Decoding Morgan Stanley's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 19, 2024 02:01pm

Deep-pocketed investors have adopted a bearish approach towards Morgan Stanley (NYSE:MS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Morgan Stanley. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 66% bearish. Among these notable options, 11 are puts, totaling $398,379, and 7 are calls, amounting to $274,217.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $95.0 for Morgan Stanley over the recent three months.

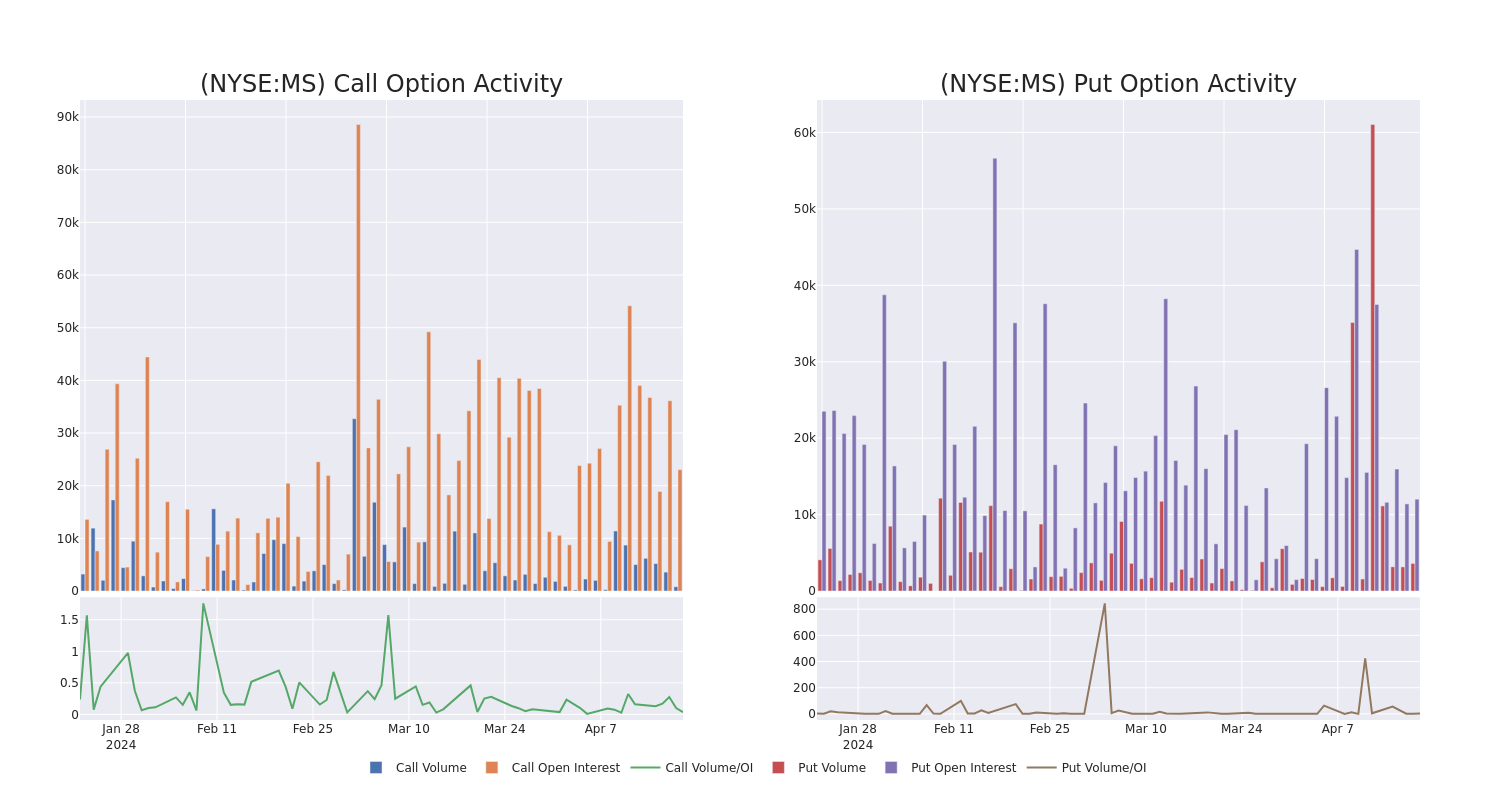

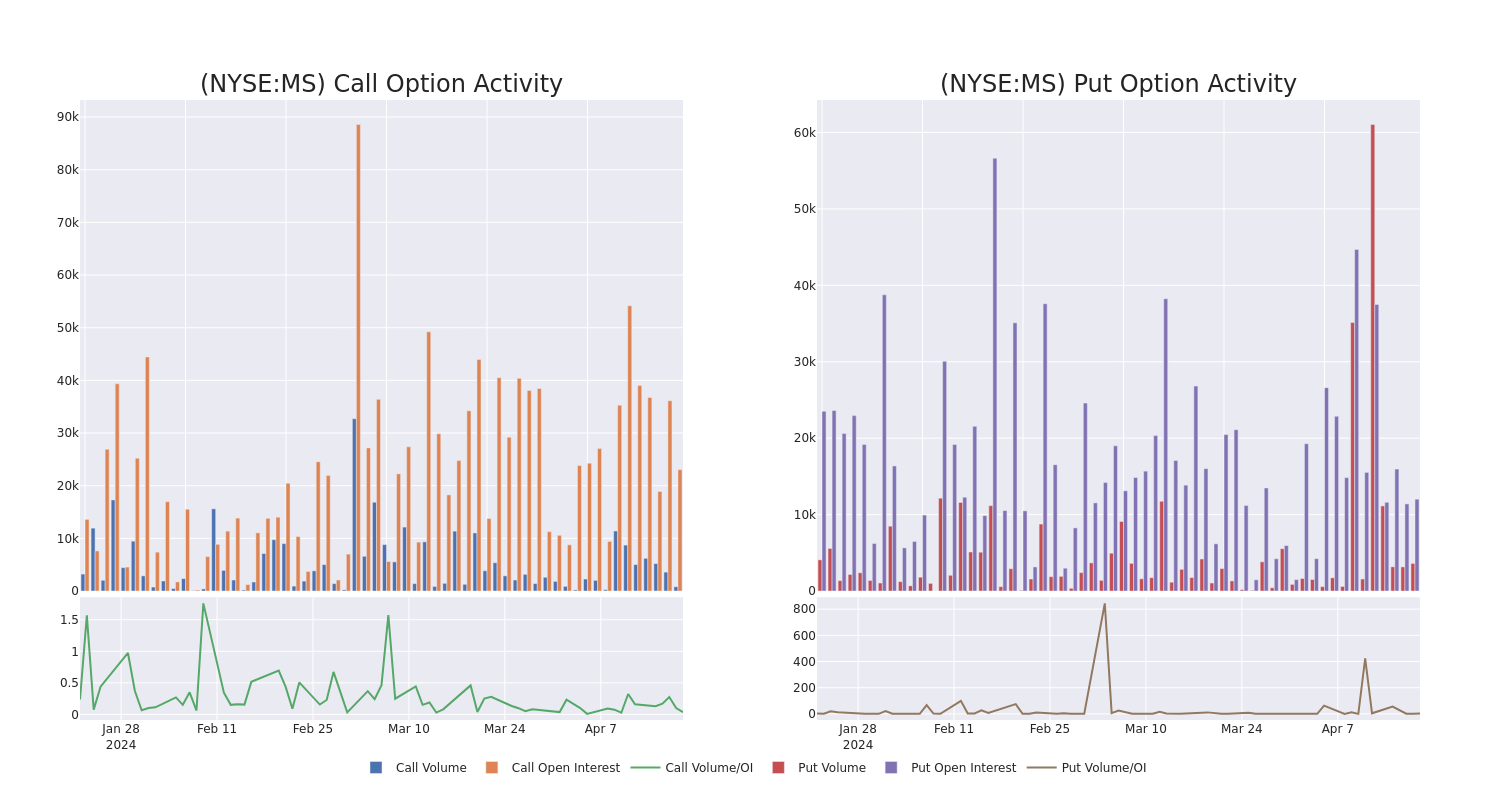

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Morgan Stanley options trades today is 2923.0 with a total volume of 4,429.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Morgan Stanley's big money trades within a strike price range of $75.0 to $95.0 over the last 30 days.

Morgan Stanley Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MS |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$2.83 |

$2.8 |

$2.83 |

$92.50 |

$50.9K |

6.2K |

198 |

| MS |

PUT |

SWEEP |

NEUTRAL |

07/19/24 |

$6.35 |

$6.3 |

$6.33 |

$95.00 |

$50.7K |

929 |

81 |

| MS |

PUT |

TRADE |

BEARISH |

07/19/24 |

$6.35 |

$6.25 |

$6.32 |

$95.00 |

$50.5K |

929 |

241 |

| MS |

PUT |

SWEEP |

NEUTRAL |

07/19/24 |

$6.45 |

$6.35 |

$6.4 |

$95.00 |

$48.0K |

929 |

316 |

| MS |

CALL |

TRADE |

NEUTRAL |

04/19/24 |

$11.5 |

$11.25 |

$11.36 |

$80.00 |

$45.4K |

1.0K |

172 |

About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments. The company had over $4 trillion of client assets as well as over 80,000 employees at the end of 2022. Approximately 50% of the company's net revenue is from its institutional securities business, with the remainder coming from wealth and investment management. The company derives about 30% of its total revenue outside the Americas.

Having examined the options trading patterns of Morgan Stanley, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Morgan Stanley Standing Right Now?

- Currently trading with a volume of 3,865,476, the MS's price is up by 1.12%, now at $91.27.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 88 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Morgan Stanley, Benzinga Pro gives you real-time options trades alerts.

Posted In: MS