Strategies To Use For Tesla Earnings Season: Using Debit Spreads To Capitalize On Earnings Reports

Author: Sandra Stone | April 23, 2024 02:51pm

On 4-19-24, Sandra with Trading Made Simple LLC was on Benzinga Live with Zunaid Suleman discussing trade ideas for earnings season.

Sandra explained using Butterflies and Debit Spreads near the expected earnings range can be a great way to limit risk and take a directional trade or trade both sides of the expected move for a volatile market. Both Sandra & Zunaid took out of the money debits spreads using the expected move for the upside and downside for a potential move in either direction or both. Tesla, Inc. (NASDAQ:TSLA) stock was at $147. On Monday, 4-22-24 $TSLA ended the day at 142, and Sandra’s ATM Put Debit Spread was at a 30% profit, and the OTM Put Debit Spread was at a 50% Profit. Now Awaiting $TSLA’s earnings report for another possible move.

AT THE MONEY PUT DEBIT SPREAD: Analyze Graph ThinkorSwim

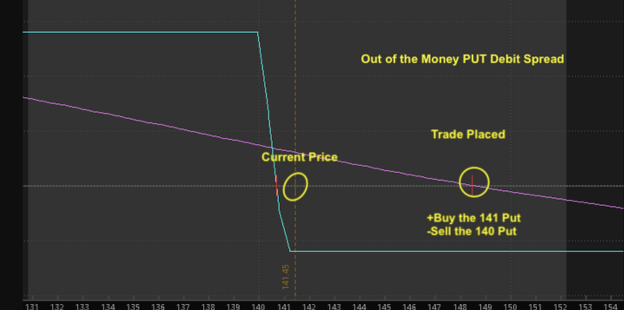

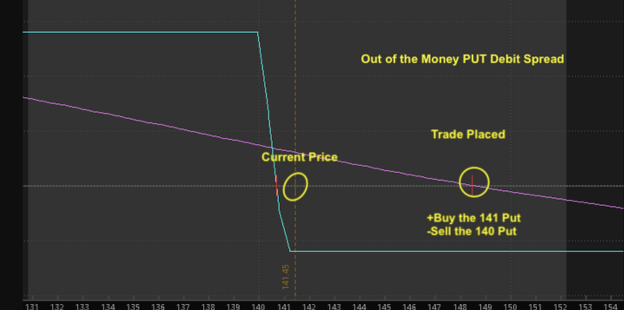

OUT OF THE MONEY PUT DEBIT SPREAD: Analyze Graph ThinkorSwim:

Let’s discuss the Debit Spread strategy in more detail:

Earnings season can be a thrilling time for traders, offering increased volatility and potential for significant gains. However, navigating this period can be tricky. Stock prices can swing wildly based on earnings reports, leading to both windfalls and potential losses. Here, we explore how debit spreads, a strategic options technique, can help you approach earnings season with more control and potentially mitigate risk.

Understanding Debit Spreads

A debit spread involves buying one option contract a Call or Put and simultaneously selling another option contract, with the same underlying stock but with different strike prices and the same expiration date. Example: The option you buy (call) has a higher strike price than the option you sell (call). Since you're paying a premium to buy the call and collecting a premium from selling the call, you have a net debit (cost) when initiating the spread.

Why Debit Spreads for Earnings?

Traditional long calls (buying calls outright) can be risky for earnings trades. The time value of the call erodes quickly if the stock price doesn't rise significantly after the earnings report. Debit spreads offer several advantages:

- Limited Risk: Your maximum loss is limited to the net debit you paid for the spread.

- Defined Profit Potential: The maximum profit on a debit spread is capped at the difference between the strike prices minus the net debit paid. However, this profit can be achieved even with a moderate increase in the stock price after earnings.

- Reduced Cost: Compared to buying a long call outright, debit spreads offer a lower upfront cost, allowing you to control more shares for the same amount of capital.

Crafting Your Earnings Debit Spread

Here are some key factors to consider when constructing a debit spread for an earnings play:

- Choosing Strike Prices: Select a call strike price with potential upside after a positive earnings report. If choosing a bearish position, select a put strike price with potential upside after a negative earnings report. This can be placed in the money, out of money or at the money. Using the expected move for the earnings can help you place the strike prices.

- Expiration Date: Consider options expiring shortly after the earnings report. However, be mindful of time decay, which accelerates closer to expiration.

- Net Debit: Balance the cost of the debit spread with your potential profit and risk tolerance. Aim for a debit spread with a favorable risk-reward ratio.

Example:

- Stock price: $50

- Earnings report date: Next week

- Debit Spread: Buy a call option with a strike price of $55 and sell a call option with a strike price of $45 (both expiring in one week).

- Net Debit: $5 (assuming the call premium is $7 and selling the call earned a premium and collected $2)

Profit Potential:

- If the stock price rises to $60 after earnings, you could potentially earn $5 per contract (maximum profit potential). This considers the difference between the call strike price ($55) and the stock price ($60) minus the net debit paid ($5).

- Even if the stock price only increases moderately to $52, you could still potentially breakeven or achieve a small profit depending on the specific debit spread costs.

Remember:

- Debit spreads are not without risk. The stock price could fall after earnings, leading to losses up to the net debit paid.

- Earnings reports are unpredictable events. Always prioritize proper risk management and position sizing when using debit spreads. Consider using a stop-loss order to limit potential losses.

- Debit spreads offer a strategic approach to earnings season. By understanding their mechanics and carefully crafting your spread, you can potentially capitalize on positive earnings surprises while limiting your downside risk. Remember, this is just one tool in your trading arsenal. Use it alongside sound risk management practices, and a healthy dose of caution when navigating the exciting, yet volatile, world of earnings season.

You can watch Sandra live on Benzinga every Friday at 11:30am EST. She can also be reached at https://tradingmadesimple.org every trading day at 714-202-7361 for more information and to follow on X: Options_Sandy

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

Posted In: TSLA