A Closer Look at Rivian Automotive's Options Market Dynamics

Author: Benzinga Insights | April 24, 2024 10:01am

Investors with a lot of money to spend have taken a bearish stance on Rivian Automotive (NASDAQ:RIVN).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with RIVN, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 15 options trades for Rivian Automotive.

This isn't normal.

The overall sentiment of these big-money traders is split between 20% bullish and 73%, bearish.

Out of all of the options we uncovered, 14 are puts, for a total amount of $806,400, and there was 1 call, for a total amount of $25,560.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1.0 to $12.5 for Rivian Automotive over the recent three months.

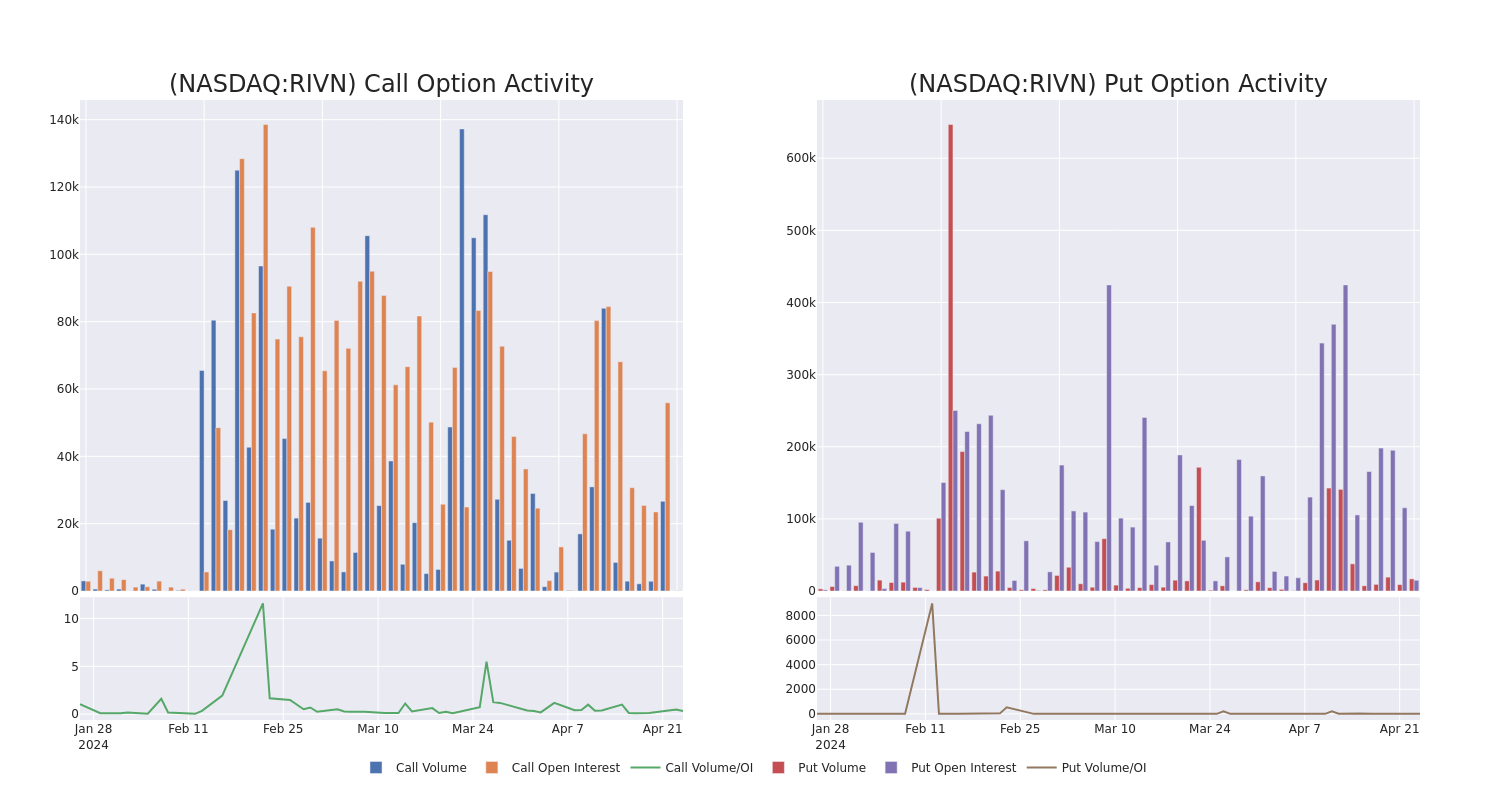

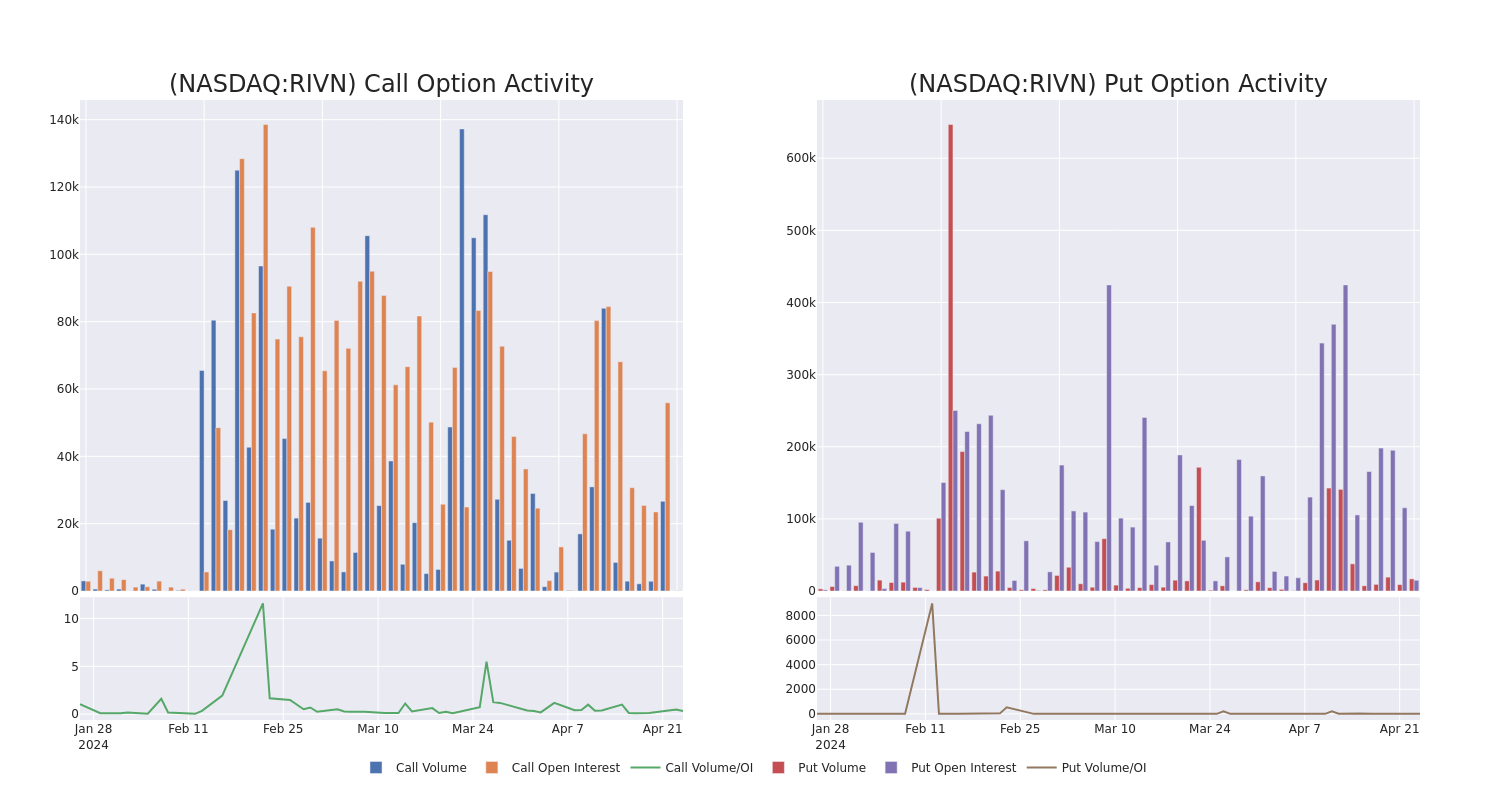

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Rivian Automotive's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Rivian Automotive's substantial trades, within a strike price spectrum from $1.0 to $12.5 over the preceding 30 days.

Rivian Automotive 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| RIVN |

PUT |

SWEEP |

BEARISH |

07/19/24 |

$4.05 |

$3.95 |

$4.05 |

$12.50 |

$105.3K |

14.9K |

1.5K |

| RIVN |

PUT |

SWEEP |

BEARISH |

07/19/24 |

$4.05 |

$3.9 |

$4.05 |

$12.50 |

$85.0K |

14.9K |

2.1K |

| RIVN |

