Key Takeaways From Ocugen Analyst Ratings

Author: Benzinga Insights | April 22, 2024 08:01am

4 analysts have expressed a variety of opinions on Ocugen (NASDAQ:OCGN) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

0 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

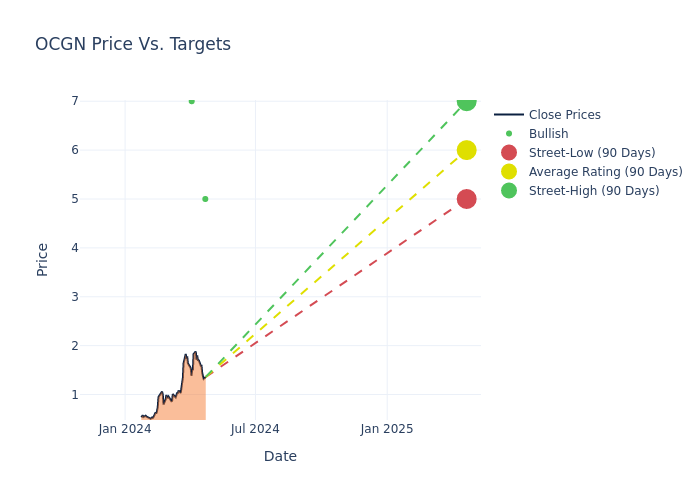

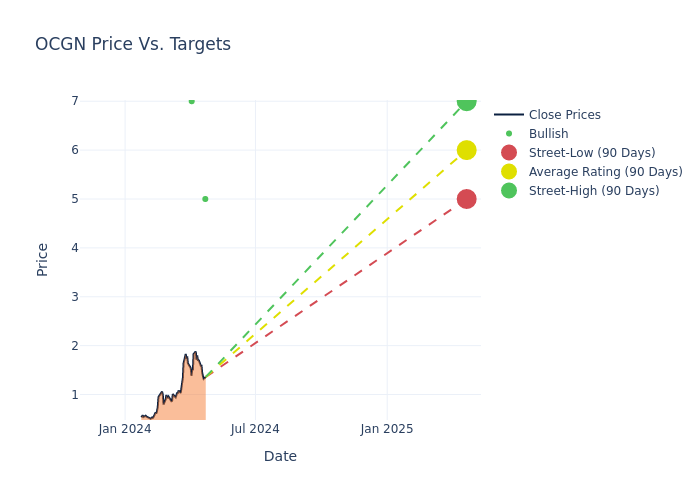

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $6.5, with a high estimate of $7.00 and a low estimate of $5.00. This current average has increased by 44.44% from the previous average price target of $4.50.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Ocugen by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Daniil Gataulin |

Chardan Capital |

Raises |

Buy |

$5.00 |

$4.00 |

| Swayampakula Ramakanth |

HC Wainwright & Co. |

Maintains |

Buy |

$7.00 |

- |

| Swayampakula Ramakanth |

HC Wainwright & Co. |

Maintains |

Buy |

$7.00 |

- |

| Swayampakula Ramakanth |

HC Wainwright & Co. |

Raises |

Buy |

$7.00 |

$5.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Ocugen. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ocugen compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Ocugen's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Ocugen's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Ocugen analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Ocugen's Background

Ocugen Inc company focused on discovering, developing, and commercializing novel gene and cell therapies and vaccines that improve health and offer hope for patients across the globe. The company's pipeline includes Modifier Gene Therapy Platform, Novel Biologic Therapy for Retinal Diseases, Regenerative Medicine Cell Therapy Platform. The company is developing a modifier gene therapy platform designed to fulfill unmet medical needs related to retinal diseases, including inherited retinal diseases ("IRDs"), such as RP, LCA, Stargardt disease, and multifactorial diseases such as dAMD and Geographic Atrophy ("GA").

Ocugen's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Ocugen's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 142.6%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Ocugen's net margin excels beyond industry benchmarks, reaching -157.27%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -19.19%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -13.64%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Ocugen's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.17.

The Basics of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: OCGN