MongoDB Unusual Options Activity For April 22

Author: Benzinga Insights | April 22, 2024 10:45am

Financial giants have made a conspicuous bearish move on MongoDB. Our analysis of options history for MongoDB (NASDAQ:MDB) revealed 11 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 63% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $187,051, and 7 were calls, valued at $375,767.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $315.0 to $395.0 for MongoDB during the past quarter.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for MongoDB options trades today is 23.0 with a total volume of 381.00.

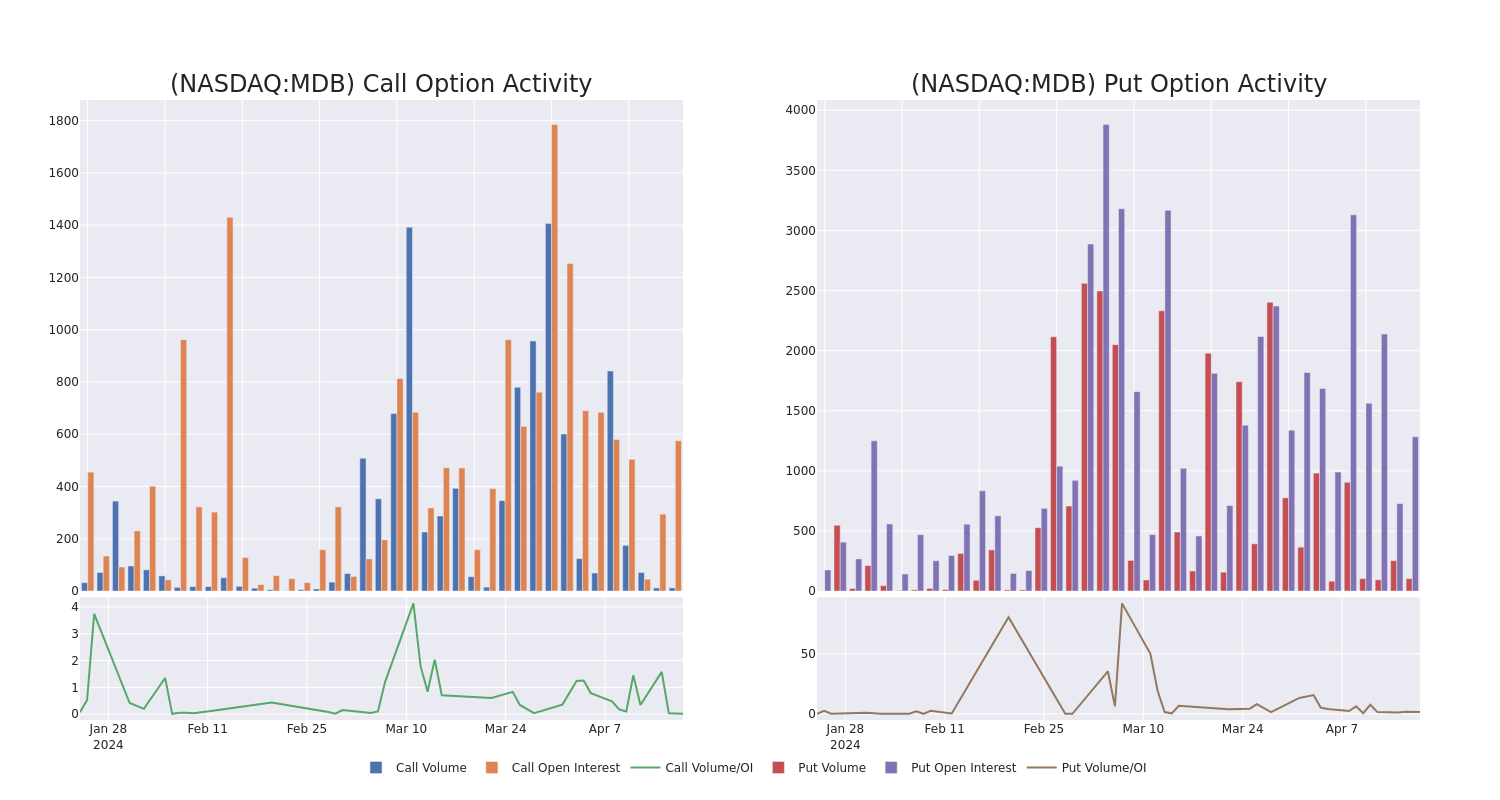

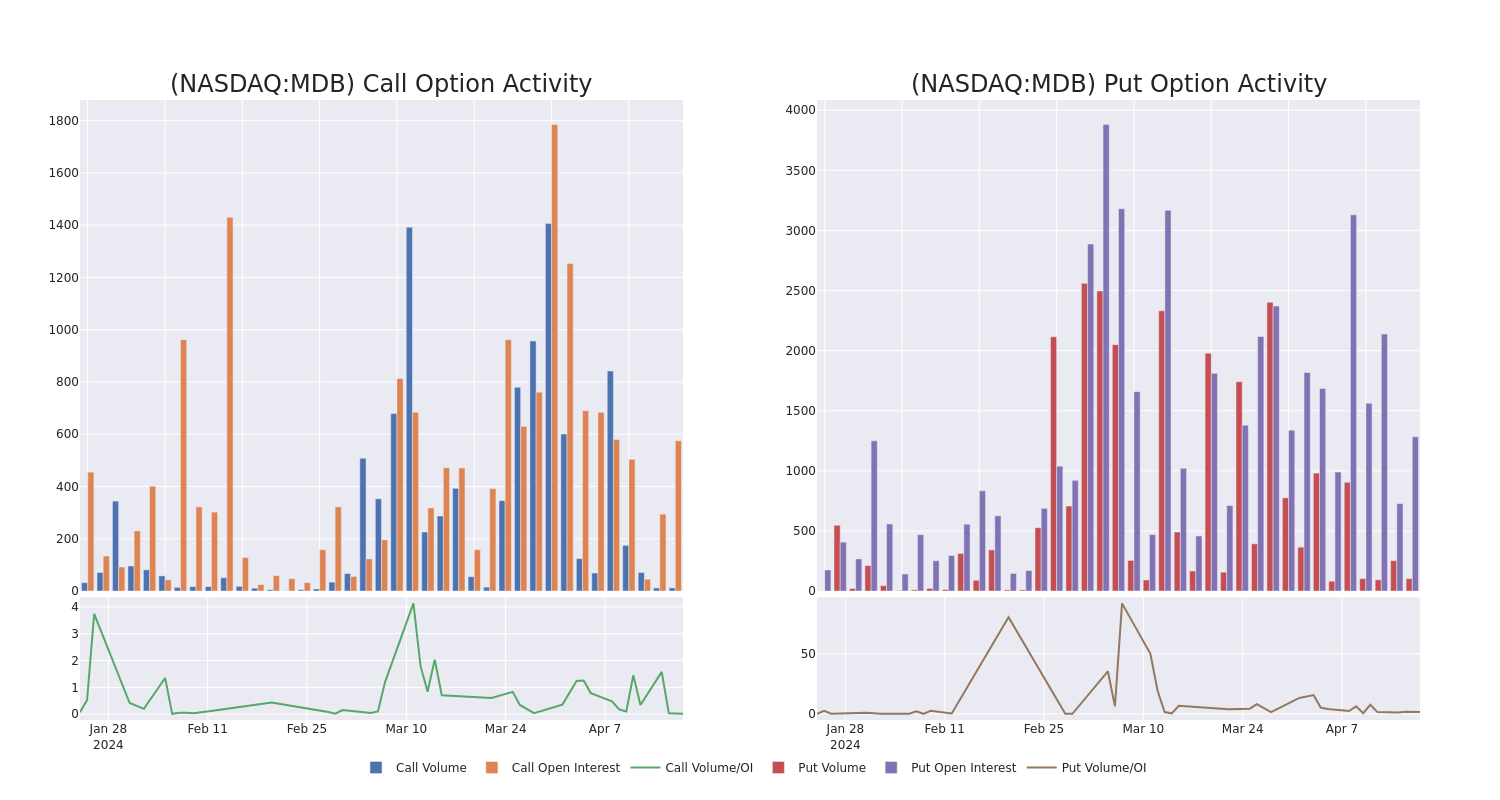

In the following chart, we are able to follow the development of volume and open interest of call and put options for MongoDB's big money trades within a strike price range of $315.0 to $395.0 over the last 30 days.

MongoDB Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MDB |

CALL |

TRADE |

BEARISH |

08/16/24 |

$41.7 |

$40.5 |

$40.5 |

$330.00 |

$117.4K |

0 |

29 |

| MDB |

CALL |

SWEEP |

BULLISH |

05/03/24 |

$21.15 |

$20.6 |

$21.15 |

$315.00 |

$93.0K |

1 |

44 |

| MDB |

PUT |

TRADE |

NEUTRAL |

05/10/24 |

$69.95 |

$60.65 |

$64.55 |

$395.00 |

$77.4K |

3 |

12 |

| MDB |

PUT |

TRADE |

BEARISH |

05/17/24 |

$68.0 |

$68.0 |

$68.0 |

$395.00 |

$40.8K |

0 |

0 |

| MDB |

CALL |

TRADE |

BEARISH |

06/21/24 |

$37.2 |

$36.5 |

$36.65 |

$320.00 |

$36.6K |

13 |

11 |

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Following our analysis of the options activities associated with MongoDB, we pivot to a closer look at the company's own performance.

Current Position of MongoDB

- Currently trading with a volume of 187,669, the MDB's price is up by 0.92%, now at $330.47.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 38 days.

Professional Analyst Ratings for MongoDB

In the last month, 3 experts released ratings on this stock with an average target price of $468.3333333333333.

- An analyst from Needham downgraded its action to Buy with a price target of $465.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for MongoDB, targeting a price of $440.

- An analyst from Tigress Financial has decided to maintain their Buy rating on MongoDB, which currently sits at a price target of $500.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MongoDB with Benzinga Pro for real-time alerts.

Posted In: MDB