PepsiCo's Options Frenzy: What You Need to Know

Author: Benzinga Insights | April 19, 2024 12:46pm

Deep-pocketed investors have adopted a bearish approach towards PepsiCo (NASDAQ:PEP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PEP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for PepsiCo. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 62% bearish. Among these notable options, 4 are puts, totaling $102,560, and 4 are calls, amounting to $347,464.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $195.0 for PepsiCo over the last 3 months.

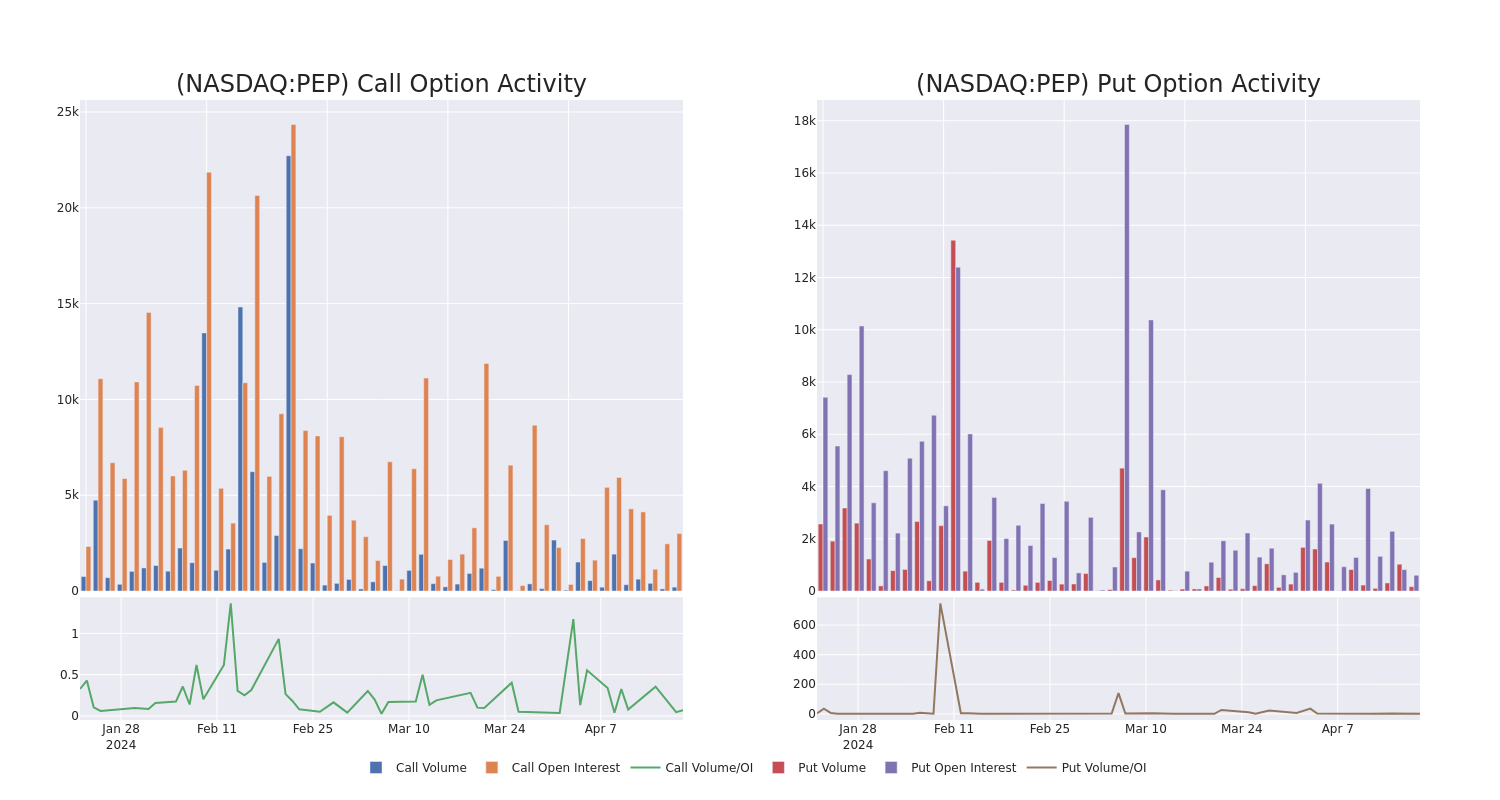

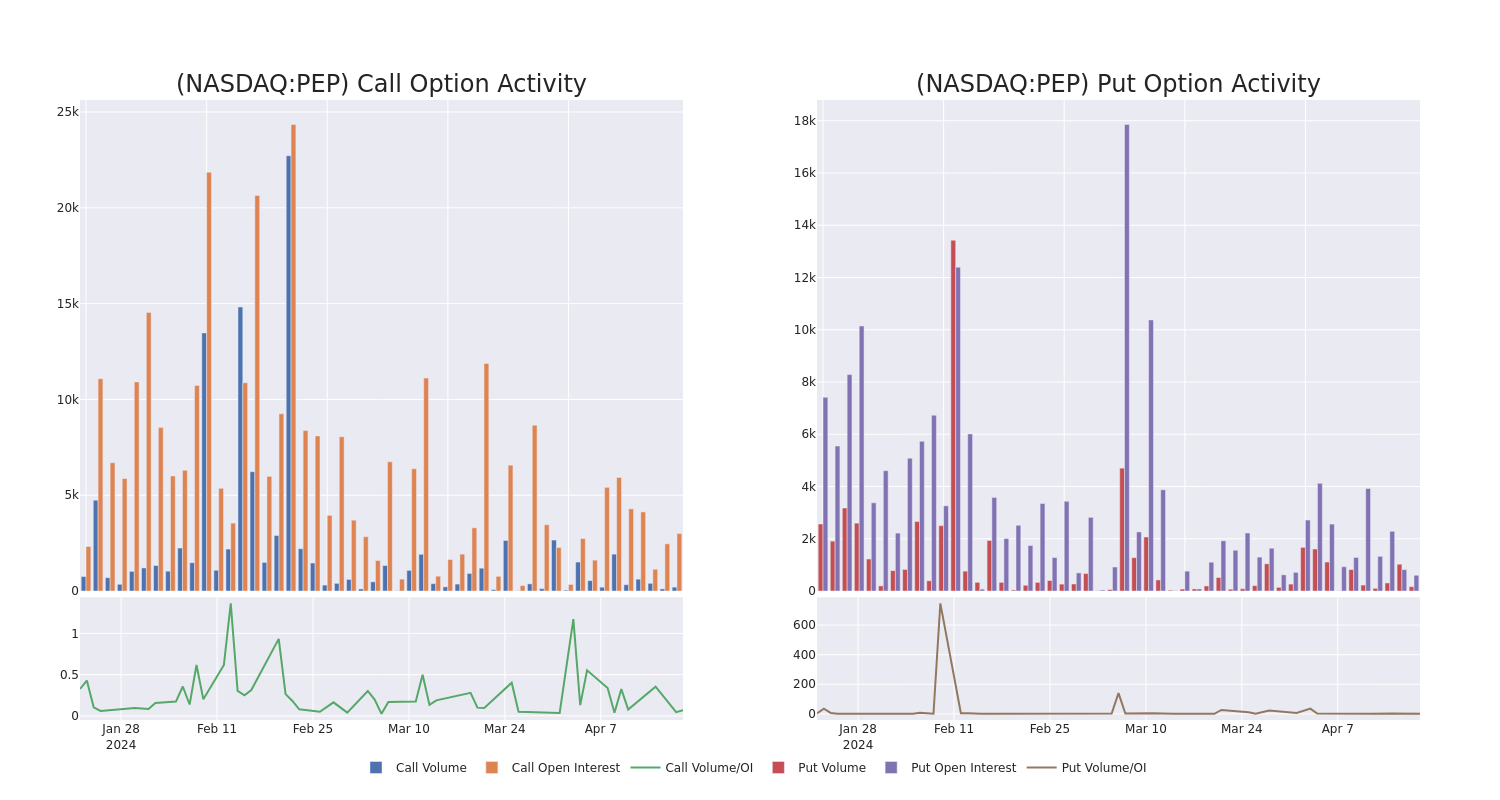

Volume & Open Interest Trends

In today's trading context, the average open interest for options of PepsiCo stands at 600.33, with a total volume reaching 372.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in PepsiCo, situated within the strike price corridor from $155.0 to $195.0, throughout the last 30 days.

PepsiCo Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PEP |

CALL |

TRADE |

BEARISH |

01/16/26 |

$30.7 |

$28.6 |

$29.4 |

$155.00 |

$199.9K |

215 |

68 |

| PEP |

CALL |

SWEEP |

NEUTRAL |

01/16/26 |

$15.95 |

$15.2 |

$15.2 |

$180.00 |

$88.1K |

198 |

0 |

| PEP |

CALL |

SWEEP |

NEUTRAL |

09/20/24 |

$7.15 |

$7.05 |

$7.1 |

$175.00 |

$30.5K |

2.4K |

85 |

| PEP |

CALL |

TRADE |

