Decoding Riot Platforms's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 25, 2024 10:31am

Deep-pocketed investors have adopted a bullish approach towards Riot Platforms (NASDAQ:RIOT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RIOT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Riot Platforms. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 54% leaning bullish and 18% bearish. Among these notable options, 4 are puts, totaling $233,998, and 7 are calls, amounting to $278,056.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $25.0 for Riot Platforms over the last 3 months.

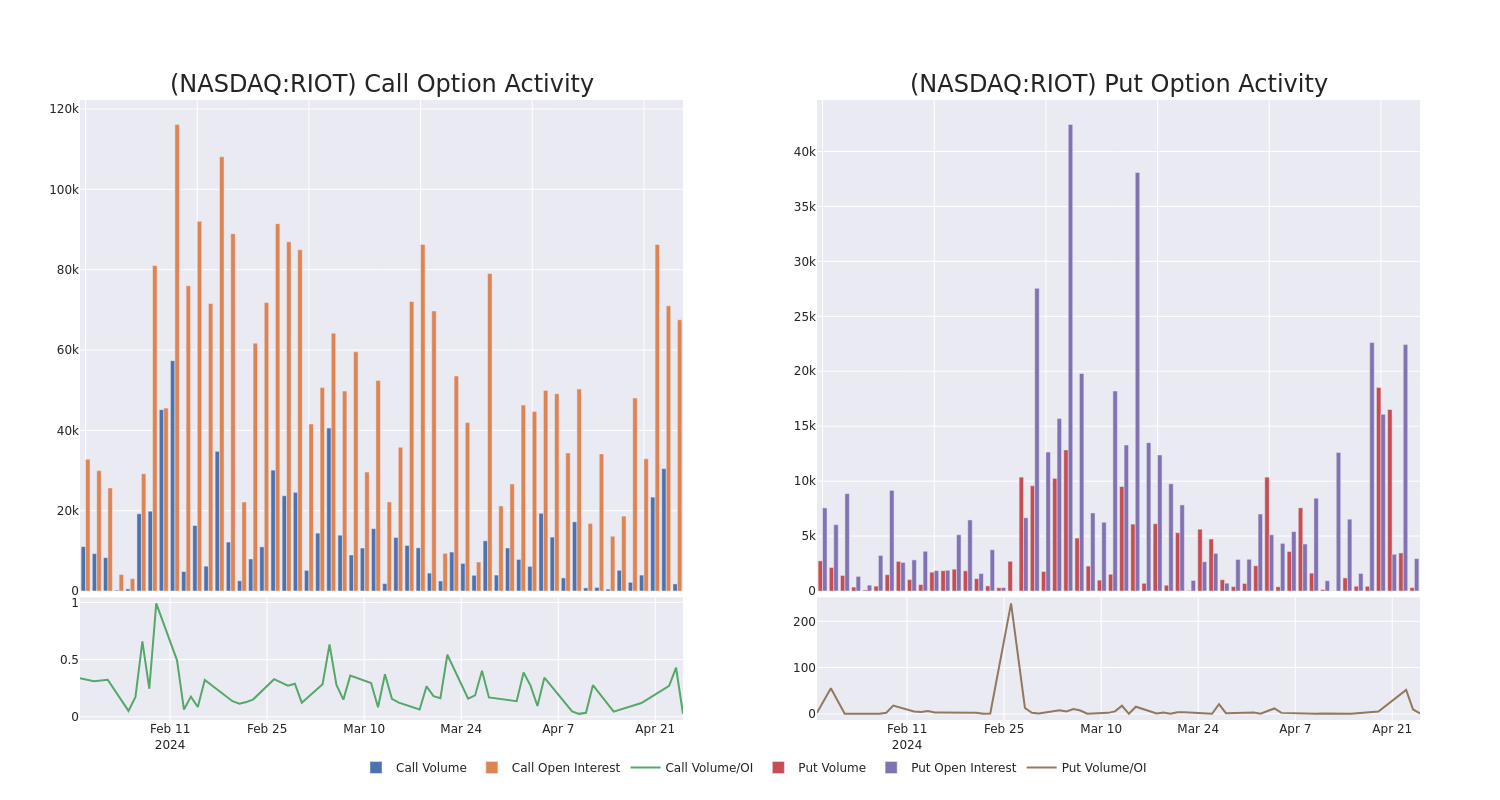

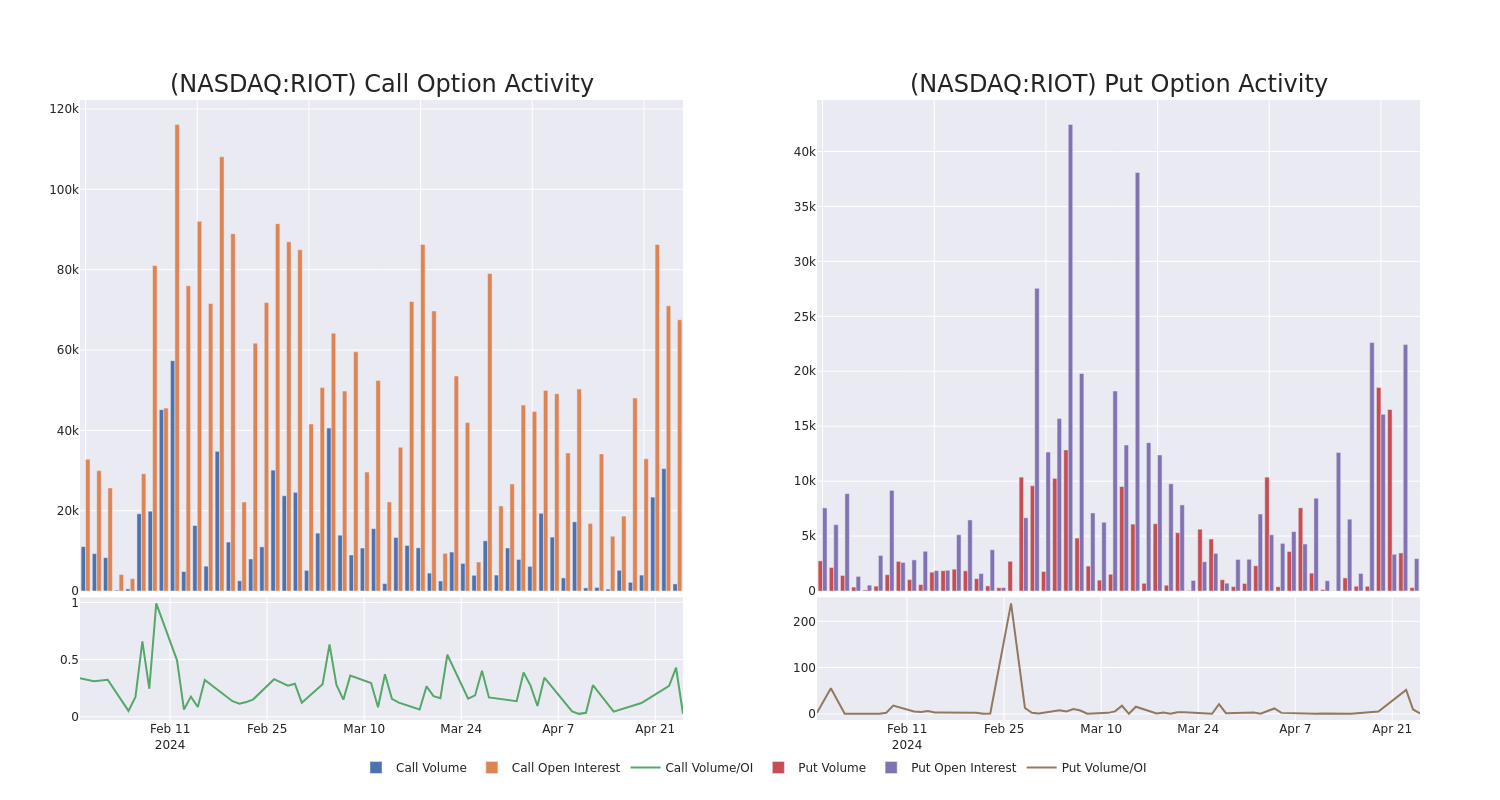

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Riot Platforms's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Riot Platforms's substantial trades, within a strike price spectrum from $10.0 to $25.0 over the preceding 30 days.

Riot Platforms Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| RIOT |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$3.4 |

$3.35 |

$3.35 |

$11.00 |

$100.5K |

286 |

300 |

| RIOT |

CALL |

SWEEP |

NEUTRAL |

01/17/25 |

$1.98 |

$1.5 |

$1.7 |

$25.00 |

$72.4K |

13.3K |

1 |

| RIOT |

PUT |

SWEEP |

BULLISH |

12/20/24 |

$3.2 |

$3.15 |

$3.15 |

$11.00 |

$55.7K |

23 |

0 |

| RIOT |

PUT |

SWEEP |

BULLISH |

06/21/24 |

$5.5 |

$5.45 |

$5.45 |

$16.00 |

$48.5K |

1.6K |

0 |

| RIOT |

CALL |

TRADE |

BULLISH |

01/16/26 |

$6.45 |

$6.1 |

$6.45 |

$10.00 |

$43.8K |

9.6K |

70 |

About Riot Platforms

Riot Platforms Inc is a vertically integrated Bitcoin mining company focused on building, supporting, and operating blockchain technologies. The company's segments include Bitcoin Mining; Data Center Hosting and Engineering. It generates maximum revenue from the Bitcoin Mining segment which generates revenue from the Bitcoin the company earns through its mining activities.

Following our analysis of the options activities associated with Riot Platforms, we pivot to a closer look at the company's own performance.

Current Position of Riot Platforms

- With a trading volume of 11,772,044, the price of RIOT is down by -3.45%, reaching $11.47.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 13 days from now.

What The Experts Say On Riot Platforms

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $19.2.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $20.

- An analyst from B. Riley Securities persists with their Buy rating on Riot Platforms, maintaining a target price of $16.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $20.

- An analyst from ATB Capital has revised its rating downward to Outperform, adjusting the price target to $20.

- An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Riot Platforms options trades with real-time alerts from Benzinga Pro.

Posted In: RIOT