Assessing Vail Resorts: Insights From 12 Financial Analysts

Author: Benzinga Insights | April 22, 2024 04:01pm

Throughout the last three months, 12 analysts have evaluated Vail Resorts (NYSE:MTN), offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

0 |

7 |

1 |

0 |

| Last 30D |

0 |

0 |

2 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

3 |

0 |

5 |

1 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

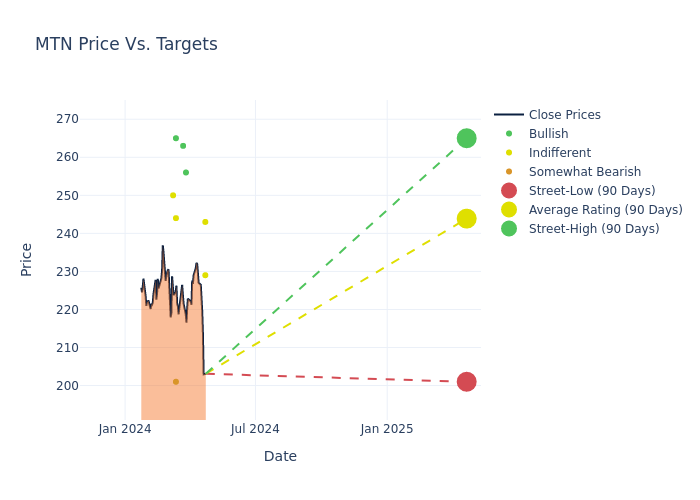

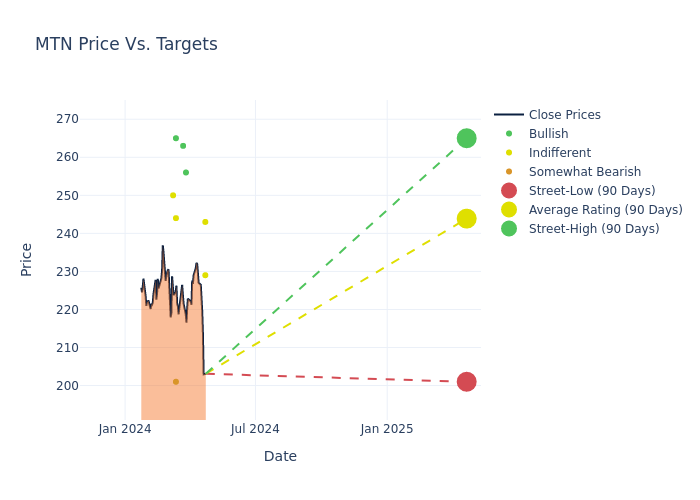

In the assessment of 12-month price targets, analysts unveil insights for Vail Resorts, presenting an average target of $246.33, a high estimate of $265.00, and a low estimate of $201.00. A 3.93% drop is evident in the current average compared to the previous average price target of $256.40.

Investigating Analyst Ratings: An Elaborate Study

The analysis of recent analyst actions sheds light on the perception of Vail Resorts by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Brandt Montour |

JP Morgan |

Lowers |

Neutral |

$243.00 |

$252.00 |

| Megan Alexander |

Morgan Stanley |

Lowers |

Equal-Weight |

$229.00 |

$242.00 |

| Ben Chaiken |

Mizuho |

Announces |

Buy |

$256.00 |

- |

| Jeffrey Stantial |

Stifel |

Maintains |

Buy |

$263.00 |

- |

| Patrick Scholes |

Truist Securities |

Lowers |

Buy |

$265.00 |

$290.00 |

| Chris Woronka |

Deutsche Bank |

Lowers |

Hold |

$244.00 |

$253.00 |

| Jeffrey Stantial |

Stifel |

Lowers |

Buy |

$263.00 |

$268.00 |

| Megan Alexander |

Morgan Stanley |

Lowers |

Equal-Weight |

$242.00 |

$248.00 |

| Brandt Montour |

JP Morgan |

Lowers |

Neutral |

$252.00 |

$262.00 |

| Brandt Montour |

Barclays |

Lowers |

Underweight |

$201.00 |

$217.00 |

| Shaun Kelley |

B of A Securities |

Lowers |

Neutral |

$250.00 |

$285.00 |

| Megan Alexander |

Morgan Stanley |

Raises |

Equal-Weight |

$248.00 |

$247.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Vail Resorts. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Vail Resorts compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Vail Resorts's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Vail Resorts's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Vail Resorts analyst ratings.

Unveiling the Story Behind Vail Resorts

Vail Resorts Inc Bhd is a resorts and casinos company that operates mountain resorts and ski areas. The company has three business segments that include Mountain, Lodging, and Real Estate. The Mountain segment operates numerous ski resort properties that offer a variety of winter and summer activities, such as skiing, snowboarding, snowshoeing, hiking, and mountain biking. The Lodging segment owns and operates hotels and condominiums. The Real Estate segment owns, develops, and leases real estate, typically near its other properties. The company generates the vast majority of its revenue within the United States.

Understanding the Numbers: Vail Resorts's Finances

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Decline in Revenue: Over the 3 months period, Vail Resorts faced challenges, resulting in a decline of approximately -2.16% in revenue growth as of 31 January, 2024. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Vail Resorts's net margin is impressive, surpassing industry averages. With a net margin of 20.34%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 29.98%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Vail Resorts's ROA stands out, surpassing industry averages. With an impressive ROA of 3.78%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Vail Resorts's debt-to-equity ratio surpasses industry norms, standing at 3.61. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MTN