BULLISH |

10/18/24 |

$5.75 |

$5.7 |

$5.77 |

$180.00 |

$28.8K |

167 |

52 |

| PEP |

PUT |

TRADE |

BEARISH |

01/16/26 |

$25.9 |

$25.9 |

$25.9 |

$195.00 |

$25.9K |

42 |

20 |

About PepsiCo

PepsiCo is a global leader in snacks and beverages, owning well-known household brands including Pepsi, Mountain Dew, Gatorade, Lay's, Cheetos, and Doritos, among others. The company dominates the global savory snacks market and also ranks as the second-largest beverage provider in the world (behind Coca-Cola) with diversified exposure to carbonated soft drinks, or CSD, as well as water, sports, and energy drink offerings. Convenience foods account for approximately 55% of its total revenue, with beverages making up the rest. Pepsi owns the bulk of its manufacturing and distribution capacity in the United States and overseas. International markets make up 40% of total sales and one third of operating profits.

In light of the recent options history for PepsiCo, it's now appropriate to focus on the company itself. We aim to explore its current performance.

PepsiCo's Current Market Status

- Trading volume stands at 2,283,948, with PEP's price up by 0.19%, positioned at $172.59.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 4 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for PepsiCo, Benzinga Pro gives you real-time options trades alerts.

Posted In: PEP