Baidu Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | April 22, 2024 01:45pm

Financial giants have made a conspicuous bullish move on Baidu. Our analysis of options history for Baidu (NASDAQ:BIDU) revealed 21 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $418,177, and 14 were calls, valued at $573,403.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $120.0 for Baidu, spanning the last three months.

Insights into Volume & Open Interest

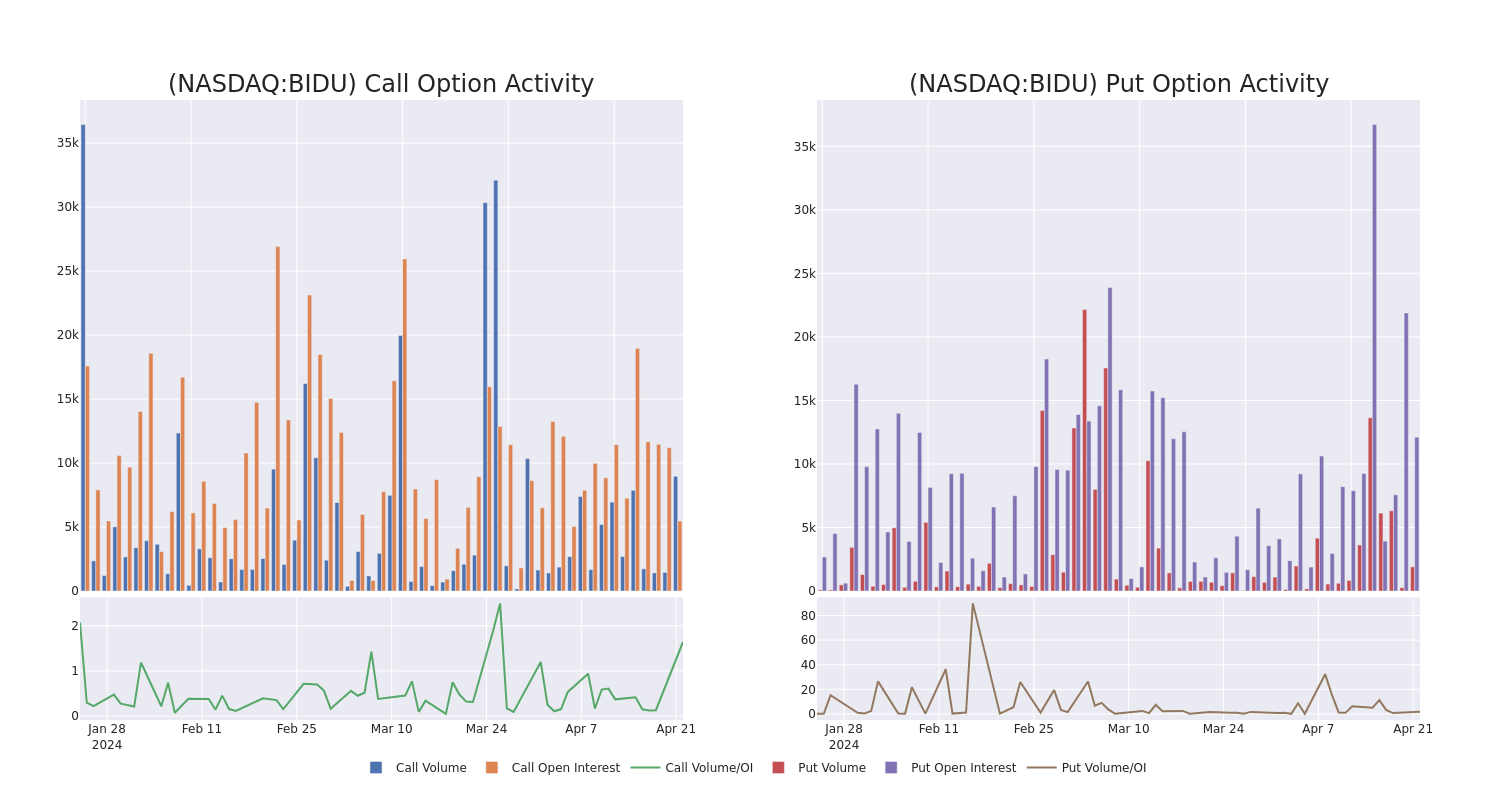

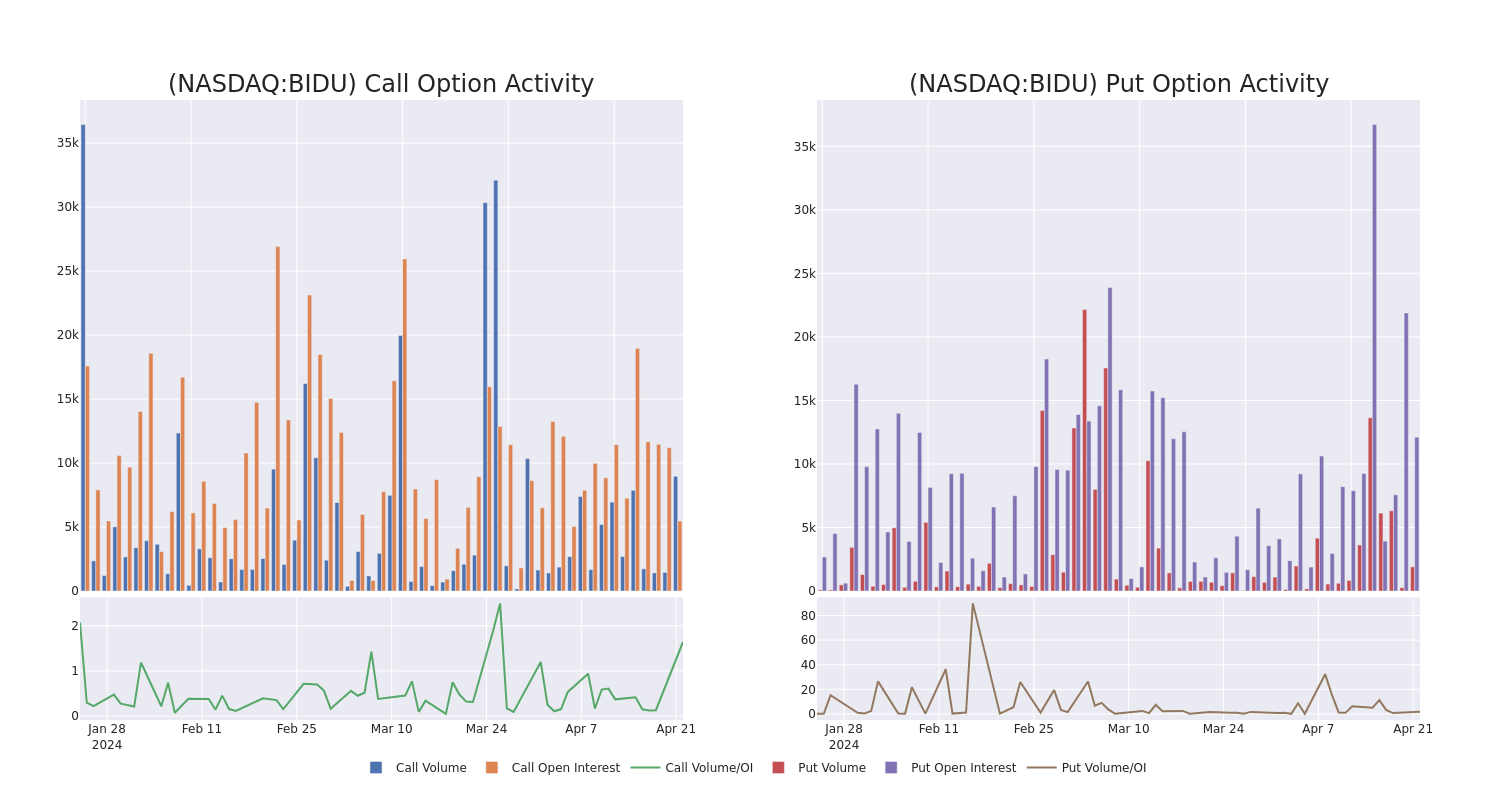

In today's trading context, the average open interest for options of Baidu stands at 1098.31, with a total volume reaching 10,862.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Baidu, situated within the strike price corridor from $50.0 to $120.0, throughout the last 30 days.

Baidu 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| BIDU |

PUT |

SWEEP |

BULLISH |

05/10/24 |

$8.0 |

$7.65 |

$7.65 |

$104.00 |

$112.4K |

190 |

147 |

| BIDU |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$5.9 |

$5.75 |

$5.75 |

$80.00 |

$112.1K |

784 |

195 |

| BIDU |

CALL |

SWEEP |

BULLISH |

05/10/24 |

$1.65 |

$1.39 |

$1.65 |

$100.00 |

$82.5K |

248 |

2 |

| BIDU |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$5.7 |

$5.25 |

$5.25 |

$80.00 |

$65.9K |

784 |

196 |

| BIDU |

CALL |

TRADE |

BEARISH |

09/20/24 |

$21.7 |

$21.35 |

$21.4 |

$80.00 |

$53.5K |

94 |

25 |

About Baidu

Baidu is the largest internet search engine in China with 84% share of the search engine market in September 2021 per web analytics firm, Statcounter. The firm generated 72% of core revenue from online marketing services from its search engine in 2022. Outside its search engine, Baidu is a technology-driven company and its other major growth initiatives are artificial intelligence cloud, video streaming services, voice recognition technology, and autonomous driving.

In light of the recent options history for Baidu, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Baidu

- Trading volume stands at 1,840,262, with BIDU's price up by 2.88%, positioned at $97.79.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 24 days.

Professional Analyst Ratings for Baidu

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $176.0.

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Baidu with a target price of $176.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Baidu options trades with real-time alerts from Benzinga Pro.

Posted In: BIDU