Decoding Micron Technology's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 25, 2024 11:01am

Whales with a lot of money to spend have taken a noticeably bearish stance on Micron Technology.

Looking at options history for Micron Technology (NASDAQ:MU) we detected 20 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 55% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $982,938 and 9, calls, for a total amount of $504,492.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $150.0 for Micron Technology, spanning the last three months.

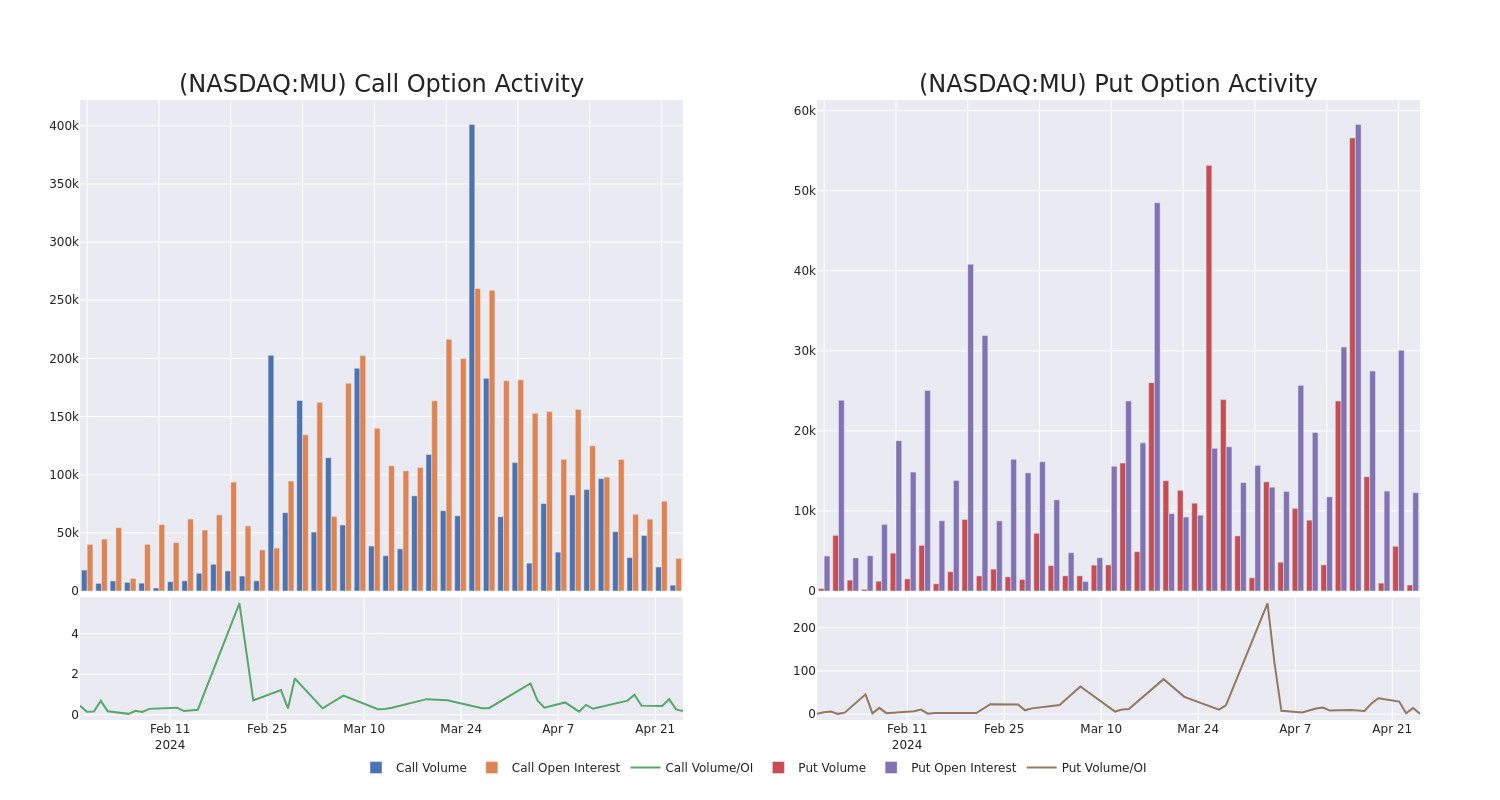

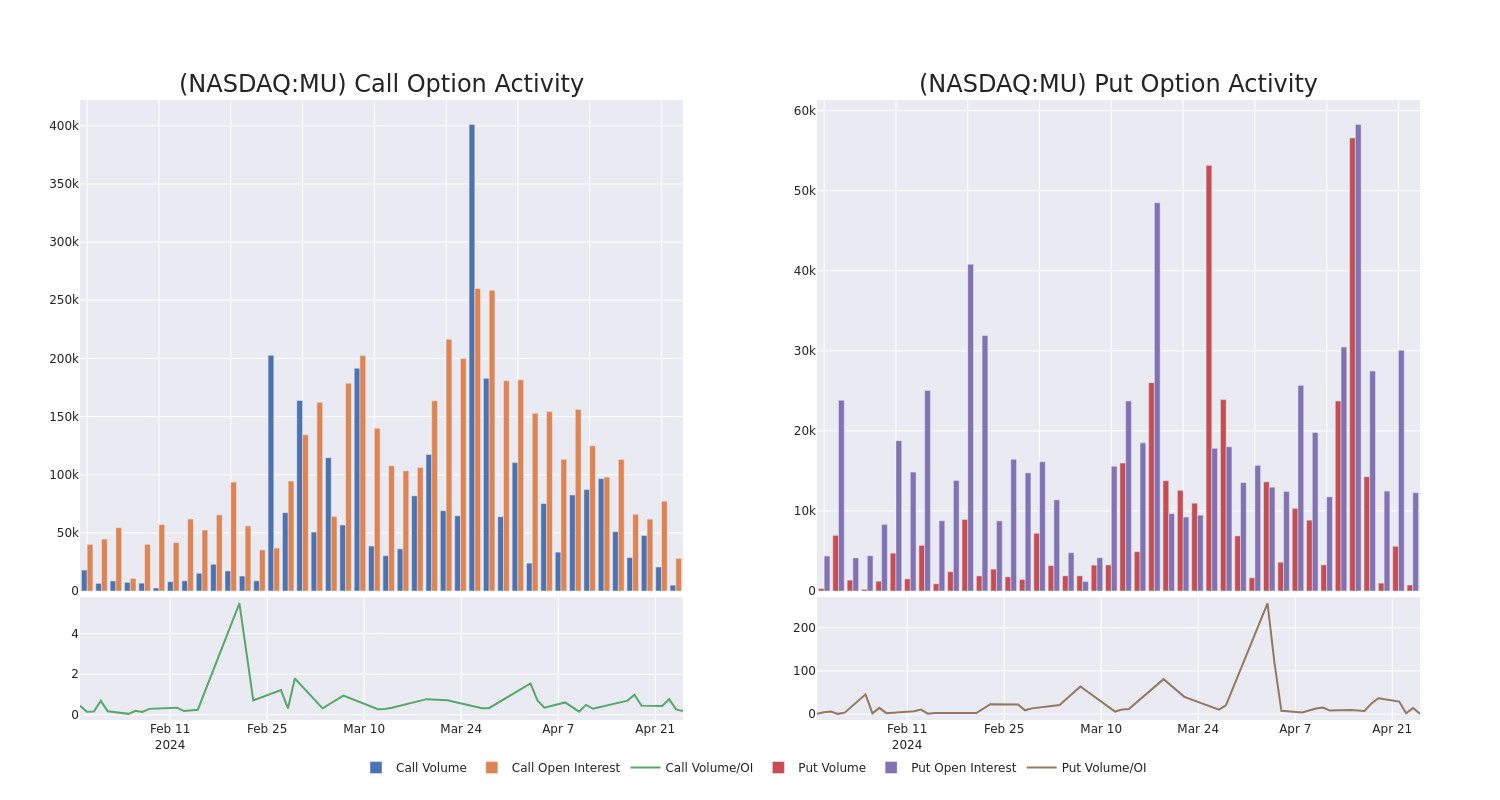

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Micron Technology's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Micron Technology's whale trades within a strike price range from $65.0 to $150.0 in the last 30 days.

Micron Technology Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MU |

PUT |

TRADE |

BEARISH |

09/20/24 |

$6.0 |

$5.9 |

$6.0 |

$100.00 |

$450.0K |

911 |

2 |

| MU |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$4.45 |

$4.4 |

$4.4 |

$120.00 |

$195.3K |

10.0K |

259 |

| MU |

PUT |

SWEEP |

BEARISH |

03/21/25 |

$8.4 |

$8.35 |

$8.35 |

$95.00 |

$137.7K |

1.9K |

165 |

| MU |

CALL |

SWEEP |

NEUTRAL |

05/17/24 |

$5.45 |

$5.4 |

$5.41 |

$110.00 |

$64.8K |

6.5K |

161 |

| MU |

PUT |

SWEEP |

NEUTRAL |

09/20/24 |

$8.1 |

$8.0 |

$8.0 |

$105.00 |

$61.6K |

697 |

2 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

In light of the recent options history for Micron Technology, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Micron Technology

- With a trading volume of 5,354,997, the price of MU is down by -2.28%, reaching $109.23.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 62 days from now.

Professional Analyst Ratings for Micron Technology

In the last month, 5 experts released ratings on this stock with an average target price of $146.8.

- An analyst from Keybanc has decided to maintain their Overweight rating on Micron Technology, which currently sits at a price target of $150.

- An analyst from Cantor Fitzgerald has decided to maintain their Overweight rating on Micron Technology, which currently sits at a price target of $150.

- An analyst from Citigroup persists with their Buy rating on Micron Technology, maintaining a target price of $150.

- An analyst from Stifel persists with their Buy rating on Micron Technology, maintaining a target price of $140.

- An analyst from B of A Securities has decided to maintain their Buy rating on Micron Technology, which currently sits at a price target of $144.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.

Posted In: MU