Beyond The Numbers: 7 Analysts Discuss Silence Therapeutics Stock

Author: Benzinga Insights | April 22, 2024 02:00pm

7 analysts have expressed a variety of opinions on Silence Therapeutics (NASDAQ:SLN) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

3 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

4 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

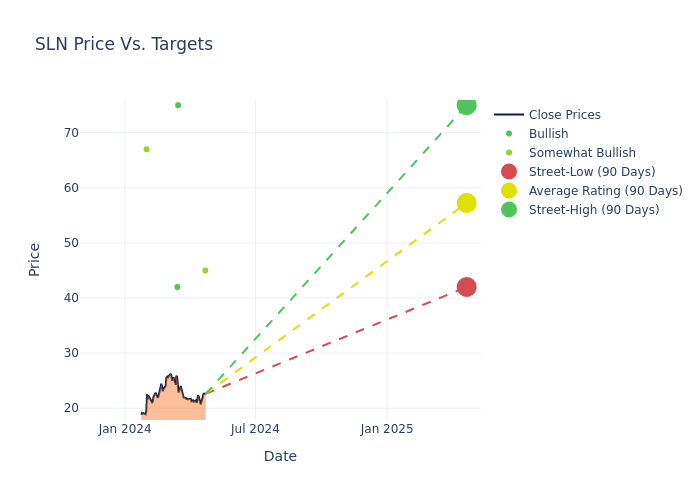

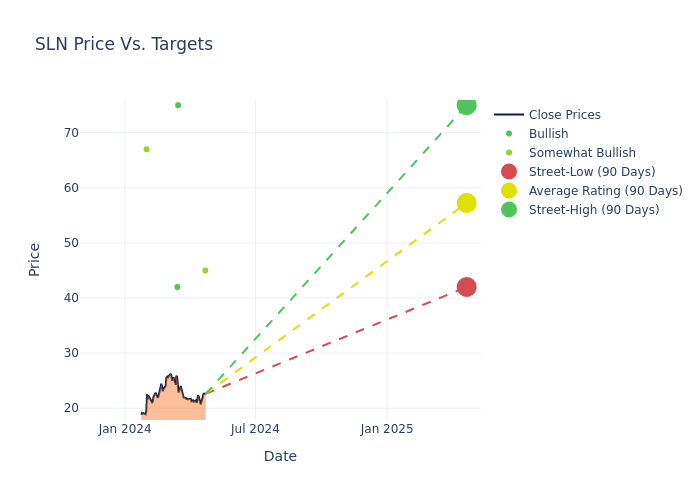

Analysts have set 12-month price targets for Silence Therapeutics, revealing an average target of $60.57, a high estimate of $75.00, and a low estimate of $42.00. This current average reflects an increase of 38.45% from the previous average price target of $43.75.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Silence Therapeutics by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Michael Ulz |

Morgan Stanley |

Maintains |

Overweight |

$45.00 |

$45.00 |

| Patrick Trucchio |

HC Wainwright & Co. |

Maintains |

Buy |

$75.00 |

- |

| Michael Ulz |

Morgan Stanley |

Raises |

Overweight |

$45.00 |

$29.00 |

| Keay Nakae |

Chardan Capital |

Raises |

Buy |

$42.00 |

$26.00 |

| Patrick Trucchio |

HC Wainwright & Co. |

Maintains |

Buy |

$75.00 |

$75.00 |

| Patrick Trucchio |

HC Wainwright & Co. |

Maintains |

Buy |

$75.00 |

- |

| Kostas Biliouris |

BMO Capital |

Announces |

Outperform |

$67.00 |

- |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Silence Therapeutics. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Silence Therapeutics compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Silence Therapeutics's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Silence Therapeutics's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Silence Therapeutics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Silence Therapeutics

Silence Therapeutics PLC is a biotechnology company focused on discovering and developing novel molecules incorporating short-interfering ribonucleic acid. its pipeline products are; SLN360 therapy designed to temporarily block a specific gene's message that would otherwise trigger an unwanted effect. By silencing the LPA gene, the levels of Lp(a) are lowered, which in turn is expected to lower the risks of heart diseases, heart attacks, and strokes, and SLN124 therapy aims to temporarily silence TMPRSS6, a gene that prevents the liver from producing a particular hormone that controls iron levels in the body hepcidin. As hepcidin increases, iron levels in the blood are expected to decrease, which may increase the production of healthy red blood cells, thereby reducing anemia.

Key Indicators: Silence Therapeutics's Financial Health

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Challenges: Silence Therapeutics's revenue growth over 3 months faced difficulties. As of 31 December, 2023, the company experienced a decline of approximately -55.95%. This indicates a decrease in top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Silence Therapeutics's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -686.61%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -77.8%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Silence Therapeutics's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -15.03%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Silence Therapeutics's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.02.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SLN