Wells Fargo's Options Frenzy: What You Need to Know

Author: Benzinga Insights | April 25, 2024 10:45am

Deep-pocketed investors have adopted a bearish approach towards Wells Fargo (NYSE:WFC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WFC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Wells Fargo. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 25% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $90,790, and 6 are calls, amounting to $529,120.

Expected Price Movements

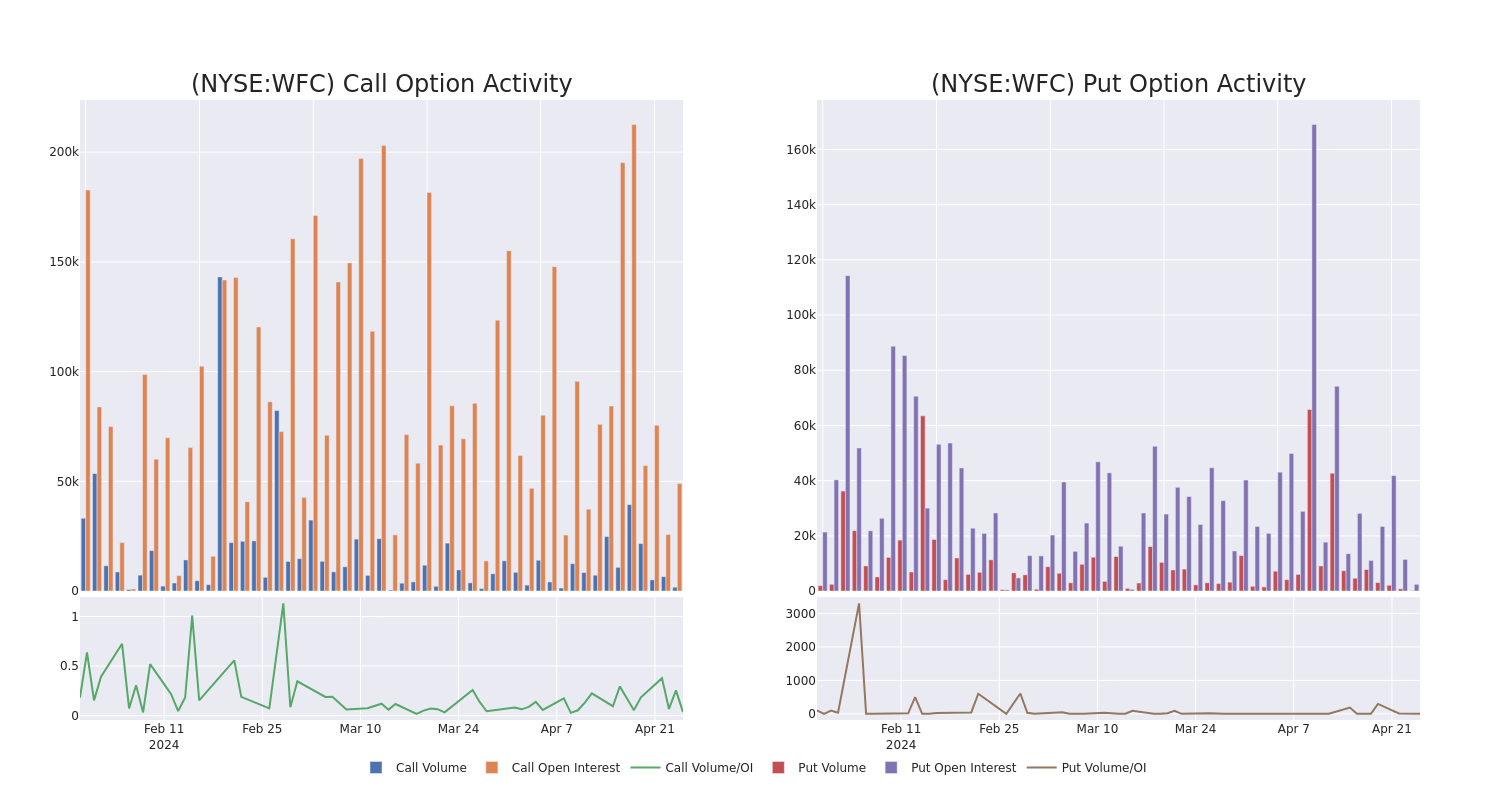

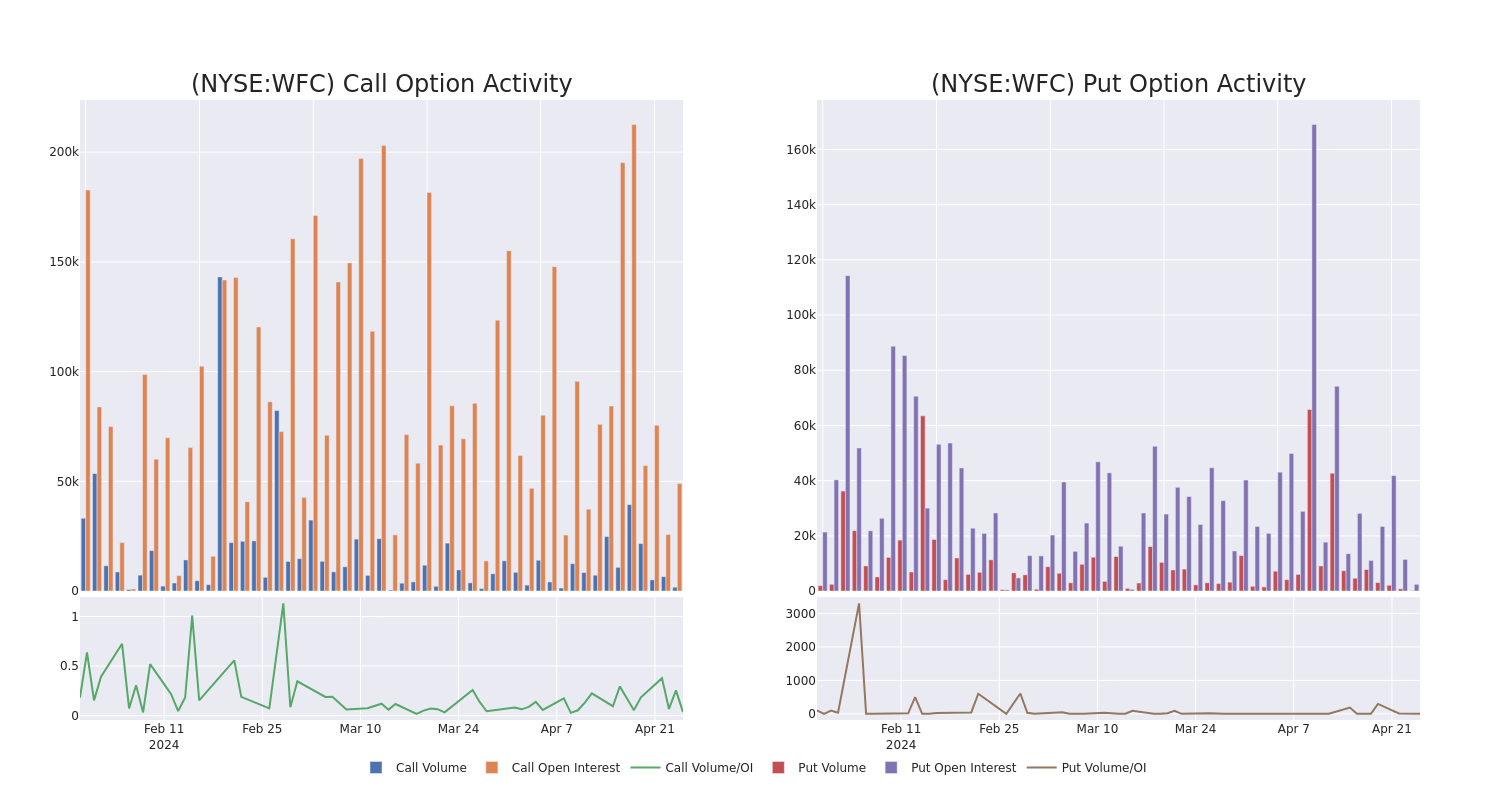

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $62.5 for Wells Fargo during the past quarter.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Wells Fargo's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wells Fargo's whale trades within a strike price range from $25.0 to $62.5 in the last 30 days.

Wells Fargo Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| WFC |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$23.0 |

$21.5 |

$21.6 |

$40.00 |

$216.0K |

20.2K |

0 |

| WFC |

CALL |

TRADE |

BEARISH |

01/17/25 |

$18.35 |

$16.35 |

$17.1 |

$45.00 |

$171.0K |

18.2K |

100 |

| WFC |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$4.6 |

$4.5 |

$4.5 |

$62.50 |

$56.2K |

762 |

125 |

| WFC |

CALL |

SWEEP |

BEARISH |

04/26/24 |

$0.54 |

$0.53 |

$0.53 |

$60.00 |

$42.3K |

5.4K |

243 |

| WFC |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$1.0 |

$0.98 |

$0.98 |

$60.00 |

$39.1K |

2.6K |

1.4K |

About Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

Having examined the options trading patterns of Wells Fargo, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Wells Fargo

- With a trading volume of 3,190,470, the price of WFC is down by -0.6%, reaching $60.23.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 78 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wells Fargo options trades with real-time alerts from Benzinga Pro.

Posted In: WFC