Decoding 13 Analyst Evaluations For Elevance Health

Author: Benzinga Insights | April 24, 2024 08:01am

Analysts' ratings for Elevance Health (NYSE:ELV) over the last quarter vary from bullish to bearish, as provided by 13 analysts.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

9 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

3 |

6 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

2 |

0 |

0 |

0 |

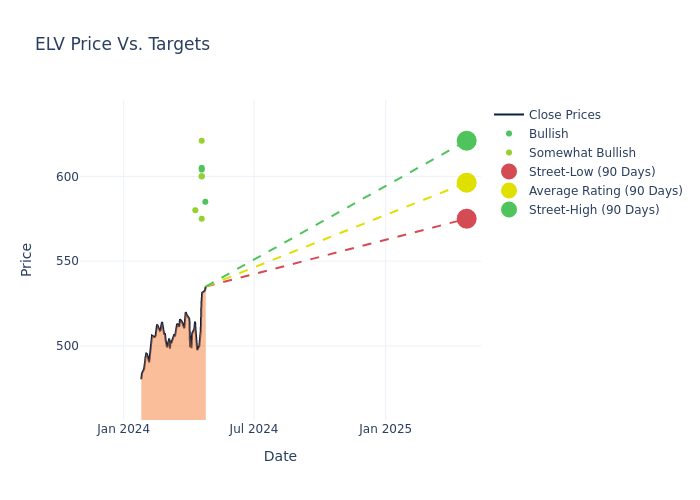

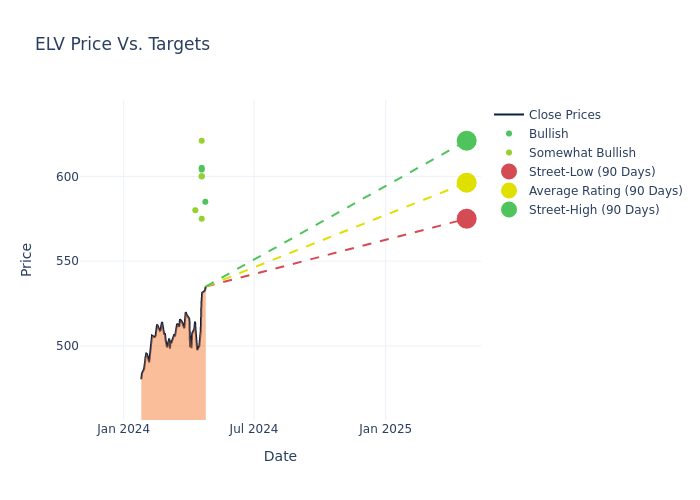

The 12-month price targets, analyzed by analysts, offer insights with an average target of $586.0, a high estimate of $621.00, and a low estimate of $547.00. Witnessing a positive shift, the current average has risen by 2.11% from the previous average price target of $573.89.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Elevance Health's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Ann Hynes |

Mizuho |

Raises |

Buy |

$585.00 |

$575.00 |

| Ben Hendrix |

RBC Capital |

Raises |

Outperform |

$575.00 |

$574.00 |

| A.J. Rice |

UBS |

Raises |

Buy |

$605.00 |

$585.00 |

| Stephen Baxter |

Wells Fargo |

Raises |

Overweight |

$600.00 |

$557.00 |

| David Macdonald |

Truist Securities |

Raises |

Buy |

$600.00 |

$580.00 |

| David Windley |

Jefferies |

Raises |

Buy |

$604.00 |

$602.00 |

| Andrew Mok |

Barclays |

Raises |

Overweight |

$621.00 |

$584.00 |

| Sarah James |

Cantor Fitzgerald |

Maintains |

Overweight |

$580.00 |

- |

| Stephen Baxter |

Wells Fargo |

Lowers |

Overweight |

$557.00 |

$561.00 |

| Sarah James |

Cantor Fitzgerald |

Maintains |

Overweight |

$580.00 |

- |

| Andrew Mok |

Barclays |

Announces |

Overweight |

$584.00 |

- |

| Sarah James |

Cantor Fitzgerald |

Raises |

Overweight |

$580.00 |

$547.00 |

| Sarah James |

Cantor Fitzgerald |

Maintains |

Overweight |

$547.00 |

- |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Elevance Health. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Elevance Health compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Elevance Health's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Elevance Health's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Elevance Health analyst ratings.

Delving into Elevance Health's Background

Elevance Health remains one of the leading health insurers in the U.S., providing medical benefits to 47 million medical members as of December 2023. The company offers employer, individual, and government-sponsored coverage plans. Elevance differs from its peers in its unique position as the largest single provider of Blue Cross Blue Shield branded coverage, operating as the licensee for the Blue Cross Blue Shield Association in 14 states. Through acquisitions, such as the Amerigroup deal in 2012 and MMM in 2021, Elevance's reach expands beyond those states through government-sponsored programs such as Medicaid and Medicare Advantage plans, too.

A Deep Dive into Elevance Health's Financials

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Positive Revenue Trend: Examining Elevance Health's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.96% as of 31 March, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 5.28%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Elevance Health's ROE excels beyond industry benchmarks, reaching 5.62%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Elevance Health's ROA stands out, surpassing industry averages. With an impressive ROA of 2.03%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.65, caution is advised due to increased financial risk.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ELV