Decoding Fair Isaac's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 23, 2024 04:45pm

Financial giants have made a conspicuous bearish move on Fair Isaac. Our analysis of options history for Fair Isaac (NYSE:FICO) revealed 9 unusual trades.

Delving into the details, we found 22% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $664,490, and 3 were calls, valued at $419,720.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1150.0 to $1300.0 for Fair Isaac during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Fair Isaac options trades today is 77.75 with a total volume of 994.00.

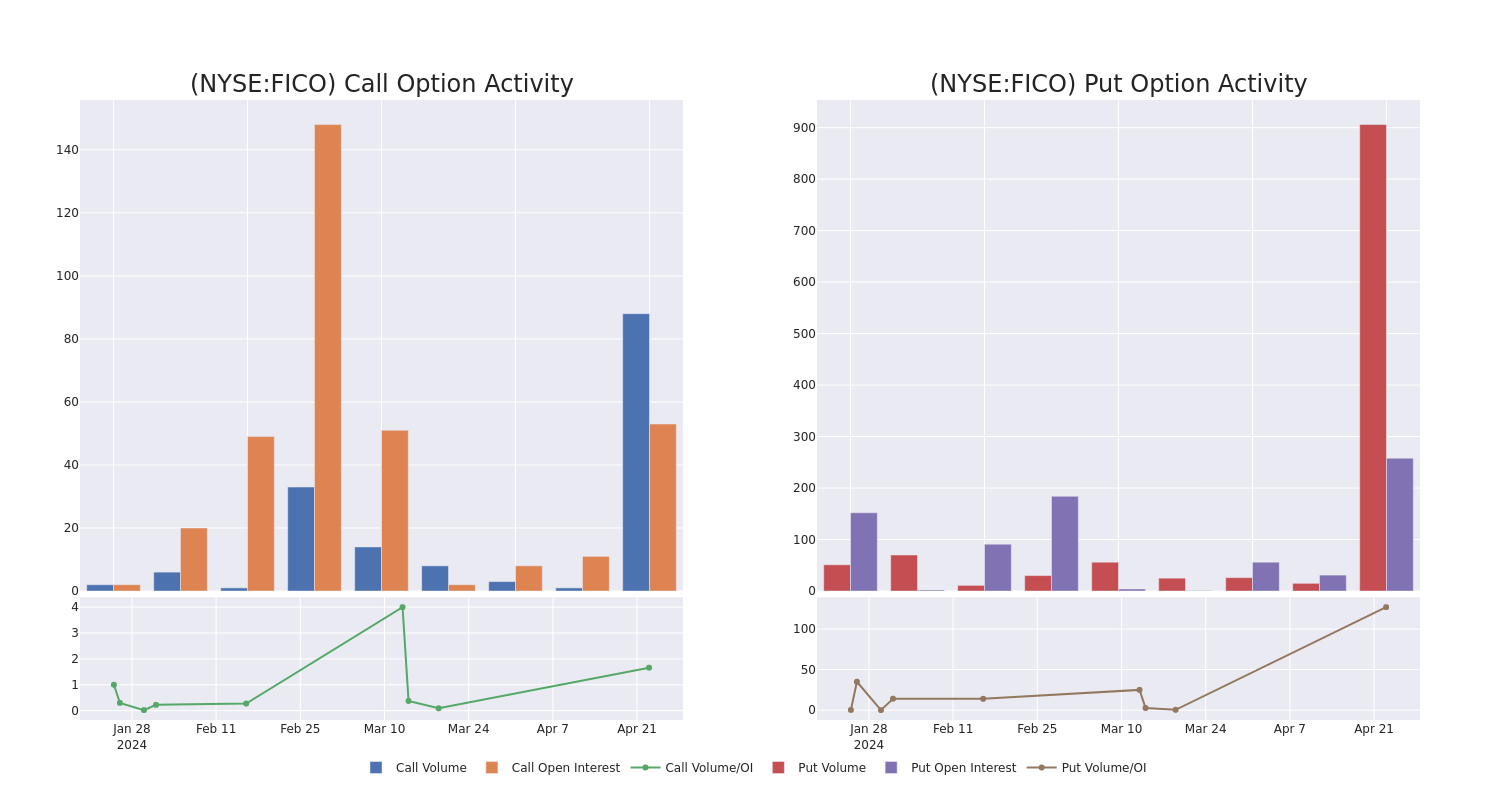

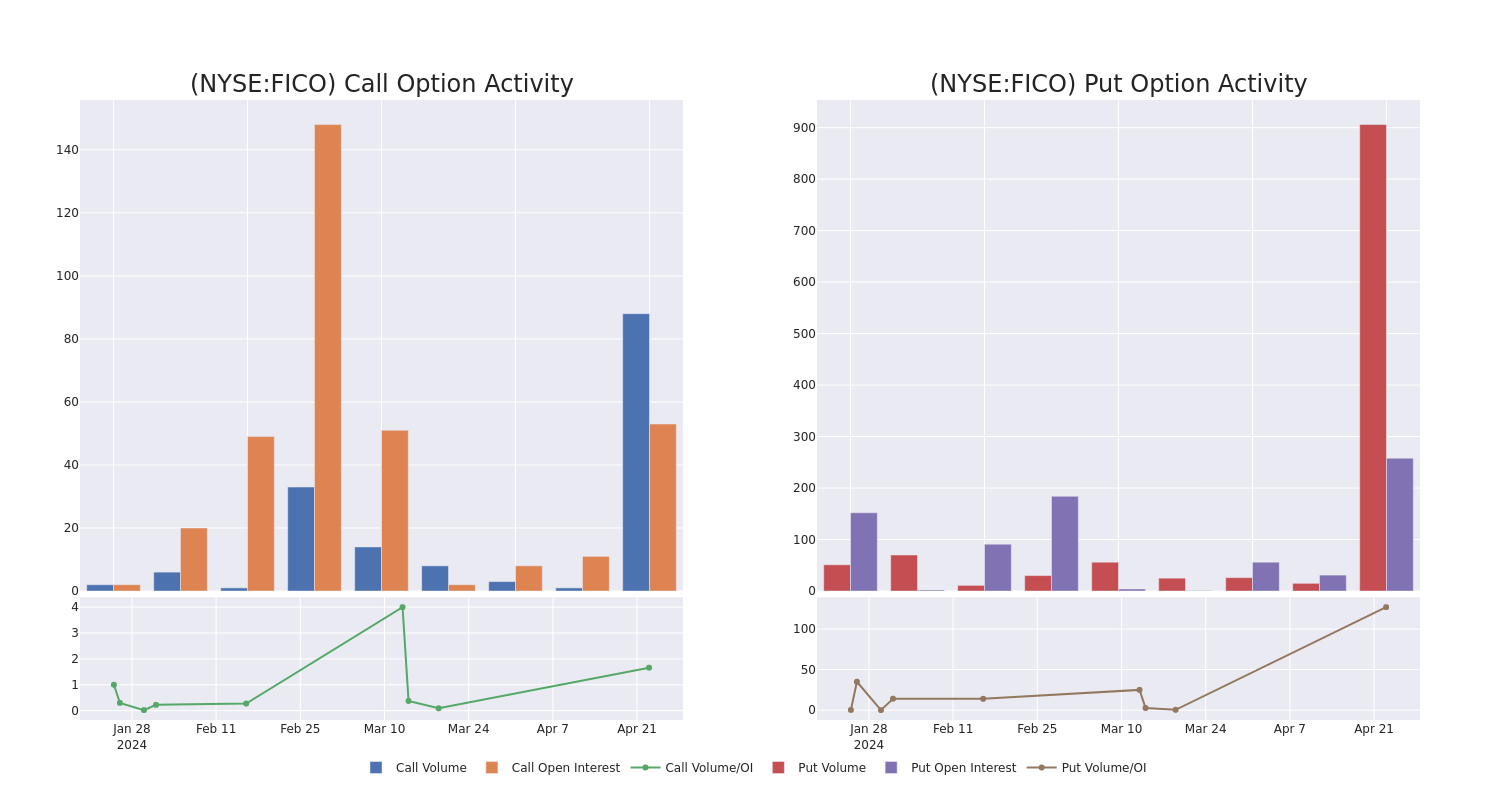

In the following chart, we are able to follow the development of volume and open interest of call and put options for Fair Isaac's big money trades within a strike price range of $1150.0 to $1300.0 over the last 30 days.

Fair Isaac Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| FICO |

PUT |

SWEEP |

NEUTRAL |

05/17/24 |

$37.3 |

$35.2 |

$37.0 |

$1150.00 |

$336.4K |

7 |

133 |

| FICO |

CALL |

TRADE |

BEARISH |

12/20/24 |

$98.7 |

$95.3 |

$95.3 |

$1300.00 |

$219.1K |

43 |

23 |

| FICO |

CALL |

TRADE |

NEUTRAL |

12/20/24 |

$99.1 |

$93.5 |

$95.9 |

$1300.00 |

$163.0K |

43 |

40 |

| FICO |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$38.1 |

$37.8 |

$38.19 |

$1150.00 |

$136.5K |

7 |

269 |

| FICO |

PUT |

SWEEP |

NEUTRAL |

05/17/24 |

$37.8 |

$33.2 |

$37.57 |

$1150.00 |

$77.7K |

7 |

54 |

About Fair Isaac

Founded in 1956, Fair Isaac Corporation is a leading applied analytics company. Fair Isaac is primarily known for its FICO credit scores, which is a widely used industry benchmark to determine the creditworthiness of an individual consumer. The firm's credit scores business accounts for most of the firm's profits and consists of business-to-business and business-to-consumer services. In addition to scores, Fair Isaac also sells software primarily to financial institutions for areas such as analytics, decision-making, customer workflows, and fraud.

Following our analysis of the options activities associated with Fair Isaac, we pivot to a closer look at the company's own performance.

Where Is Fair Isaac Standing Right Now?

- With a volume of 266,464, the price of FICO is up 3.26% at $1188.19.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 2 days.

Expert Opinions on Fair Isaac

2 market experts have recently issued ratings for this stock, with a consensus target price of $1306.5.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $1500.

- In a cautious move, an analyst from Redburn Atlantic downgraded its rating to Neutral, setting a price target of $1113.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Fair Isaac, Benzinga Pro gives you real-time options trades alerts.

Posted In: FICO