Snowflake Unusual Options Activity For April 22

Author: Benzinga Insights | April 22, 2024 09:46am

Investors with a lot of money to spend have taken a bearish stance on Snowflake (NYSE:SNOW).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SNOW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for Snowflake.

This isn't normal.

The overall sentiment of these big-money traders is split between 18% bullish and 81%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $253,126, and 7 are calls, for a total amount of $1,012,366.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $115.0 to $190.0 for Snowflake during the past quarter.

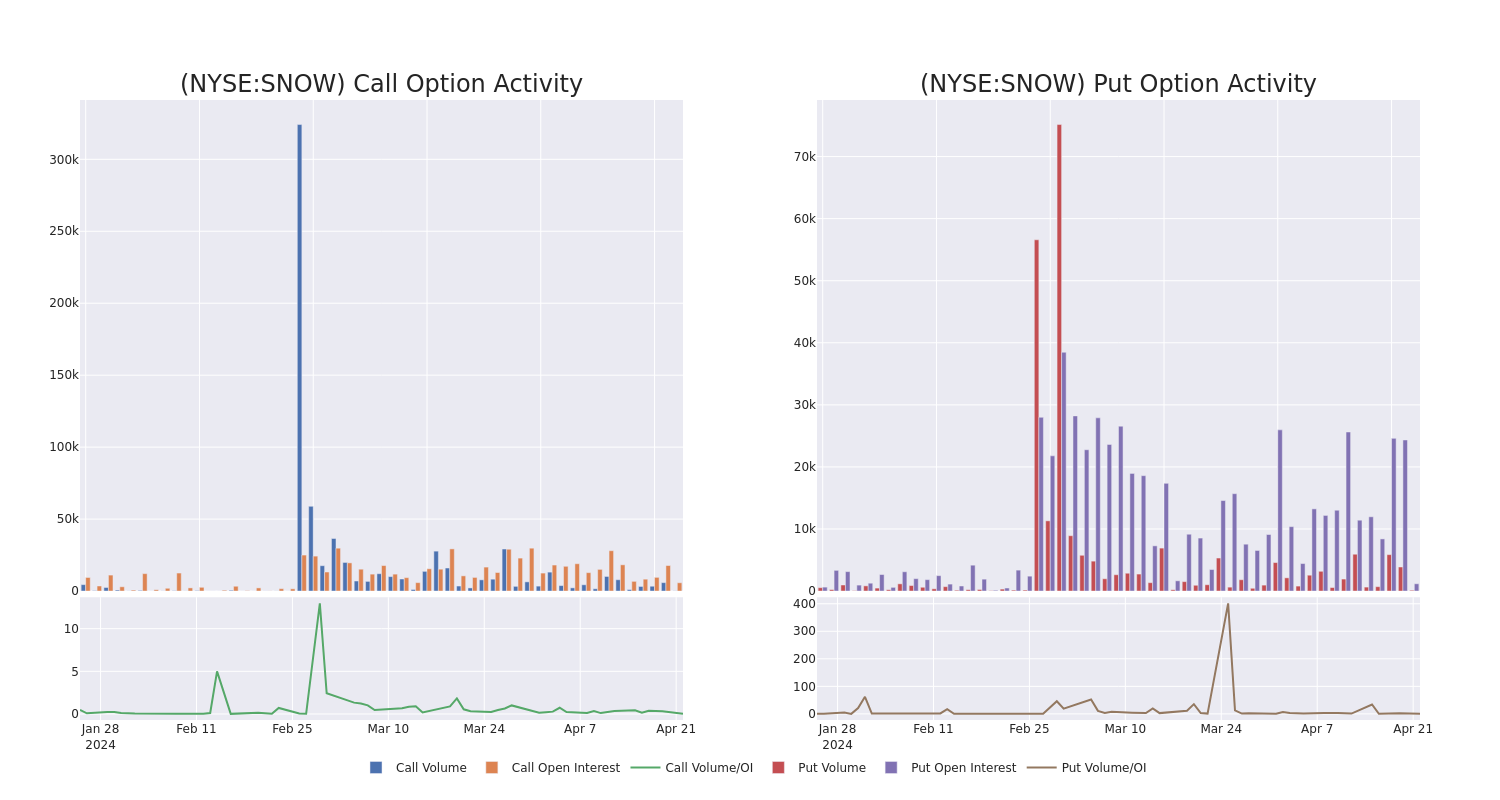

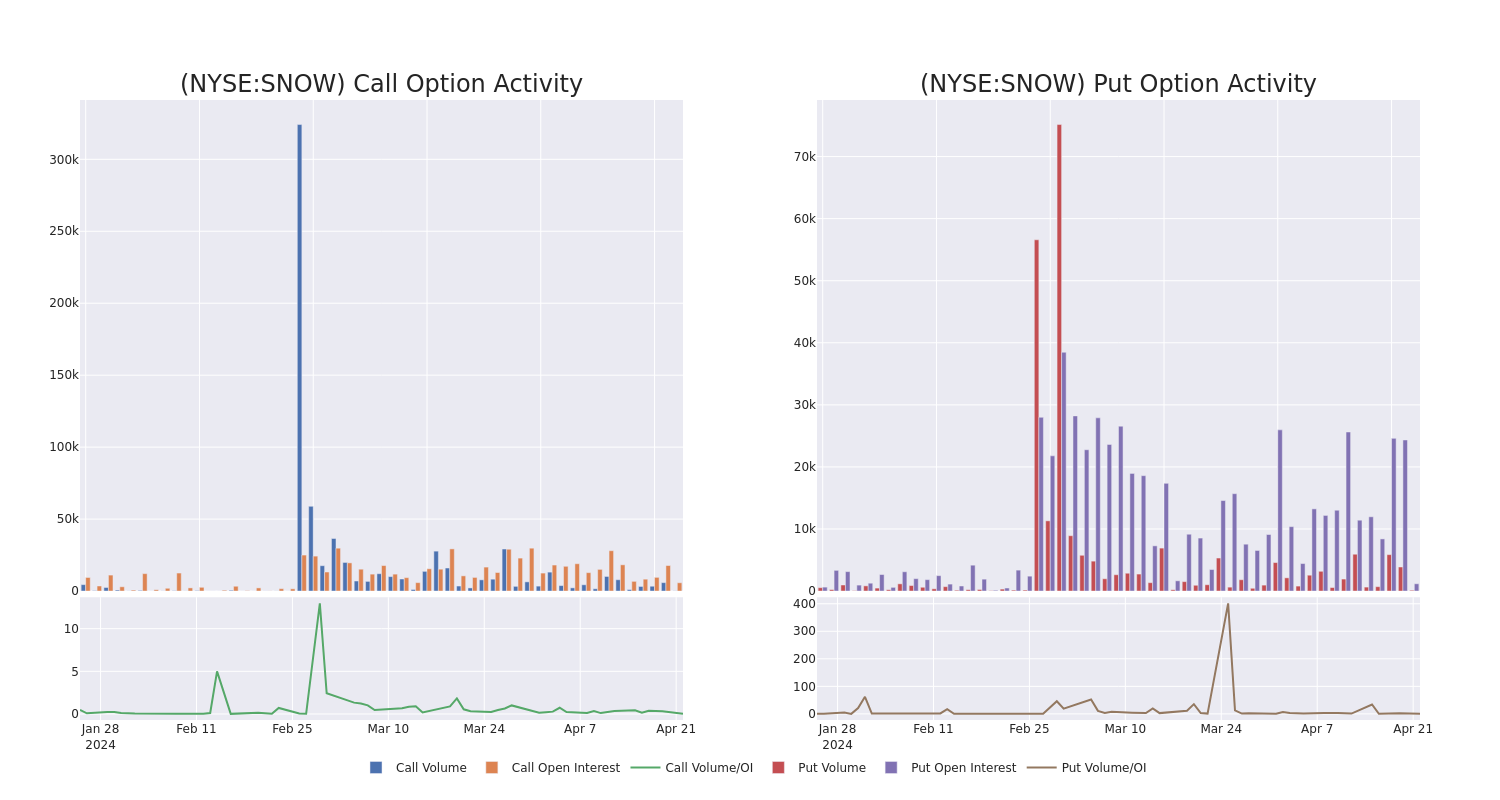

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Snowflake's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Snowflake's substantial trades, within a strike price spectrum from $115.0 to $190.0 over the preceding 30 days.

Snowflake Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SNOW |

CALL |

SWEEP |

NEUTRAL |

05/10/24 |

$4.75 |

$4.7 |

$4.75 |

$150.00 |

$440.5K |

257 |

0 |

| SNOW |

CALL |

TRADE |

BEARISH |

06/21/24 |

$23.85 |

$22.55 |

$23.07 |

$130.00 |

$203.0K |

407 |

0 |

| SNOW |

CALL |

SWEEP |

BULLISH |

05/03/24 |

$3.8 |

$3.75 |

$3.8 |

$150.00 |

$180.4K |

197 |

17 |

| SNOW |

PUT |

SWEEP |

BEARISH |

05/03/24 |

$10.65 |

$9.2 |

$10.35 |

$155.00 |

$103.2K |

343 |

108 |

| SNOW |

PUT |

TRADE |

NEUTRAL |

06/21/24 |

$47.9 |

$42.9 |

$45.29 |

$190.00 |

$63.4K |

601 |

14 |

About Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Current Position of Snowflake

- Currently trading with a volume of 673,148, the SNOW's price is up by 0.28%, now at $145.85.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 30 days.

Professional Analyst Ratings for Snowflake

2 market experts have recently issued ratings for this stock, with a consensus target price of $185.0.

- In a positive move, an analyst from Rosenblatt has upgraded their rating to Buy and adjusted the price target to $185.

- In a cautious move, an analyst from Keybanc downgraded its rating to Overweight, setting a price target of $185.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snowflake with Benzinga Pro for real-time alerts.

Posted In: SNOW