Expert Ratings For American Express

Author: Benzinga Insights | April 24, 2024 11:00am

In the preceding three months, 17 analysts have released ratings for American Express (NYSE:AXP), presenting a wide array of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

7 |

5 |

2 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

3 |

3 |

4 |

1 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

3 |

1 |

1 |

0 |

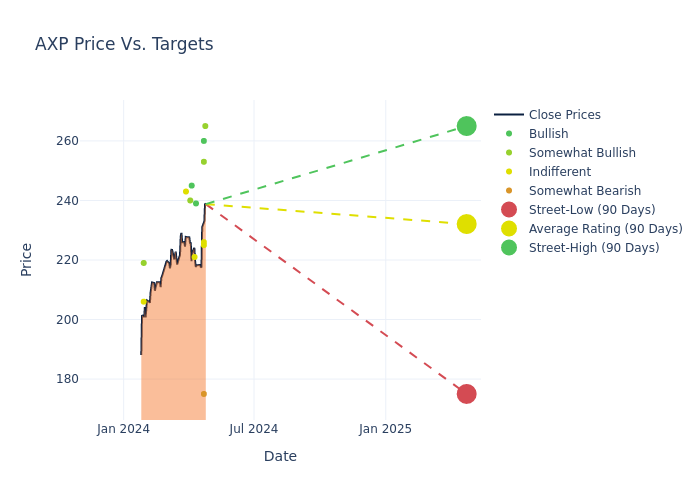

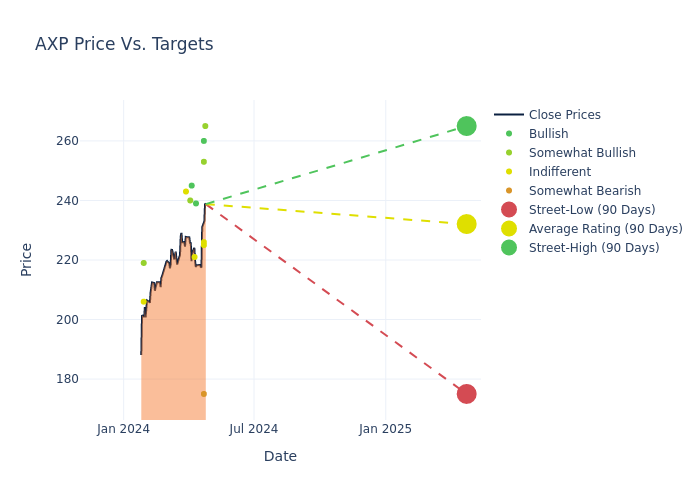

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $227.76, a high estimate of $265.00, and a low estimate of $159.00. Witnessing a positive shift, the current average has risen by 5.5% from the previous average price target of $215.88.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive American Express. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Donald Fandetti |

Wells Fargo |

Raises |

Overweight |

$265.00 |

$250.00 |

| Moshe Orenbuch |

TD Cowen |

Raises |

Hold |

$225.00 |

$221.00 |

| Jon Arfstrom |

RBC Capital |

Raises |

Outperform |

$253.00 |

$250.00 |

| Mark Devries |

Deutsche Bank |

Raises |

Buy |

$260.00 |

$240.00 |

| James Fotheringham |

BMO Capital |

Raises |

Underperform |

$175.00 |

$167.00 |

| Betsy Graseck |

Morgan Stanley |

Raises |

Equal-Weight |

$226.00 |

$222.00 |

| Saul Martinez |

HSBC |

Raises |

Buy |

$239.00 |

$232.00 |

| Donald Fandetti |

Wells Fargo |

Raises |

Overweight |

$250.00 |

$220.00 |

| Terry Ma |

Barclays |

Raises |

Equal-Weight |

$221.00 |

$220.00 |

| Gus Gala |

Monness, Crespi, Hardt |

Announces |

Buy |

$245.00 |

- |

| Richard Shane |

JP Morgan |

Raises |

Overweight |

$240.00 |

$214.00 |

| John Pancari |

Evercore ISI Group |

Raises |

In-Line |

$243.00 |

$229.00 |

| Dominick Gabriele |

Oppenheimer |

Raises |

Outperform |

$219.00 |

$208.00 |

| Jon Arfstrom |

RBC Capital |

Raises |

Outperform |

$226.00 |

$220.00 |

| Eric Wasserstrom |

UBS |

Raises |

Neutral |

$206.00 |

$188.00 |

| James Fotheringham |

BMO Capital |

Raises |

Underperform |

$159.00 |

$157.00 |

| Mark Devries |

Barclays |

Raises |

Overweight |

$220.00 |

$216.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to American Express. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of American Express compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of American Express's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of American Express's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on American Express analyst ratings.

About American Express

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

American Express: A Financial Overview

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Positive Revenue Trend: Examining American Express's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.64% as of 31 March, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: American Express's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 15.22% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): American Express's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.47% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): American Express's ROA excels beyond industry benchmarks, reaching 0.91%. This signifies efficient management of assets and strong financial health.

Debt Management: American Express's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.76.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AXP