Unpacking the Latest Options Trading Trends in Marvell Tech

Author: Benzinga Insights | April 25, 2024 10:31am

Deep-pocketed investors have adopted a bearish approach towards Marvell Tech (NASDAQ:MRVL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRVL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Marvell Tech. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 38% leaning bullish and 53% bearish. Among these notable options, 3 are puts, totaling $113,400, and 10 are calls, amounting to $563,474.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $70.0 for Marvell Tech over the recent three months.

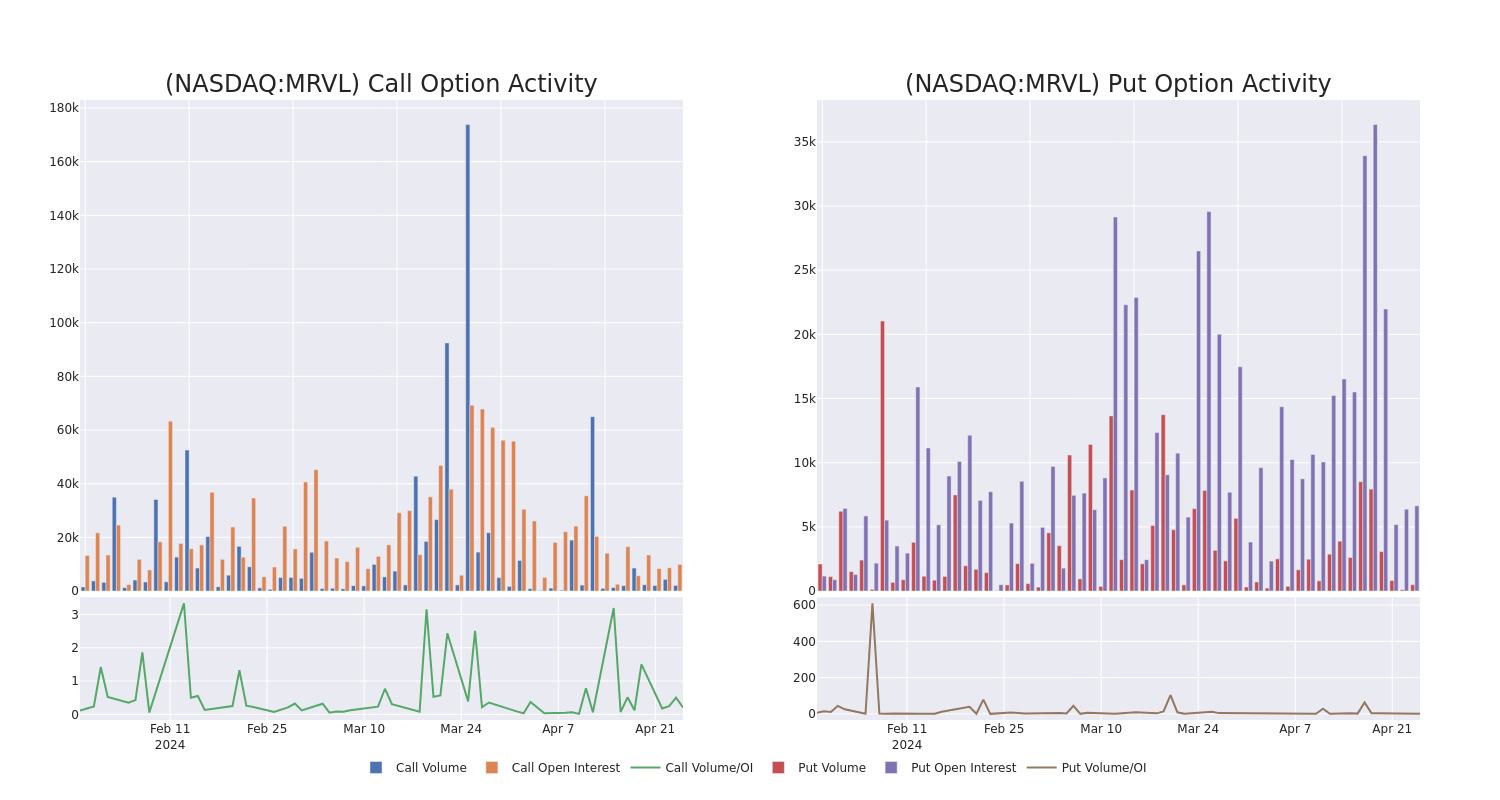

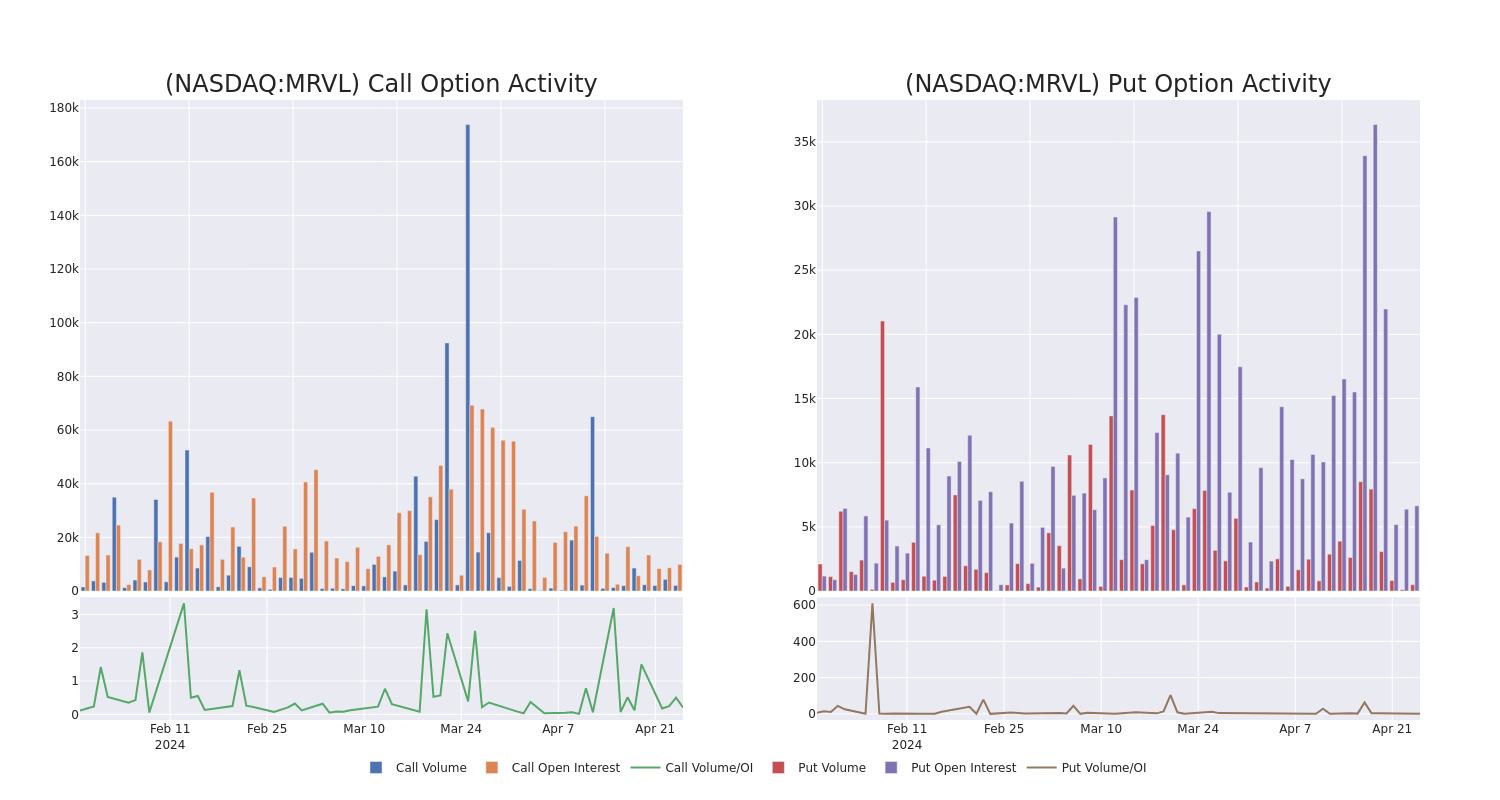

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Marvell Tech's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Marvell Tech's whale activity within a strike price range from $60.0 to $70.0 in the last 30 days.

Marvell Tech Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MRVL |

CALL |

SWEEP |

BEARISH |

08/16/24 |

$10.45 |

$10.15 |

$10.22 |

$60.00 |

$157.7K |

225 |

0 |

| MRVL |

CALL |

TRADE |

BULLISH |

08/16/24 |

$8.8 |

$8.65 |

$8.8 |

$62.50 |

$88.0K |

571 |

0 |

| MRVL |

CALL |

SWEEP |

BULLISH |

01/17/25 |

$13.9 |

$13.8 |

$13.9 |

$62.50 |

$52.8K |

715 |

34 |

| MRVL |

CALL |

SWEEP |

BEARISH |

04/26/24 |

$1.89 |

$1.88 |

$1.88 |

$65.00 |

$50.1K |

1.1K |

304 |

| MRVL |

PUT |

SWEEP |

BEARISH |

07/19/24 |

$3.05 |

$3.0 |

$3.0 |

$60.00 |

$49.2K |

6.6K |

14 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Having examined the options trading patterns of Marvell Tech, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Marvell Tech Standing Right Now?

- With a volume of 2,081,632, the price of MRVL is up 1.03% at $65.52.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

Expert Opinions on Marvell Tech

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $89.4.

- An analyst from Keybanc has decided to maintain their Overweight rating on Marvell Tech, which currently sits at a price target of $90.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $85.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Marvell Tech with a target price of $86.

- Reflecting concerns, an analyst from Citigroup lowers its rating to Buy with a new price target of $91.

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $95.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marvell Tech with Benzinga Pro for real-time alerts.

Posted In: MRVL