Spotlight on Thermo Fisher Scientific: Analyzing the Surge in Options Activity

Author: Benzinga Insights | April 22, 2024 02:45pm

Deep-pocketed investors have adopted a bullish approach towards Thermo Fisher Scientific (NYSE:TMO), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TMO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Thermo Fisher Scientific. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 40% bearish. Among these notable options, 6 are puts, totaling $368,240, and 4 are calls, amounting to $427,718.

Expected Price Movements

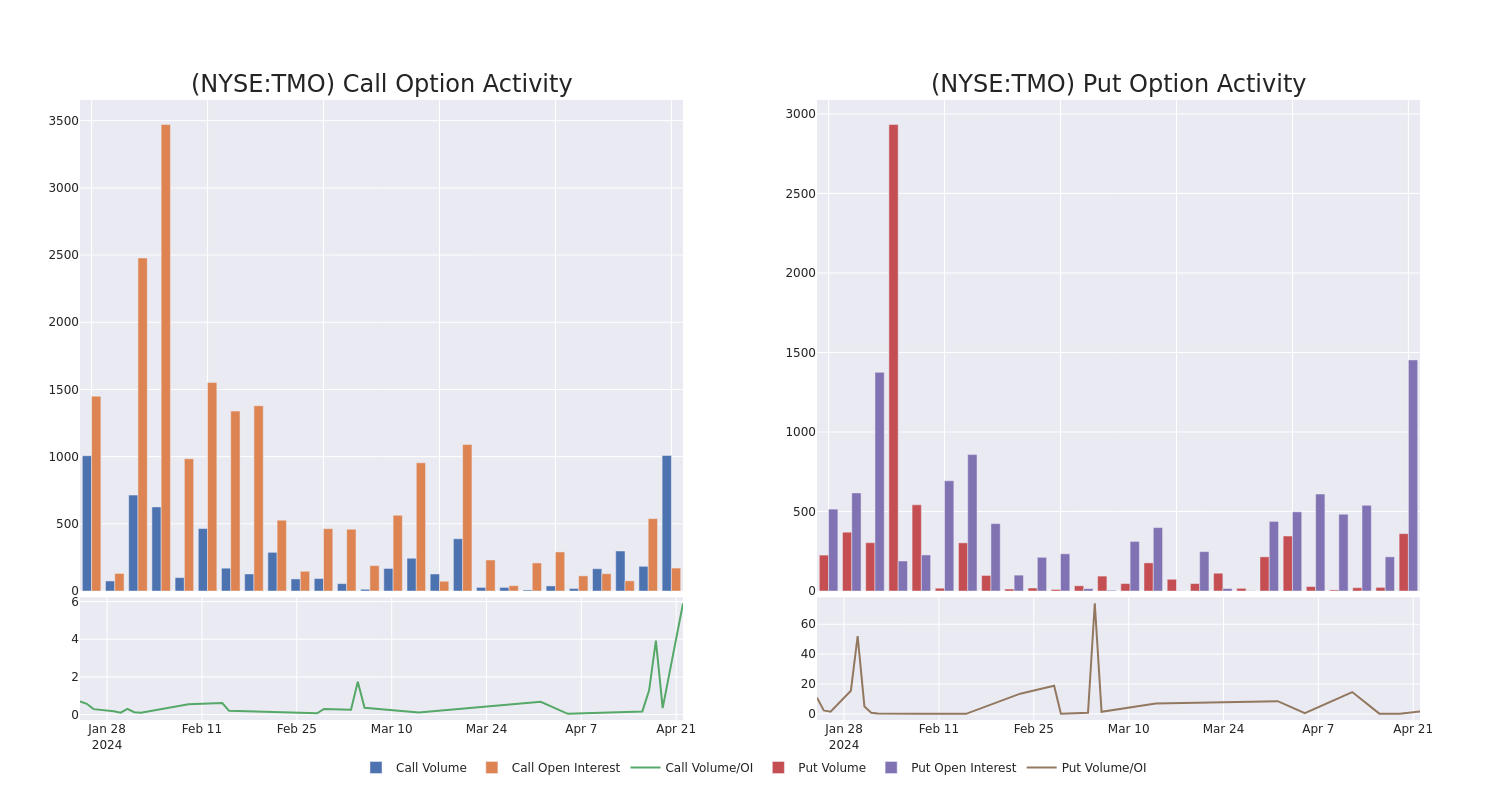

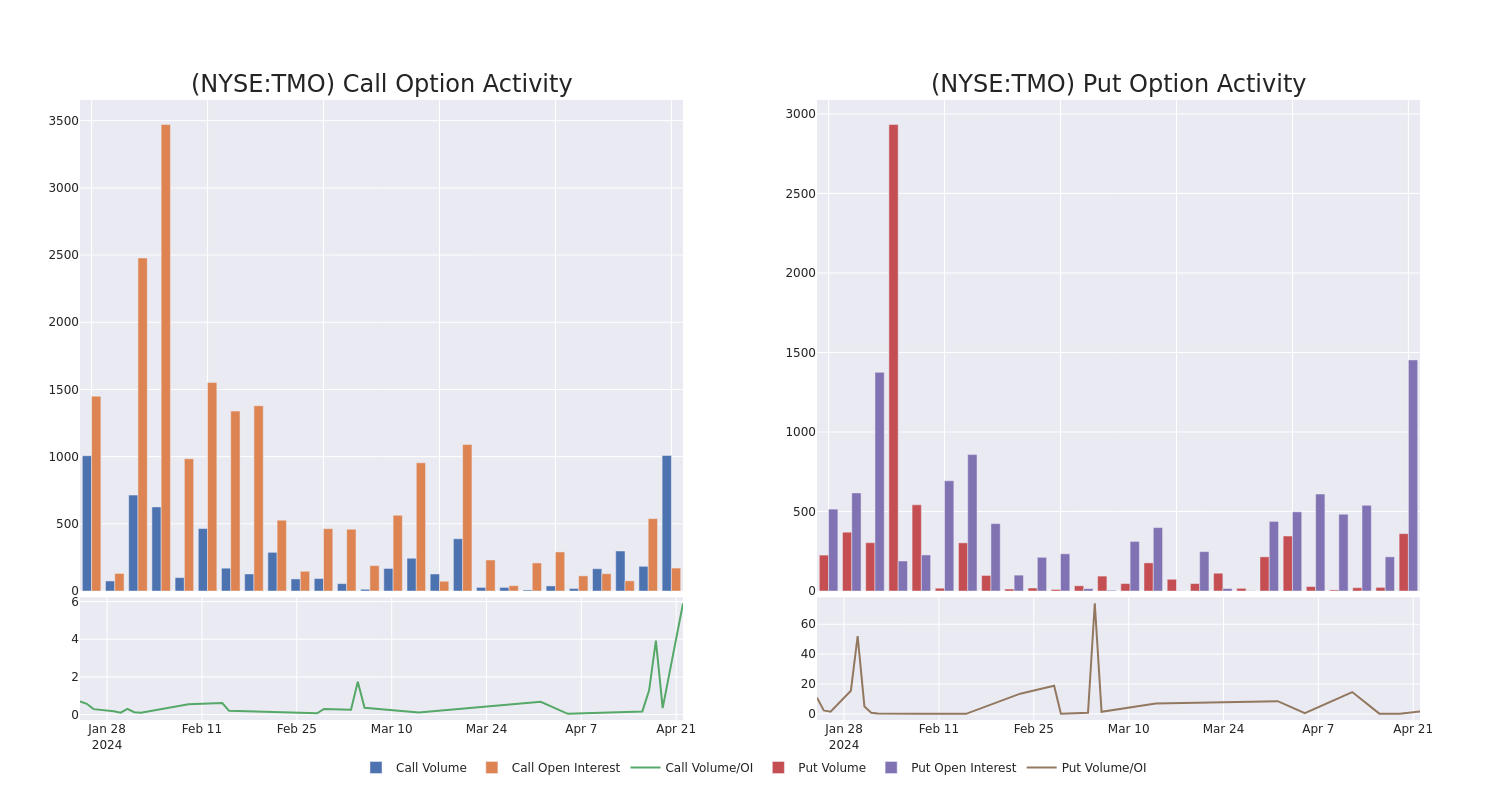

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $520.0 to $590.0 for Thermo Fisher Scientific during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Thermo Fisher Scientific's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Thermo Fisher Scientific's whale activity within a strike price range from $520.0 to $590.0 in the last 30 days.

Thermo Fisher Scientific Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TMO |

CALL |

TRADE |

BEARISH |

05/17/24 |

$4.1 |

$3.4 |

$3.49 |

$590.00 |

$253.0K |

109 |

725 |

| TMO |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$6.1 |

$5.8 |

$5.9 |

$520.00 |

$104.9K |

560 |

188 |

| TMO |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$12.6 |

$12.4 |

$12.5 |

$562.50 |

$88.6K |

0 |

71 |

| TMO |

PUT |

SWEEP |

BULLISH |

05/03/24 |

$12.3 |

$11.9 |

$11.9 |

$550.00 |

$61.7K |

83 |

59 |

| TMO |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$22.5 |

$22.4 |

$22.4 |

$530.00 |

$58.2K |

161 |

26 |

About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of mid-2023 (revenue figures include some cross-segment revenue): analytical technologies (16% of sales); specialty diagnostic products (10%); life science solutions (24%); and lab products and services, which includes CRO services (54%).

Having examined the options trading patterns of Thermo Fisher Scientific, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Thermo Fisher Scientific's Current Market Status

- Currently trading with a volume of 853,302, the TMO's price is up by 1.32%, now at $551.96.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 2 days.

What The Experts Say On Thermo Fisher Scientific

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $636.6666666666666.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Thermo Fisher Scientific, targeting a price of $610.

- An analyst from HSBC has decided to maintain their Buy rating on Thermo Fisher Scientific, which currently sits at a price target of $660.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on Thermo Fisher Scientific, which currently sits at a price target of $640.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Thermo Fisher Scientific with Benzinga Pro for real-time alerts.

Posted In: TMO