Unpacking the Latest Options Trading Trends in Advanced Micro Devices

Author: Benzinga Insights | April 25, 2024 10:46am

Whales with a lot of money to spend have taken a noticeably bearish stance on Advanced Micro Devices.

Looking at options history for Advanced Micro Devices (NASDAQ:AMD) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $145,646 and 7, calls, for a total amount of $703,721.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $135.0 to $195.0 for Advanced Micro Devices over the recent three months.

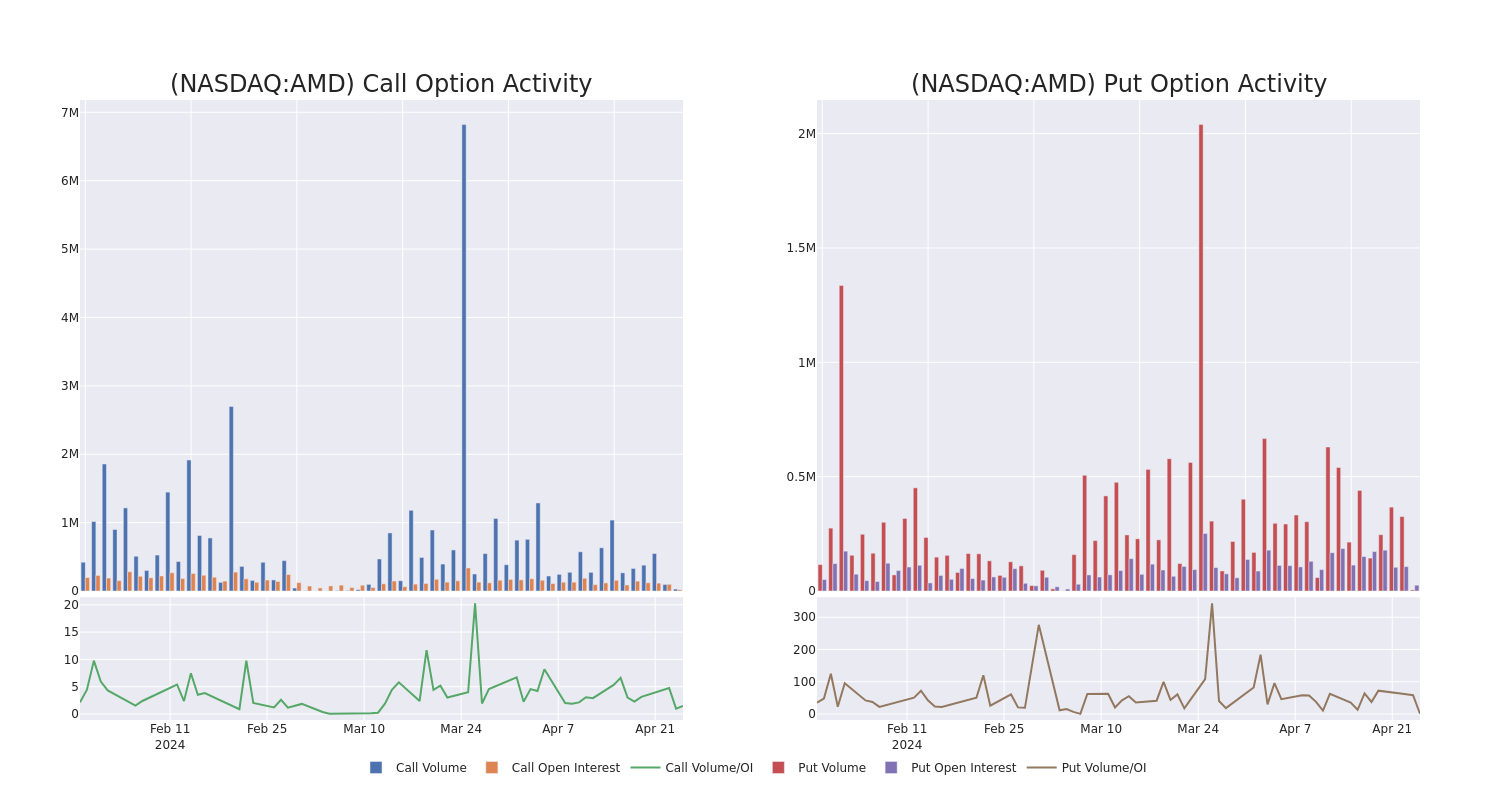

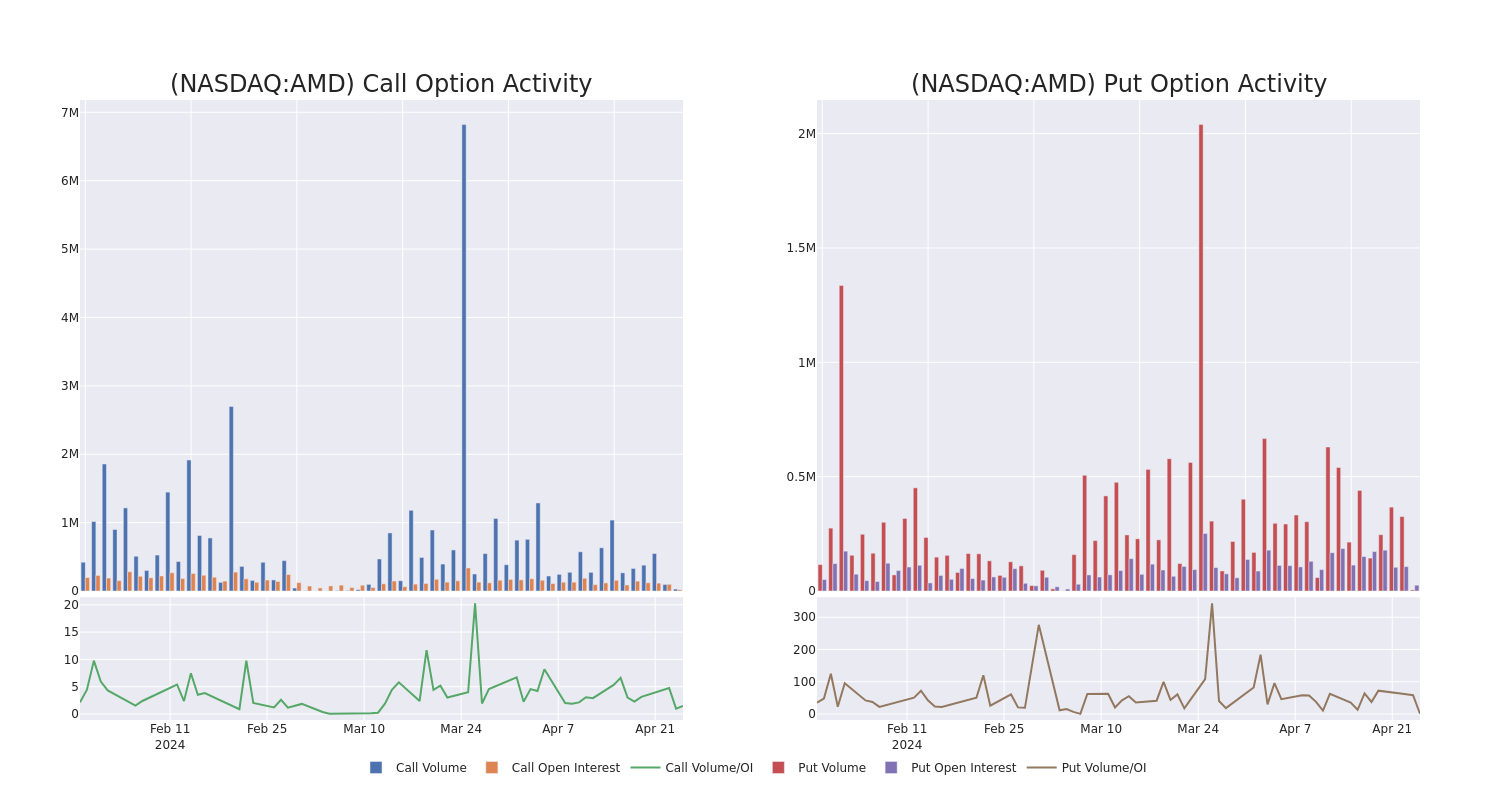

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Advanced Micro Devices's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Advanced Micro Devices's substantial trades, within a strike price spectrum from $135.0 to $195.0 over the preceding 30 days.

Advanced Micro Devices Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| AMD |

CALL |

SWEEP |

BEARISH |

05/10/24 |

$9.95 |

$9.9 |

$9.9 |

$149.00 |

$304.9K |

417 |

355 |

| AMD |

CALL |

SWEEP |

BEARISH |

04/26/24 |

$2.5 |

$2.47 |

$2.47 |

$152.50 |

$122.7K |

6.2K |

5.0K |

| AMD |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$11.0 |

$10.9 |

$10.95 |

$160.00 |

$89.7K |

2.9K |

2.7K |

| AMD |

CALL |

SWEEP |

NEUTRAL |

07/19/24 |

$8.0 |

$7.95 |

$7.98 |

$170.00 |

$70.1K |

3.2K |

2.3K |

| AMD |

CALL |

SWEEP |

BULLISH |

05/03/24 |

$2.66 |

$2.64 |

$2.66 |

$165.00 |

$43.8K |

6.6K |

1.6K |

About Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

Following our analysis of the options activities associated with Advanced Micro Devices, we pivot to a closer look at the company's own performance.

Current Position of Advanced Micro Devices

- With a trading volume of 13,834,776, the price of AMD is up by 0.43%, reaching $152.39.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 5 days from now.

What Analysts Are Saying About Advanced Micro Devices

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $205.0.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Advanced Micro Devices with a target price of $200.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Advanced Micro Devices with a target price of $200.

- In a cautious move, an analyst from Evercore ISI Group downgraded its rating to Outperform, setting a price target of $200.

- An analyst from Wedbush downgraded its action to Outperform with a price target of $200.

- An analyst from HSBC upgraded its action to Buy with a price target of $225.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Advanced Micro Devices, Benzinga Pro gives you real-time options trades alerts.

Posted In: AMD