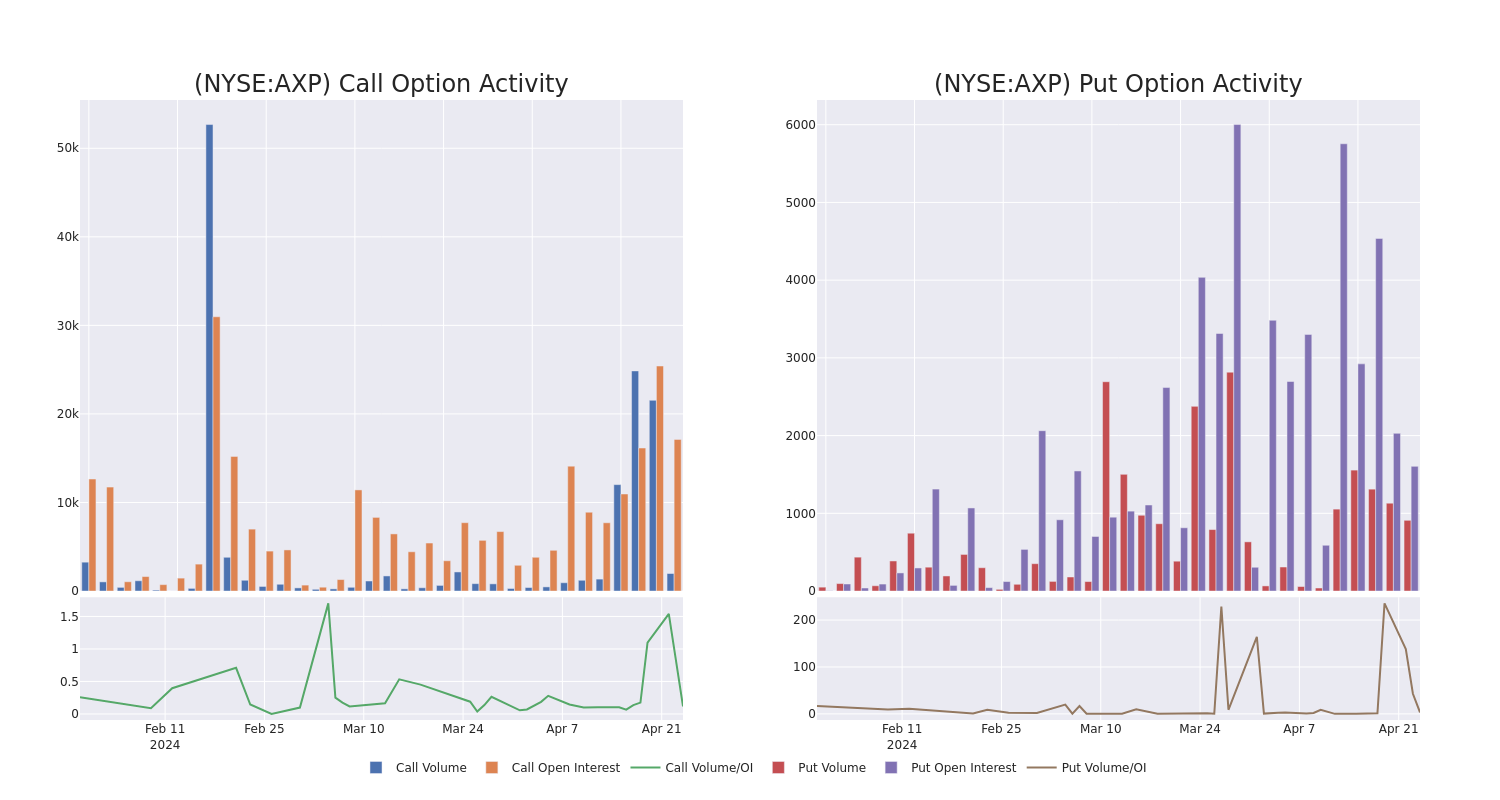

In today's trading context, the average open interest for options of American Express stands at 743.5, with a total volume reaching 1,467.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in American Express, situated within the strike price corridor from $220.0 to $310.0, throughout the last 30 days.

American Express 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| AXP |

PUT |

SWEEP |

BEARISH |

10/18/24 |

$27.5 |

$27.15 |

$27.5 |

$260.00 |

$68.7K |

0 |

25 |

| AXP |

CALL |

TRADE |

BULLISH |

05/24/24 |

$4.4 |

$4.3 |

$4.4 |

$240.00 |

$61.1K |

106 |

294 |

| AXP |

CALL |

SWEEP |

BULLISH |

07/19/24 |

$24.0 |

$23.1 |

$23.85 |

$220.00 |

$50.0K |

1.0K |

21 |

| AXP |

CALL |

TRADE |

NEUTRAL |

04/26/24 |

$7.55 |

$5.8 |

$6.62 |

$230.00 |

$39.7K |

477 |

10 |

| AXP |

CALL |

TRADE |

BEARISH |

10/18/24 |

$17.1 |

$16.85 |

$16.95 |

$240.00 |

$33.9K |

143 |

13 |

About American Express

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

In light of the recent options history for American Express, it's now appropriate to focus on the company itself. We aim to explore its current performance.

American Express's Current Market Status

- Trading volume stands at 1,634,021, with AXP's price down by -0.46%, positioned at $238.01.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 85 days.

Professional Analyst Ratings for American Express

In the last month, 5 experts released ratings on this stock with an average target price of $238.6.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Underperform rating for American Express, targeting a price of $175.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on American Express with a target price of $250.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for American Express, targeting a price of $255.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on American Express with a target price of $253.

- An analyst from Deutsche Bank has decided to maintain their Buy rating on American Express, which currently sits at a price target of $260.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for American Express with Benzinga Pro for real-time alerts.

Posted In: AXP