Block's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 23, 2024 11:45am

Whales with a lot of money to spend have taken a noticeably bullish stance on Block.

Looking at options history for Block (NYSE:SQ) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 64% of the investors opened trades with bullish expectations and 28% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $332,367 and 8, calls, for a total amount of $335,360.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $47.5 and $120.0 for Block, spanning the last three months.

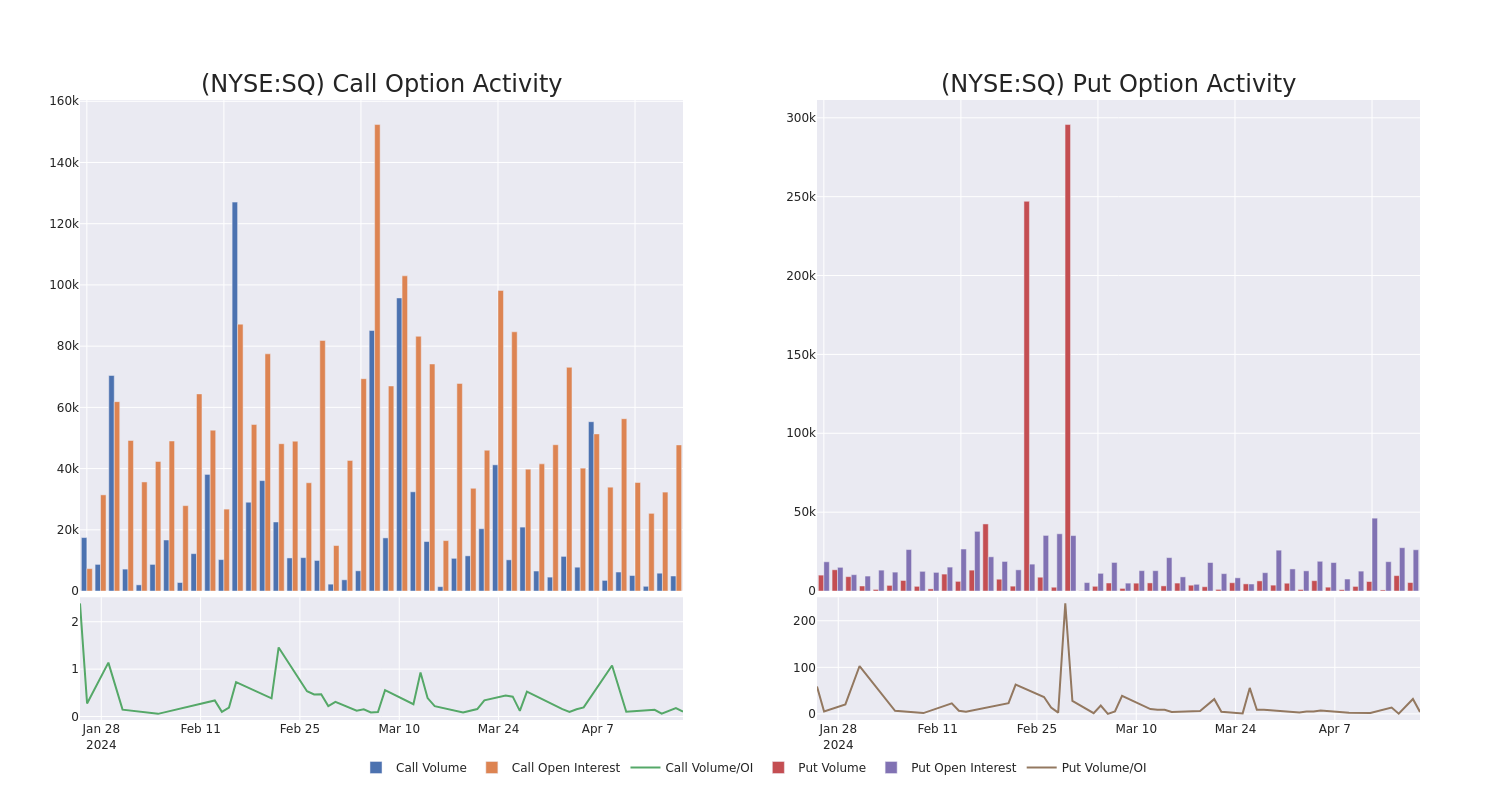

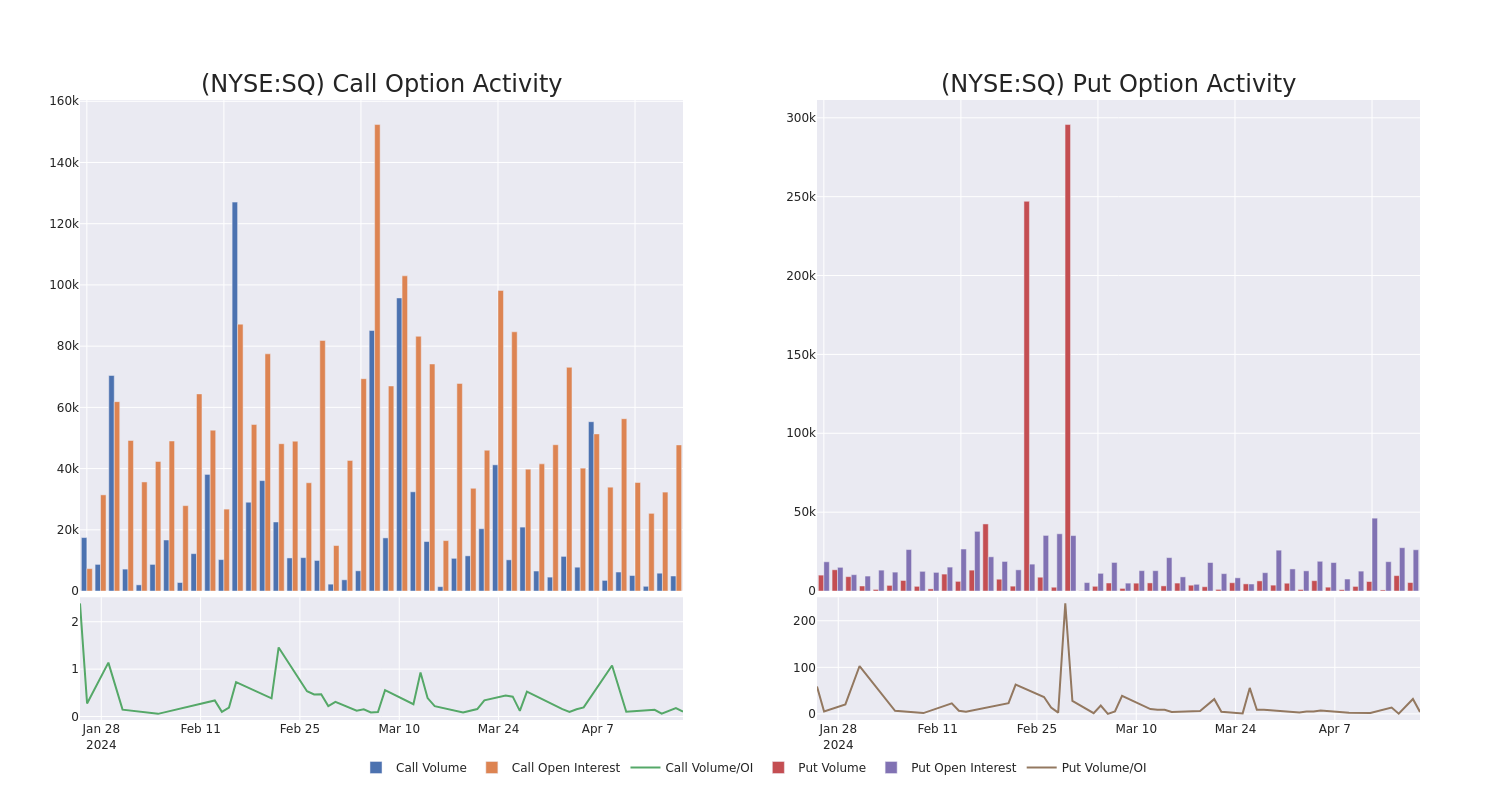

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Block's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block's whale trades within a strike price range from $47.5 to $120.0 in the last 30 days.

Block Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SQ |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$1.28 |

$1.23 |

$1.28 |

$63.00 |

$109.7K |

4 |

0 |

| SQ |

PUT |

TRADE |

BEARISH |

05/17/24 |

$4.05 |

$4.05 |

$4.05 |

$72.00 |

$80.5K |

75 |

414 |

| SQ |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$26.9 |

$26.4 |

$26.4 |

$47.50 |

$63.3K |

20 |

0 |

| SQ |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$9.55 |

$9.45 |

$9.45 |

$120.00 |

$61.4K |

1.0K |

102 |

| SQ |

CALL |

SWEEP |

BULLISH |

12/20/24 |

$15.6 |

$15.45 |

$15.5 |

$70.00 |

$57.3K |

513 |

53 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

Block's Current Market Status

- Currently trading with a volume of 2,056,696, the SQ's price is up by 2.81%, now at $73.61.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 9 days.

Expert Opinions on Block

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $94.4.

- An analyst from Susquehanna has decided to maintain their Positive rating on Block, which currently sits at a price target of $100.

- Maintaining their stance, an analyst from Mizuho continues to hold a Buy rating for Block, targeting a price of $99.

- Maintaining their stance, an analyst from Wolfe Research continues to hold a Outperform rating for Block, targeting a price of $100.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Block with a target price of $75.

- An analyst from Baird has decided to maintain their Outperform rating on Block, which currently sits at a price target of $98.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Block, Benzinga Pro gives you real-time options trades alerts.

Posted In: SQ