Market Whales and Their Recent Bets on CSCO Options

Author: Benzinga Insights | April 24, 2024 12:45pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Cisco Systems.

Looking at options history for Cisco Systems (NASDAQ:CSCO) we detected 20 trades.

If we consider the specifics of each trade, it is accurate to state that 15% of the investors opened trades with bullish expectations and 85% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $268,390 and 16, calls, for a total amount of $865,555.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $42.5 to $52.5 for Cisco Systems over the last 3 months.

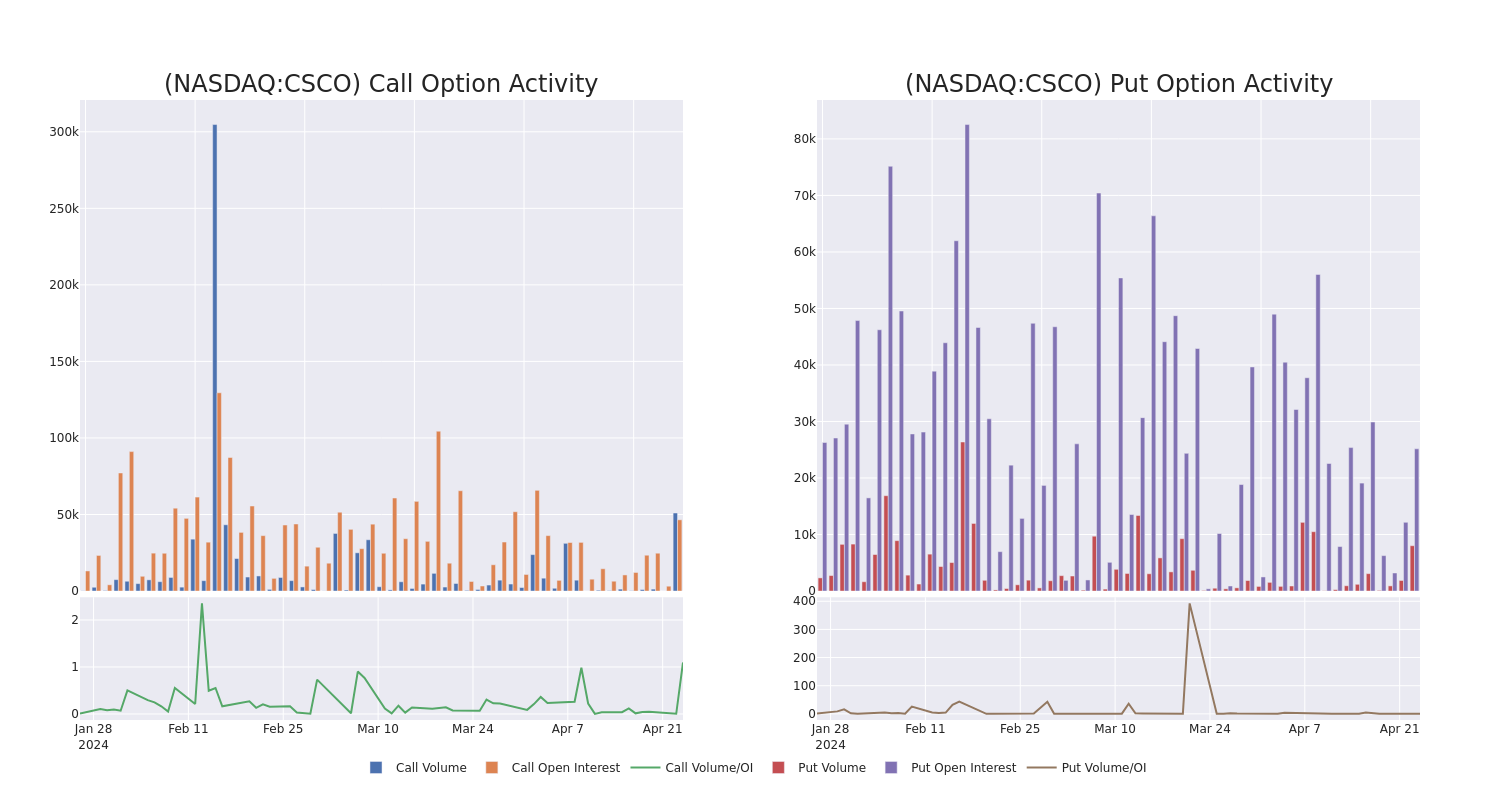

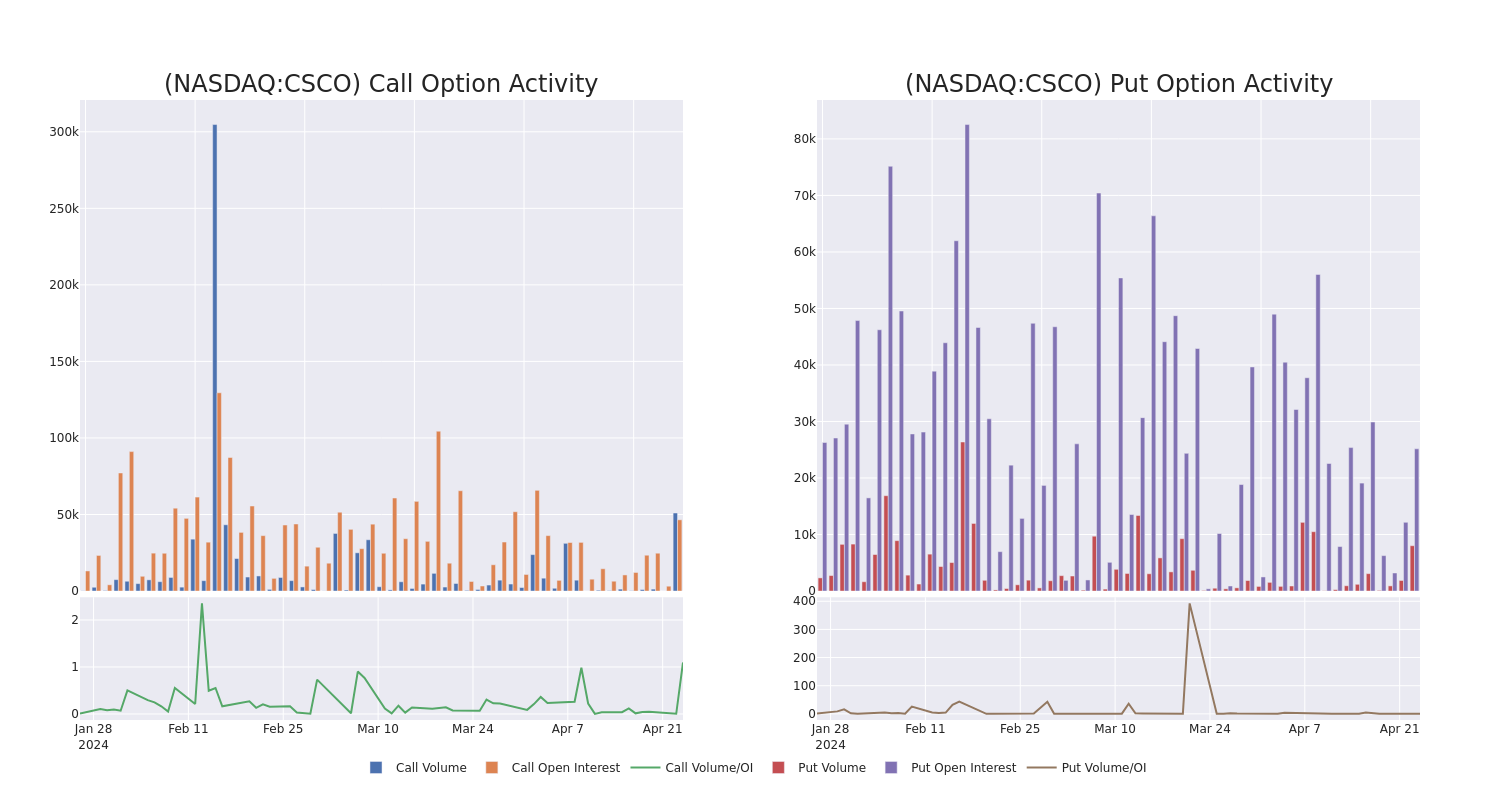

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Cisco Systems's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cisco Systems's whale activity within a strike price range from $42.5 to $52.5 in the last 30 days.

Cisco Systems Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CSCO |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$0.67 |

$0.66 |

$0.67 |

$50.00 |

$154.4K |

23.8K |

2.4K |

| CSCO |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$2.54 |

$2.53 |

$2.53 |

$47.50 |

$104.2K |

3.7K |

448 |

| CSCO |

PUT |

SWEEP |

BULLISH |

06/20/25 |

$6.55 |

$6.45 |

$6.48 |

$52.50 |

$84.1K |

427 |

0 |

| CSCO |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$4.1 |

$4.05 |

$4.06 |

$45.00 |

$81.1K |

18.4K |

0 |

| CSCO |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$0.25 |

$0.24 |

$0.24 |

$52.00 |

$80.8K |

153 |

3.3K |

About Cisco Systems

Cisco Systems is the largest provider of networking equipment in the world and one of the largest software companies in the world. Its largest businesses are selling networking hardware and software (where it has leading market shares) and cybersecurity software like firewalls. It also has collaboration products, like its Webex suite, and observability tools. It primarily outsources its manufacturing to third parties and has a large sales and marketing staff—25,000 strong across 90 countries. Overall, Cisco employees 80,000 employees and sells its products globally.

After a thorough review of the options trading surrounding Cisco Systems, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Cisco Systems's Current Market Status

- Currently trading with a volume of 6,186,993, the CSCO's price is down by -0.39%, now at $48.13.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 21 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cisco Systems options trades with real-time alerts from Benzinga Pro.

Posted In: CSCO