Analyst Ratings For Intl Game Tech

Author: Benzinga Insights | April 23, 2024 03:00pm

Ratings for Intl Game Tech (NYSE:IGT) were provided by 7 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

0 |

5 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

0 |

4 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

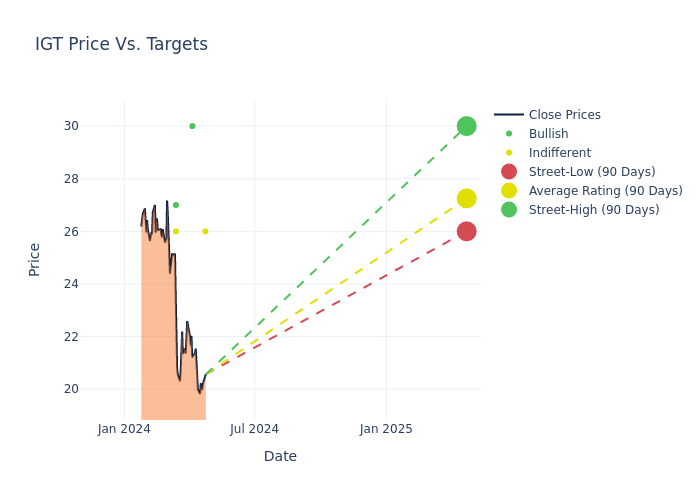

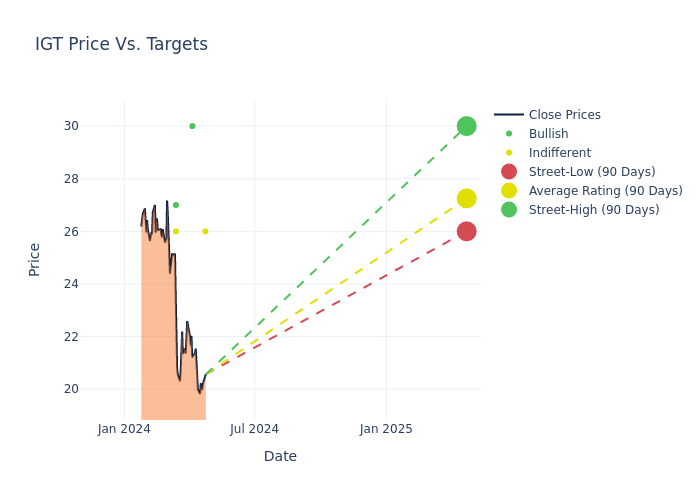

The 12-month price targets, analyzed by analysts, offer insights with an average target of $28.14, a high estimate of $30.00, and a low estimate of $26.00. A 6.73% drop is evident in the current average compared to the previous average price target of $30.17.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of Intl Game Tech by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Barry Jonas |

Truist Securities |

Lowers |

Hold |

$26.00 |

$28.00 |

| David Bain |

B. Riley Securities |

Announces |

Buy |

$30.00 |

- |

| John Staszak |

Argus Research |

Lowers |

Buy |

$27.00 |

$30.00 |

| Jeffrey Stantial |

Stifel |

Lowers |

Hold |

$26.00 |

$30.00 |

| Barry Jonas |

Truist Securities |

Lowers |

Hold |

$28.00 |

$30.00 |

| Jeffrey Stantial |

Stifel |

Lowers |

Hold |

$30.00 |

$31.00 |

| Barry Jonas |

Truist Securities |

Lowers |

Hold |

$30.00 |

$32.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Intl Game Tech. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Intl Game Tech compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Intl Game Tech's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Intl Game Tech's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Intl Game Tech analyst ratings.

About Intl Game Tech

International Game Technology PLC is a gaming company that delivers entertaining and responsible gaming experiences for players across all channels. The company's operating segments include Global Lottery, Global Gaming, and PlayDigital. It generates maximum revenue from the Global Lottery segment. Global Lottery segment provides lottery products and services to governmental organizations through operating contracts, facilities management contracts, lottery management agreements, and product sales contracts. Geographically, it derives a majority of revenue from the United States.

Intl Game Tech: A Financial Overview

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Intl Game Tech's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 3.39%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Intl Game Tech's net margin is impressive, surpassing industry averages. With a net margin of -0.71%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Intl Game Tech's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -0.55%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Intl Game Tech's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.08% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 4.11, Intl Game Tech adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: IGT