A Closer Look at 8 Analyst Recommendations For Americold Realty Trust

Author: Benzinga Insights | April 25, 2024 11:00am

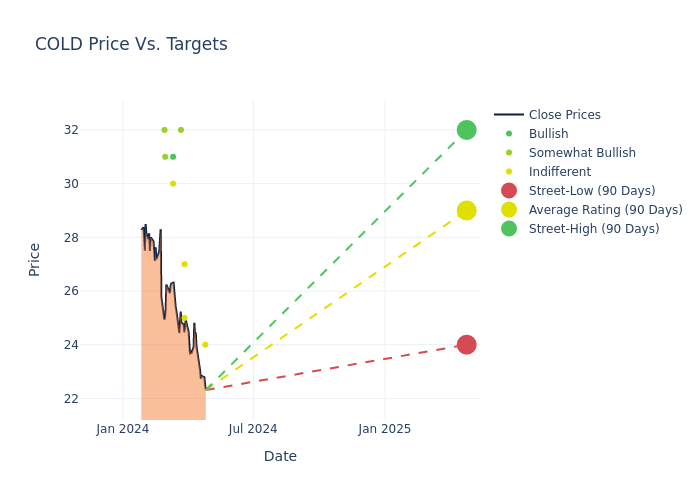

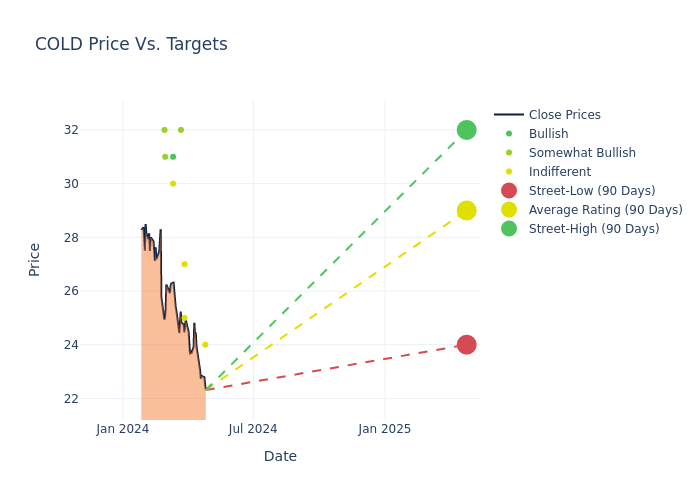

Ratings for Americold Realty Trust (NYSE:COLD) were provided by 8 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

3 |

4 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

2 |

0 |

0 |

| 2M Ago |

1 |

3 |

1 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $29.0, a high estimate of $32.00, and a low estimate of $24.00. This current average represents a 13.43% decrease from the previous average price target of $33.50.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Americold Realty Trust by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Blaine Heck |

Wells Fargo |

Announces |

Equal-Weight |

$24.00 |

- |

| Greg McGinniss |

Scotiabank |

Announces |

Sector Perform |

$27.00 |

- |

| Anthony Powell |

Barclays |

Lowers |

Equal-Weight |

$25.00 |

$32.00 |

| Craig Mailman |

Keybanc |

Lowers |

Overweight |

$32.00 |

$37.00 |

| Ki Bin Kim |

Truist Securities |

Lowers |

Buy |

$31.00 |

$35.00 |

| Michael Mueller |

JP Morgan |

Lowers |

Neutral |

$30.00 |

$32.00 |

| William Crow |

Raymond James |

Maintains |

Outperform |

$31.00 |

$31.00 |

| Michael Carroll |

RBC Capital |

Lowers |

Outperform |

$32.00 |

$34.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Americold Realty Trust. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Americold Realty Trust compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Americold Realty Trust's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Americold Realty Trust's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Americold Realty Trust analyst ratings.

About Americold Realty Trust

Americold Realty Trust Inc is the world's second-largest owner and operator of temperature-controlled warehouses behind privately held Lineage Logistics. The Atlanta, Georgia-based firm owns and operates approximately 245 temperature-controlled warehouses, spanning 1.5 billion cubic feet. In 2022, the firm derived more than 80% of its revenue from the United States but also has sizable operations in Europe, Canada, Australia, and New Zealand. Americold supplements its core business by providing supply management and transportation services to its various customers. It operates as a real estate investment trust.

Americold Realty Trust: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: Americold Realty Trust's revenue growth over 3 months faced difficulties. As of 31 December, 2023, the company experienced a decline of approximately -5.85%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Americold Realty Trust's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -33.39%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Americold Realty Trust's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -6.01%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Americold Realty Trust's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -2.86%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.97, Americold Realty Trust adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: COLD