Key Takeaways From Boston Scientific Analyst Ratings

Author: Benzinga Insights | April 25, 2024 08:00am

Boston Scientific (NYSE:BSX) underwent analysis by 16 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

7 |

8 |

1 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

3 |

2 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

4 |

4 |

1 |

0 |

0 |

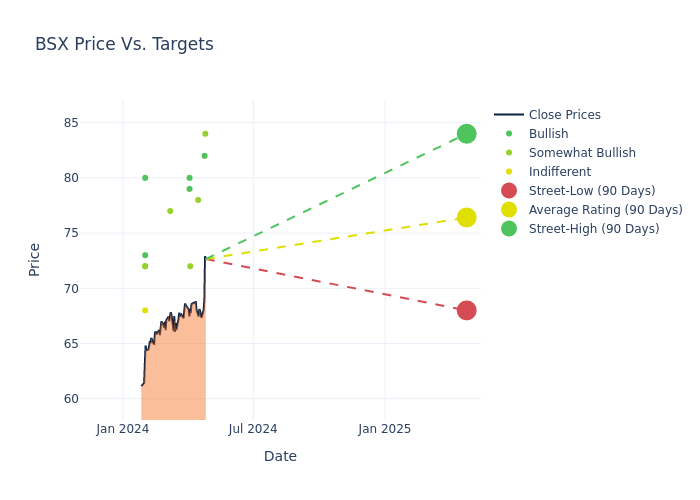

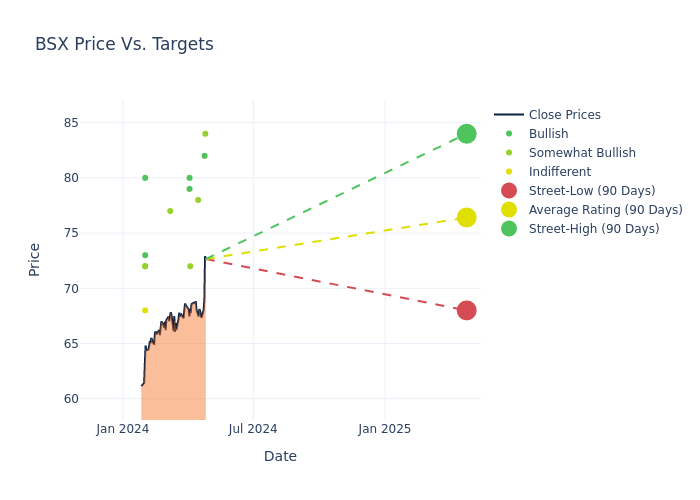

Insights from analysts' 12-month price targets are revealed, presenting an average target of $74.94, a high estimate of $84.00, and a low estimate of $68.00. This current average has increased by 11.62% from the previous average price target of $67.14.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Boston Scientific among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| David Rescott |

Baird |

Raises |

Outperform |

$84.00 |

$79.00 |

| Mike Matson |

Needham |

Raises |

Buy |

$82.00 |

$71.00 |

| Shagun Singh |

RBC Capital |

Raises |

Outperform |

$78.00 |

$70.00 |

| Vijay Kumar |

Evercore ISI Group |

Raises |

Outperform |

$72.00 |

$68.00 |

| John Eade |

Argus Research |

Raises |

Buy |

$80.00 |

$69.00 |

| Joanne Wuensch |

Citigroup |

Raises |

Buy |

$79.00 |

$71.00 |

| Joshua Jennings |

TD Cowen |

Raises |

Outperform |

$77.00 |

$65.00 |

| Shagun Singh |

RBC Capital |

Maintains |

Outperform |

$70.00 |

- |

| Joanne Wuensch |

Citigroup |

Raises |

Buy |

$71.00 |

$65.00 |

| Mike Matson |

Needham |

Raises |

Buy |

$71.00 |

$60.00 |

| Jayson Bedford |

Raymond James |

Raises |

Strong Buy |

$73.00 |

$67.00 |

| Steven Lichtman |

Oppenheimer |

Raises |

Perform |

$68.00 |

$58.00 |

| Anthony Petrone |

Mizuho |

Announces |

Buy |

$80.00 |

- |

| Shagun Singh |

RBC Capital |

Raises |

Outperform |

$70.00 |

$67.00 |

| Robbie Marcus |

JP Morgan |

Raises |

Overweight |

$72.00 |

$60.00 |

| Larry Biegelsen |

Wells Fargo |

Raises |

Overweight |

$72.00 |

$70.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Boston Scientific. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Boston Scientific compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Boston Scientific's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Boston Scientific's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Boston Scientific analyst ratings.

About Boston Scientific

Boston Scientific produces less invasive medical devices that are inserted into the human body through small openings or cuts. It manufactures products for use in angioplasty, blood clot filtration, cardiac rhythm management, catheter-directed ultrasound imaging, upper gastrointestinal tract diagnostics, interventional oncology, neuromodulation for chronic pain, and treatment of incontinence. The firm markets its devices to healthcare professionals and institutions globally. Foreign sales account for nearly half of the firm's total sales.

Financial Insights: Boston Scientific

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3 months period, Boston Scientific showcased positive performance, achieving a revenue growth rate of 14.9% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 13.56%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.65%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Boston Scientific's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.46%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.49.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BSX