A Closer Look at 10 Analyst Recommendations For UDR

Author: Benzinga Insights | April 25, 2024 11:00am

Ratings for UDR (NYSE:UDR) were provided by 10 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

2 |

5 |

1 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

1 |

1 |

0 |

| 2M Ago |

0 |

2 |

2 |

0 |

0 |

| 3M Ago |

0 |

0 |

2 |

0 |

0 |

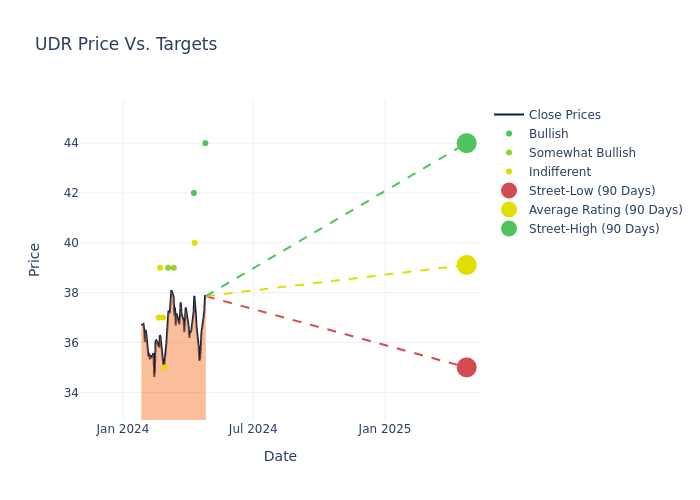

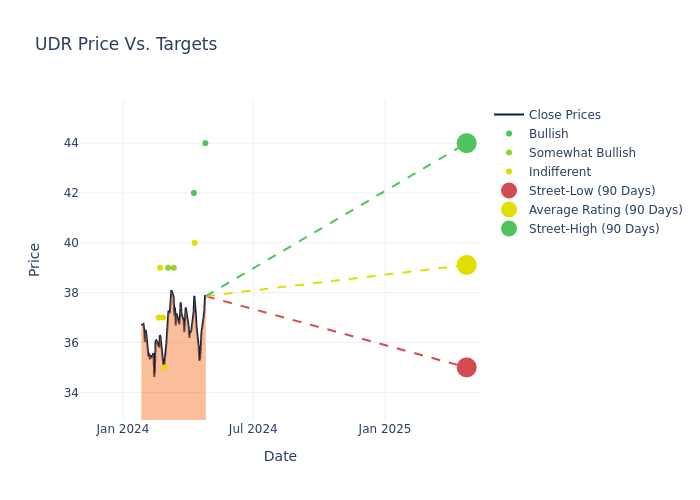

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $38.6, a high estimate of $44.00, and a low estimate of $34.00. Highlighting a 0.39% decrease, the current average has fallen from the previous average price target of $38.75.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of UDR among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Michael Goldsmith |

UBS |

Raises |

Buy |

$44.00 |

$38.00 |

| Alexander Goldfarb |

Piper Sandler |

Raises |

Neutral |

$40.00 |

$34.00 |

| Michael Lewis |

Truist Securities |

Lowers |

Buy |

$42.00 |

$45.00 |

| Alexander Goldfarb |

Piper Sandler |

Maintains |

Underweight |

$34.00 |

- |

| Wesley Golladay |

Baird |

Raises |

Outperform |

$39.00 |

$38.00 |

| James Feldman |

Wells Fargo |

Raises |

Overweight |

$39.00 |

$34.00 |

| Vikram Malhorta |

Mizuho |

Lowers |

Neutral |

$35.00 |

$38.00 |

| Adam Kramer |

Morgan Stanley |

Maintains |

Equal-Weight |

$37.00 |

$37.00 |

| Chandni Luthra |

Goldman Sachs |

Announces |

Neutral |

$39.00 |

- |

| Anthony Powell |

Barclays |

Lowers |

Equal-Weight |

$37.00 |

$46.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to UDR. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of UDR compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for UDR's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of UDR's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on UDR analyst ratings.

Discovering UDR: A Closer Look

UDR is a real estate investment trust that owns, operates, acquires, renovates, develops, redevelops, disposes of, and manages multifamily apartment communities in targeted markets located in the United States. The company has two reportable segments; Same-Store Communities segment represents those communities acquired, developed, and stabilized prior to January 1, 2021, and held as of December 31, 2022, and Non-Mature Communities/Other segment represents those communities that do not meet the criteria to be included in Same-Store Communities, including, but not limited to, recently acquired, developed and redeveloped communities, and the non-apartment components of mixed-use properties. The company generates key revenue from Same-Store Communities.

Unraveling the Financial Story of UDR

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining UDR's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.41% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: UDR's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.69% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): UDR's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 0.79%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): UDR's ROA excels beyond industry benchmarks, reaching 0.28%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 1.52, UDR adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: UDR