PUT |

TRADE |

BULLISH |

07/19/24 |

$4.05 |

$4.0 |

$4.0 |

$12.50 |

$76.0K |

14.9K |

2.0K |

| RIVN |

PUT |

SWEEP |

BEARISH |

07/19/24 |

$4.0 |

$3.9 |

$4.0 |

$12.50 |

$76.0K |

14.9K |

1.0K |

| RIVN |

PUT |

SWEEP |

BEARISH |

07/19/24 |

$4.05 |

$3.95 |

$4.05 |

$12.50 |

$68.8K |

14.9K |

1.3K |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

Rivian Automotive's Current Market Status

- With a trading volume of 4,574,867, the price of RIVN is down by -0.96%, reaching $8.95.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 13 days from now.

What Analysts Are Saying About Rivian Automotive

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $14.2.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Rivian Automotive, which currently sits at a price target of $13.

- Consistent in their evaluation, an analyst from Truist Securities keeps a Hold rating on Rivian Automotive with a target price of $11.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $23.

- Maintaining their stance, an analyst from Deutsche Bank continues to hold a Hold rating for Rivian Automotive, targeting a price of $15.

- An analyst from UBS has elevated its stance to Neutral, setting a new price target at $9.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Rivian Automotive, Benzinga Pro gives you real-time options trades alerts.

Posted In: RIVN