6 Analysts Assess Doximity: What You Need To Know

Author: Benzinga Insights | April 23, 2024 01:01pm

In the latest quarter, 6 analysts provided ratings for Doximity (NYSE:DOCS), showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

4 |

2 |

0 |

| Last 30D |

0 |

0 |

0 |

1 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

1 |

0 |

| 3M Ago |

0 |

0 |

2 |

0 |

0 |

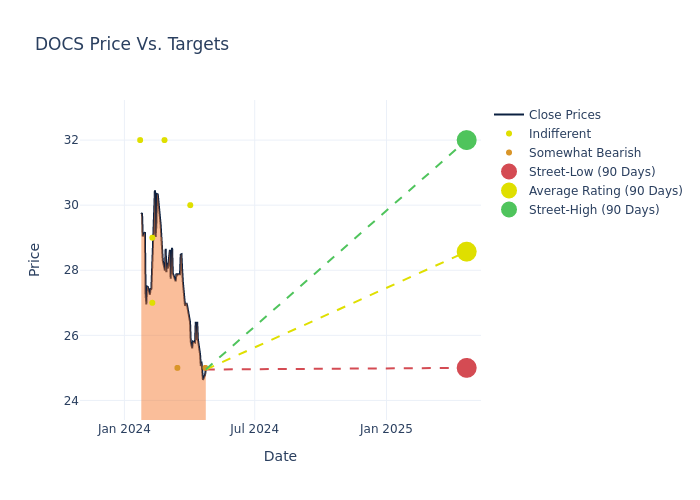

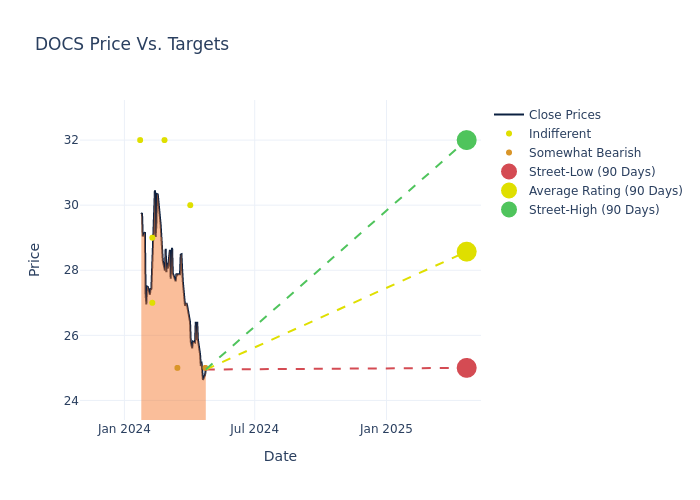

Analysts have set 12-month price targets for Doximity, revealing an average target of $28.0, a high estimate of $32.00, and a low estimate of $25.00. This upward trend is apparent, with the current average reflecting a 12.0% increase from the previous average price target of $25.00.

Investigating Analyst Ratings: An Elaborate Study

The analysis of recent analyst actions sheds light on the perception of Doximity by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Ricky Goldwasser |

Morgan Stanley |

Maintains |

Underweight |

$25.00 |

$25.00 |

| Elizabeth Anderson |

Evercore ISI Group |

Maintains |

In-Line |

$30.00 |

- |

| Anne Samuel |

JP Morgan |

Raises |

Underweight |

$25.00 |

$22.00 |

| Michael Cherny |

Leerink Partners |

Announces |

Market Perform |

$32.00 |

- |

| Jailendra Singh |

Truist Securities |

Raises |

Hold |

$29.00 |

$28.00 |

| Stan Berenshteyn |

Wells Fargo |

Raises |

Equal-Weight |

$27.00 |

$25.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Doximity. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Doximity compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Doximity's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Doximity's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Doximity analyst ratings.

All You Need to Know About Doximity

Doximity Inc is a digital platform for U.S. medical professionals. Its cloud-based platform provides members with tools specifically built for medical professionals, enabling them to collaborate with their colleagues, securely coordinate patient care, conduct virtual patient visits, stay up-to-date with the latest medical news and research, and manage their careers.

Unraveling the Financial Story of Doximity

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Positive Revenue Trend: Examining Doximity's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 17.37% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Doximity's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 35.45%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.52%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.73%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.02, Doximity adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: DOCS