What the Options Market Tells Us About Coinbase Glb

Author: Benzinga Insights | April 23, 2024 12:01pm

Deep-pocketed investors have adopted a bullish approach towards Coinbase Glb (NASDAQ:COIN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in COIN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 71 extraordinary options activities for Coinbase Glb. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 47% leaning bullish and 45% bearish. Among these notable options, 12 are puts, totaling $2,194,385, and 59 are calls, amounting to $5,336,332.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $520.0 for Coinbase Glb over the last 3 months.

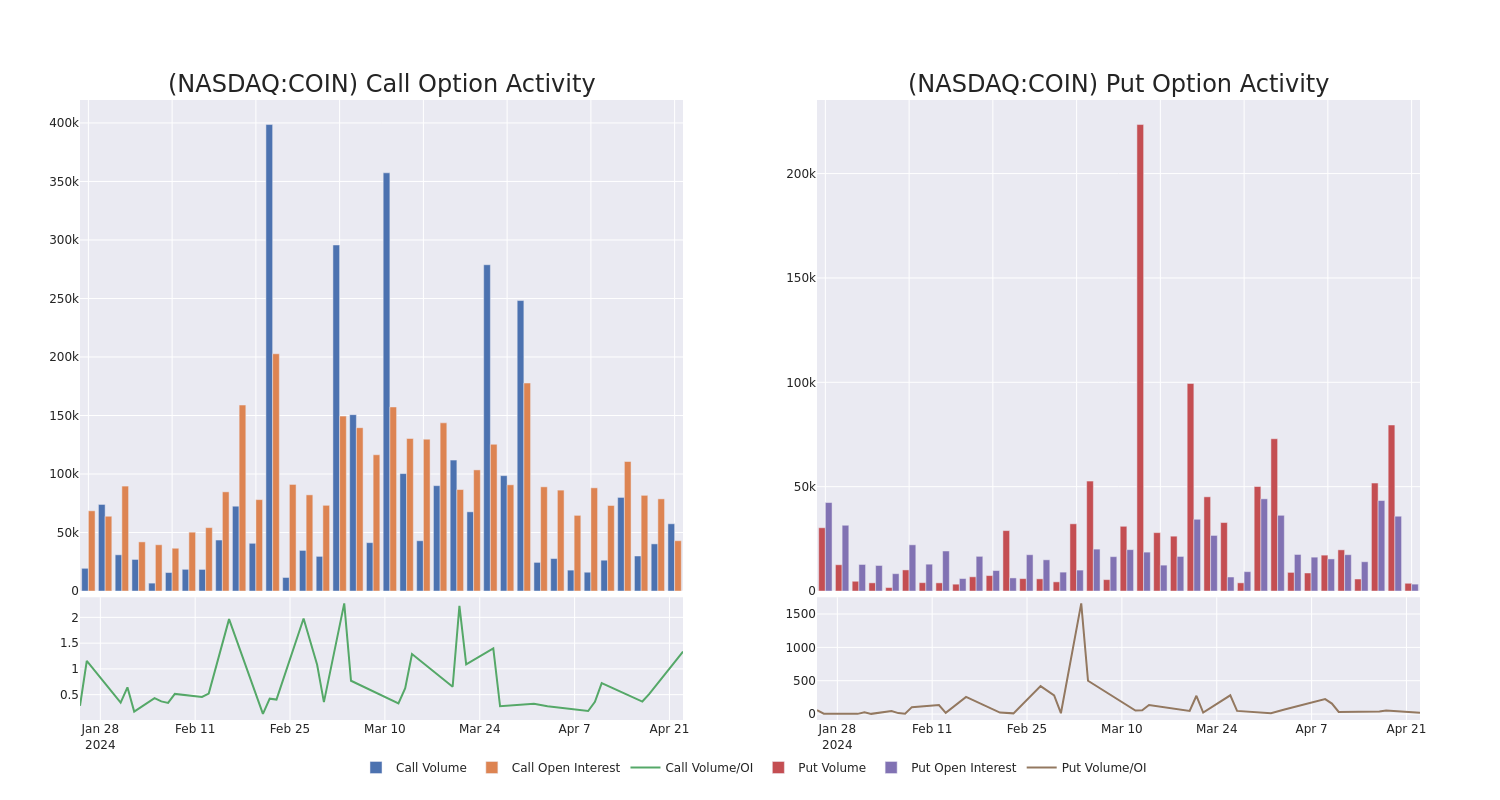

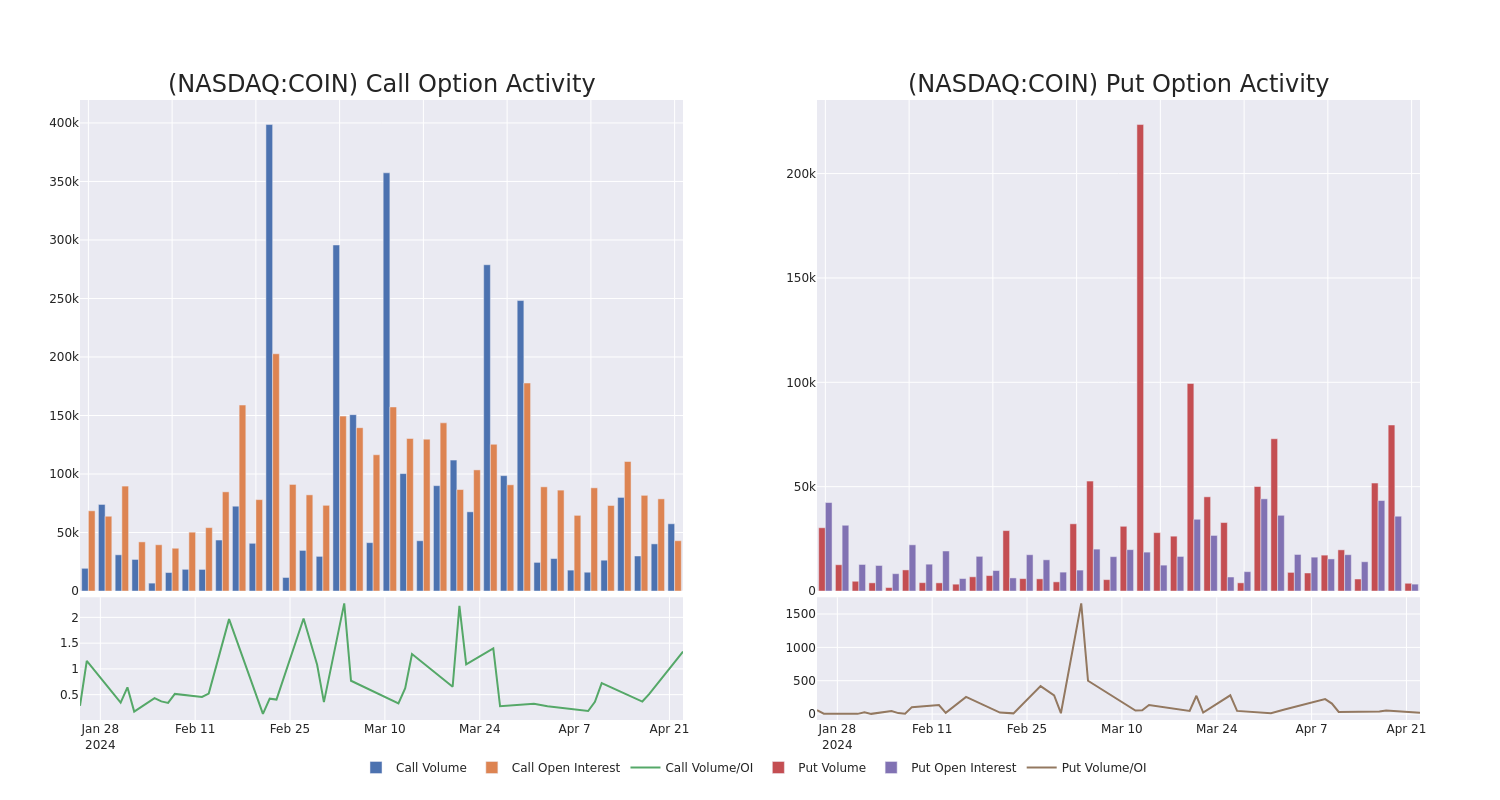

Insights into Volume & Open Interest

In today's trading context, the average open interest for options of Coinbase Glb stands at 1007.28, with a total volume reaching 61,204.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Coinbase Glb, situated within the strike price corridor from $100.0 to $520.0, throughout the last 30 days.

Coinbase Glb Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| COIN |

PUT |

SWEEP |

BEARISH |

05/03/24 |

$25.15 |

$24.15 |

$24.15 |

$247.50 |

$1.7M |

37 |

1 |

| COIN |

CALL |

SWEEP |

BULLISH |

05/03/24 |

$16.5 |

$15.45 |

$16.5 |

$240.00 |

$1.6M |

633 |

1.1K |

| COIN |

CALL |

TRADE |

BEARISH |

05/17/24 |

$19.1 |

$18.6 |

$18.6 |

$250.00 |

$548.7K |

1.7K |

1.2K |

| COIN |

CALL |

TRADE |

NEUTRAL |

12/20/24 |

$25.2 |

$23.9 |

$24.5 |

$450.00 |

$245.0K |

1.3K |

250 |

| COIN |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$15.55 |

$15.2 |

$15.2 |

$240.00 |

$152.0K |

633 |

7.8K |

About Coinbase Glb

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage and data analytics.

Coinbase Glb's Current Market Status

- With a trading volume of 4,674,492, the price of COIN is up by 3.18%, reaching $233.05.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 9 days from now.

What The Experts Say On Coinbase Glb

In the last month, 5 experts released ratings on this stock with an average target price of $248.0.

- Maintaining their stance, an analyst from Compass Point continues to hold a Buy rating for Coinbase Glb, targeting a price of $325.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Coinbase Glb with a target price of $245.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Underperform rating on Coinbase Glb with a target price of $110.

- An analyst from JMP Securities has decided to maintain their Market Outperform rating on Coinbase Glb, which currently sits at a price target of $320.

- An analyst from Canaccord Genuity has revised its rating downward to Buy, adjusting the price target to $240.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Coinbase Glb, Benzinga Pro gives you real-time options trades alerts.

Posted In: COIN