This Is What Whales Are Betting On MongoDB

Author: Benzinga Insights | April 24, 2024 12:31pm

Deep-pocketed investors have adopted a bullish approach towards MongoDB (NASDAQ:MDB), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MDB usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for MongoDB. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 33% bearish. Among these notable options, 11 are puts, totaling $373,310, and 7 are calls, amounting to $191,910.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $320.0 to $440.0 for MongoDB during the past quarter.

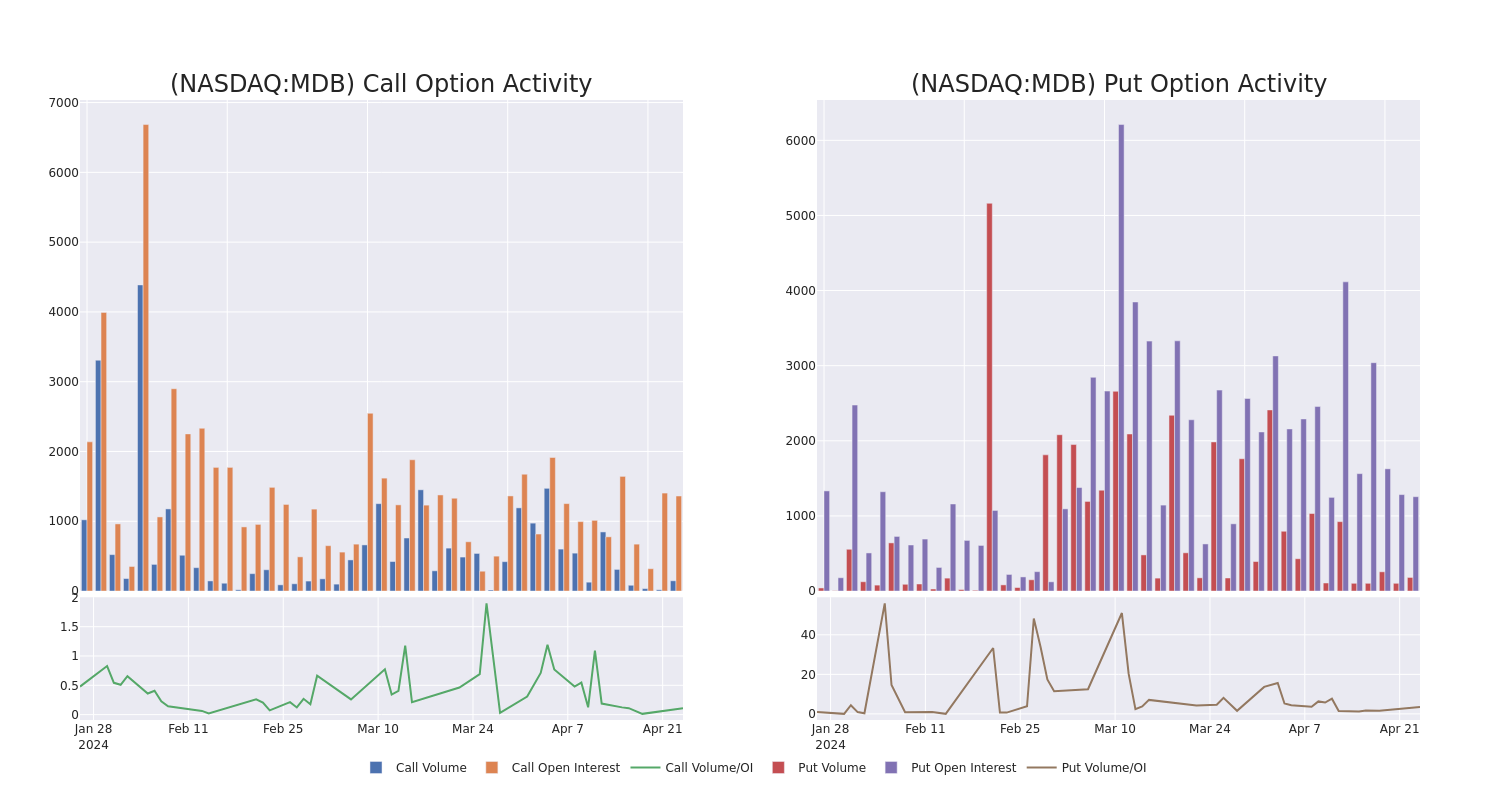

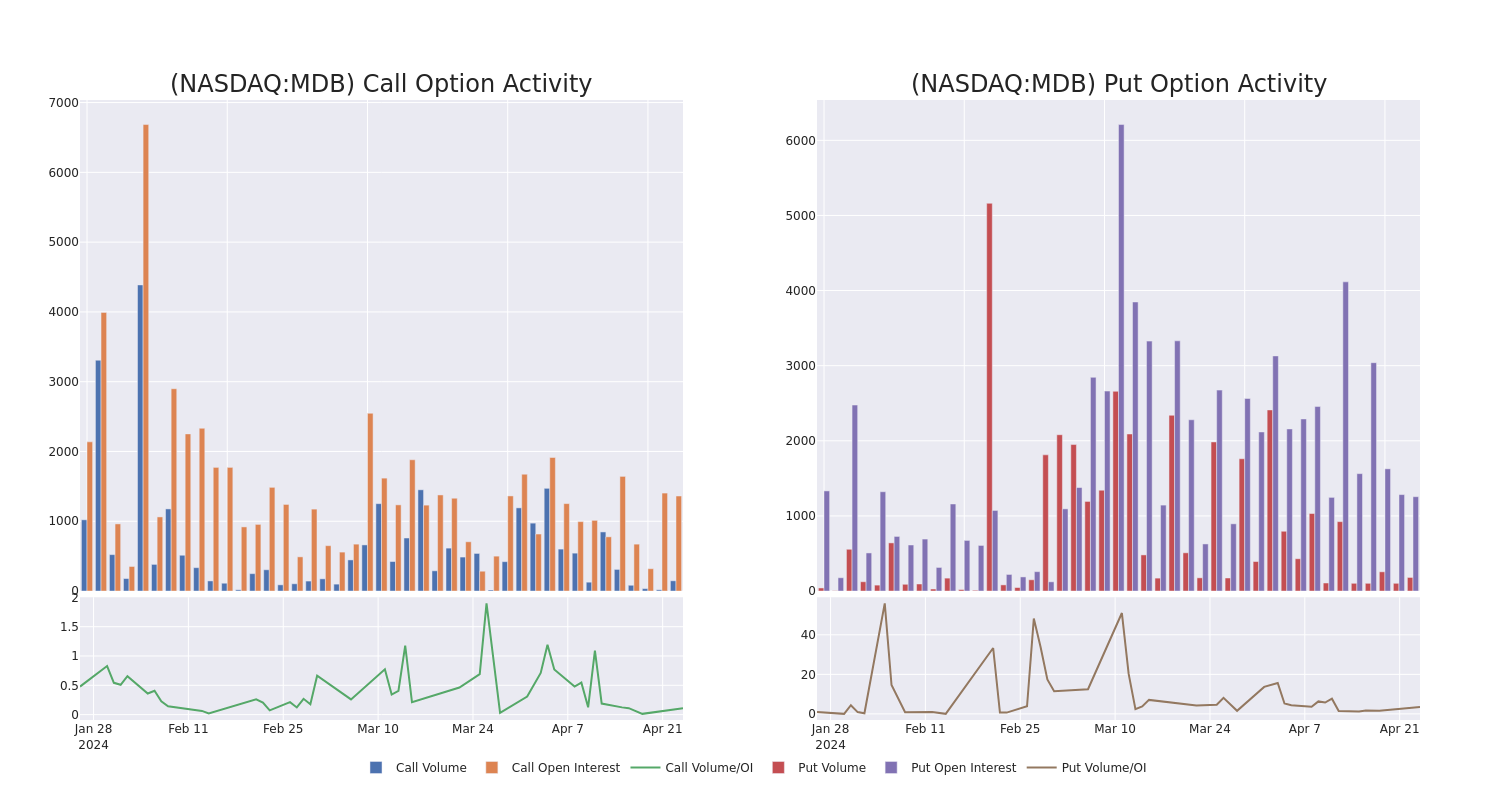

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MongoDB's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MongoDB's substantial trades, within a strike price spectrum from $320.0 to $440.0 over the preceding 30 days.

MongoDB Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MDB |

PUT |

SWEEP |

BULLISH |

05/03/24 |

$10.6 |

$10.15 |

$10.15 |

$360.00 |

$70.0K |

239 |

27 |

| MDB |

PUT |

SWEEP |

BEARISH |

08/16/24 |

$21.2 |

$20.95 |

$21.2 |

$320.00 |

$38.1K |

100 |

40 |

| MDB |

PUT |

TRADE |

BULLISH |

06/21/24 |

$60.55 |

$59.85 |

$59.85 |

$410.00 |

$35.9K |

546 |

6 |

| MDB |

PUT |

SWEEP |

BEARISH |

05/03/24 |

$13.85 |

$13.5 |

$13.85 |

$365.00 |

$34.6K |

53 |

32 |

| MDB |

PUT |

TRADE |

BULLISH |

05/17/24 |

$20.4 |

$20.35 |

$20.35 |

$370.00 |

$34.5K |

142 |

4 |

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Current Position of MongoDB

- With a volume of 644,685, the price of MDB is down -0.9% at $363.01.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 36 days.

Expert Opinions on MongoDB

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $455.0.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $465.

- An analyst from Tigress Financial persists with their Buy rating on MongoDB, maintaining a target price of $500.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for MongoDB, targeting a price of $440.

- In a cautious move, an analyst from Loop Capital downgraded its rating to Buy, setting a price target of $415.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MongoDB options trades with real-time alerts from Benzinga Pro.

Posted In: MDB