Expert Outlook: BILL Holdings Through The Eyes Of 10 Analysts

Author: Benzinga Insights | April 22, 2024 09:00am

10 analysts have expressed a variety of opinions on BILL Holdings (NYSE:BILL) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

4 |

3 |

1 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

1 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

2 |

3 |

1 |

0 |

0 |

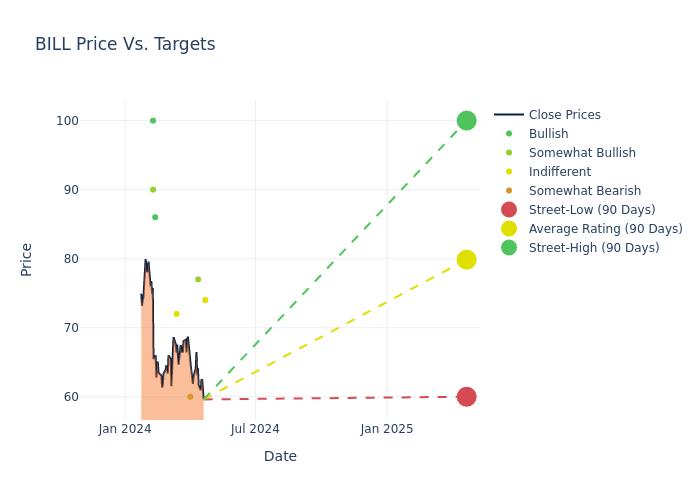

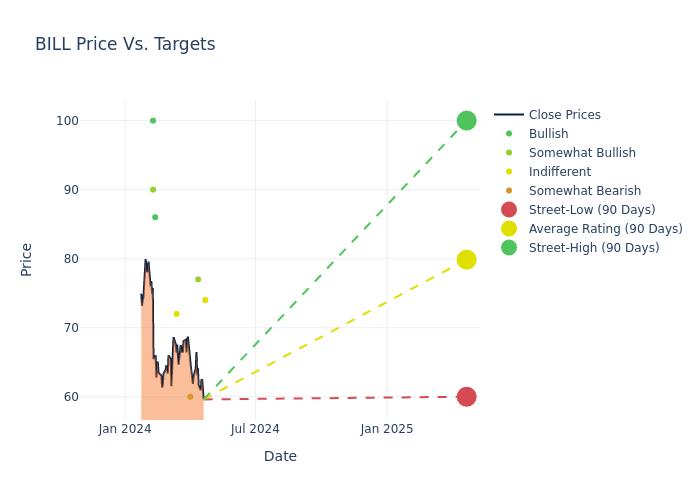

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $81.9, a high estimate of $100.00, and a low estimate of $60.00. A decline of 3.0% from the prior average price target is evident in the current average.

Investigating Analyst Ratings: An Elaborate Study

The analysis of recent analyst actions sheds light on the perception of BILL Holdings by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| David Koning |

Baird |

Lowers |

Neutral |

$74.00 |

$78.00 |

| Clarke Jeffries |

Piper Sandler |

Lowers |

Overweight |

$77.00 |

$95.00 |

| Andrew Bauch |

Wells Fargo |

Lowers |

Underweight |

$60.00 |

$70.00 |

| Thomas Poutrieux |

Exane BNP Paribas |

Announces |

Neutral |

$72.00 |

- |

| Andrew Schmitt |

Citigroup |

Raises |

Buy |

$86.00 |

$85.00 |

| Tien-Tsin Huang |

JP Morgan |

Lowers |

Overweight |

$90.00 |

$93.00 |

| Andrew Bauch |

Wells Fargo |

Lowers |

Equal-Weight |

$70.00 |

$75.00 |

| Scott Berg |

Needham |

Maintains |

Buy |

$100.00 |

- |

| Brent Bracelin |

Piper Sandler |

Maintains |

Overweight |

$95.00 |

- |

| Brent Bracelin |

Piper Sandler |

Maintains |

Overweight |

$95.00 |

$95.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to BILL Holdings. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of BILL Holdings compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for BILL Holdings's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of BILL Holdings's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on BILL Holdings analyst ratings.

Discovering BILL Holdings: A Closer Look

BILL Holdings Inc is a provider of software-as-a-service, cloud-based payments and spend and expense management products, which allow users to automate accounts payable and accounts receivable transactions, enable businesses to easily connect with their suppliers or customers to do business, eliminate expense reports, manage cash flows and improve back office efficiency. Initial Public Offering and Follow-on Offering.

BILL Holdings's Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, BILL Holdings showcased positive performance, achieving a revenue growth rate of 22.5% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: BILL Holdings's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -12.69%, the company may face hurdles in effective cost management.

Return on Equity (ROE): BILL Holdings's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -1.0%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.41%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: BILL Holdings's debt-to-equity ratio stands notably higher than the industry average, reaching 0.48. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BILL