12 Analysts Have This To Say About Prologis

Author: Benzinga Insights | April 22, 2024 01:00pm

During the last three months, 12 analysts shared their evaluations of Prologis (NYSE:PLD), revealing diverse outlooks from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

4 |

4 |

0 |

0 |

| Last 30D |

2 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

2 |

2 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

1 |

2 |

0 |

0 |

0 |

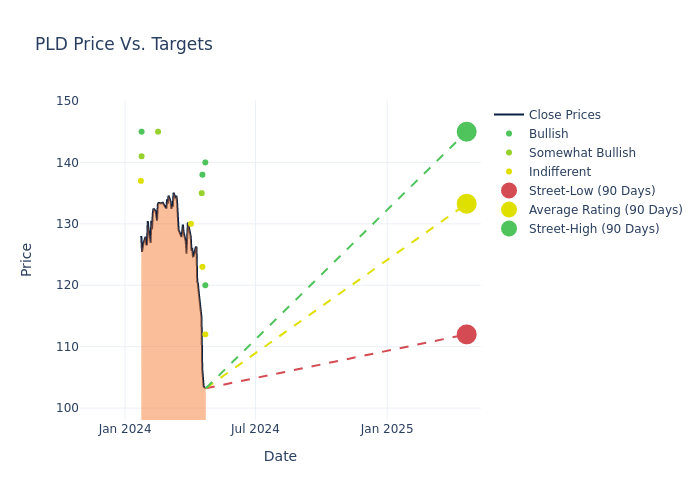

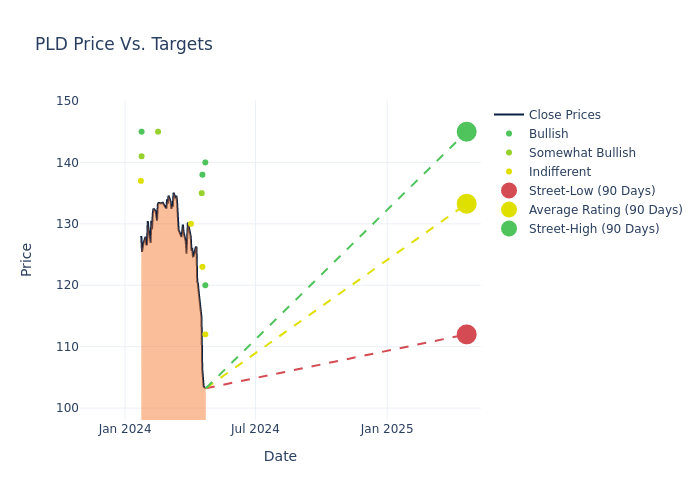

In the assessment of 12-month price targets, analysts unveil insights for Prologis, presenting an average target of $133.83, a high estimate of $145.00, and a low estimate of $112.00. Observing a downward trend, the current average is 4.65% lower than the prior average price target of $140.36.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Prologis among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Marie Ferguson |

Argus Research |

Lowers |

Buy |

$120.00 |

$139.00 |

| Caitlin Burrows |

Goldman Sachs |

Lowers |

Buy |

$140.00 |

$163.00 |

| John Kim |

BMO Capital |

Lowers |

Market Perform |

$112.00 |

$145.00 |

| Brent Dilts |

UBS |

Lowers |

Buy |

$138.00 |

$151.00 |

| Steve Sakwa |

Evercore ISI Group |

Lowers |

In-Line |

$123.00 |

$136.00 |

| Brendan Lynch |

Barclays |

Lowers |

Overweight |

$135.00 |

$141.00 |

| Vikram Malhotra |

Mizuho |

Maintains |

Neutral |

$130.00 |

$130.00 |

| Anthony Powell |

Barclays |

Lowers |

Overweight |

$141.00 |

$153.00 |

| Steve Sakwa |

Evercore ISI Group |

Announces |

In-Line |

$136.00 |

- |

| Michael Carroll |

RBC Capital |

Raises |

Outperform |

$145.00 |

$128.00 |

| Ronald Kamdem |

Morgan Stanley |

Raises |

Overweight |

$141.00 |

$128.00 |

| William Crow |

Raymond James |

Raises |

Strong Buy |

$145.00 |

$130.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Prologis. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Prologis compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Prologis's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Prologis's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Prologis analyst ratings.

Unveiling the Story Behind Prologis

Prologis was formed by the June 2011 merger of AMB Property and Prologis Trust. The company develops, acquires, and operates around 1.2 billion square feet of high-quality industrial and logistics facilities across the globe. The company also has a strategic capital business segment that has around $60 billion of third-party AUM. The company is organized into four global divisions (Americas, Europe, Asia, and other Americas) and operates as a real estate investment trust.

Breaking Down Prologis's Financial Performance

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Prologis displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 7.86%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Prologis's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 33.32% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Prologis's ROE excels beyond industry benchmarks, reaching 1.18%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.68%, the company showcases effective utilization of assets.

Debt Management: Prologis's debt-to-equity ratio is below the industry average at 0.56, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PLD