Spotlight on Occidental Petroleum: Analyzing the Surge in Options Activity

Author: Benzinga Insights | April 24, 2024 02:01pm

Investors with a lot of money to spend have taken a bullish stance on Occidental Petroleum (NYSE:OXY).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with OXY, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for Occidental Petroleum.

This isn't normal.

The overall sentiment of these big-money traders is split between 63% bullish and 27%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $59,974, and 9 are calls, for a total amount of $436,527.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $77.5 for Occidental Petroleum over the recent three months.

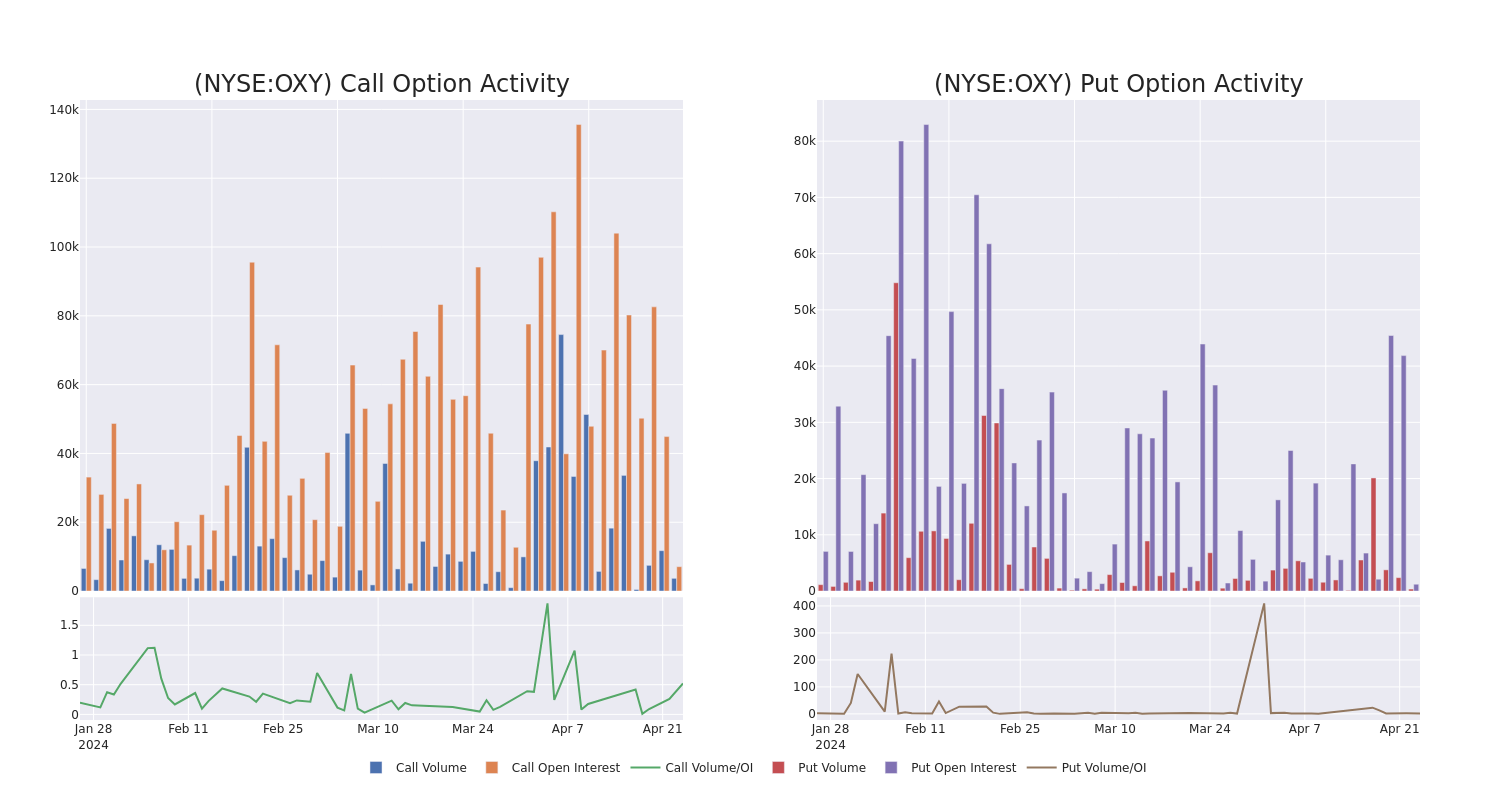

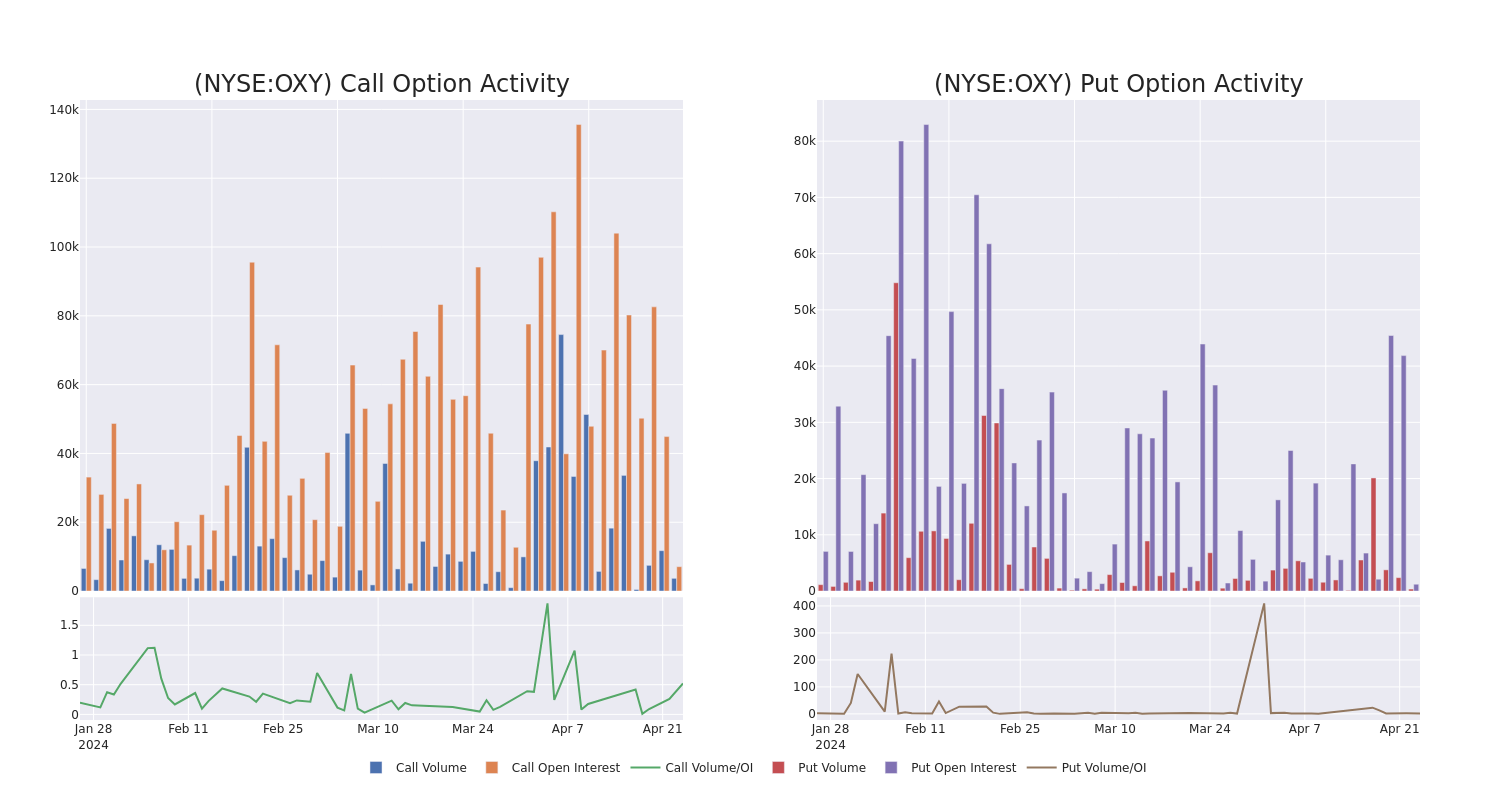

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Occidental Petroleum's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Occidental Petroleum's substantial trades, within a strike price spectrum from $50.0 to $77.5 over the preceding 30 days.

Occidental Petroleum Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| OXY |

CALL |

SWEEP |

BULLISH |

08/16/24 |

$2.14 |

$2.1 |

$2.13 |

$72.50 |

$85.6K |

848 |

10 |

| OXY |

CALL |

SWEEP |

BEARISH |

04/26/24 |

$0.72 |

$0.71 |

$0.71 |

$67.00 |

$70.5K |

2.1K |

1.6K |

| OXY |

CALL |

SWEEP |

BULLISH |

04/26/24 |

$0.68 |

$0.66 |

$0.68 |

$67.00 |

$68.0K |

2.1K |

1.6K |

| OXY |

CALL |

TRADE |

NEUTRAL |

07/19/24 |

$17.95 |

$17.5 |

$17.73 |

$50.00 |

$53.1K |

106 |

60 |

| OXY |

CALL |

TRADE |

BEARISH |

07/19/24 |

$17.9 |

$17.6 |

$17.69 |

$50.00 |

$53.0K |

106 |

0 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

After a thorough review of the options trading surrounding Occidental Petroleum, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Occidental Petroleum

- With a volume of 3,054,751, the price of OXY is down -0.03% at $67.37.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 13 days.

What Analysts Are Saying About Occidental Petroleum

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $77.2.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Occidental Petroleum, targeting a price of $72.

- In a positive move, an analyst from Scotiabank has upgraded their rating to Sector Outperform and adjusted the price target to $90.

- An analyst from Mizuho has decided to maintain their Neutral rating on Occidental Petroleum, which currently sits at a price target of $70.

- An analyst from Barclays downgraded its action to Equal-Weight with a price target of $73.

- An analyst from Susquehanna persists with their Positive rating on Occidental Petroleum, maintaining a target price of $81.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Occidental Petroleum with Benzinga Pro for real-time alerts.

Posted In: OXY