Unpacking the Latest Options Trading Trends in Qualcomm

Author: Benzinga Insights | April 19, 2024 12:45pm

Investors with a lot of money to spend have taken a bearish stance on Qualcomm (NASDAQ:QCOM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QCOM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 69 uncommon options trades for Qualcomm.

This isn't normal.

The overall sentiment of these big-money traders is split between 39% bullish and 60%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $355,404, and 62 are calls, for a total amount of $7,109,290.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $115.0 to $210.0 for Qualcomm over the recent three months.

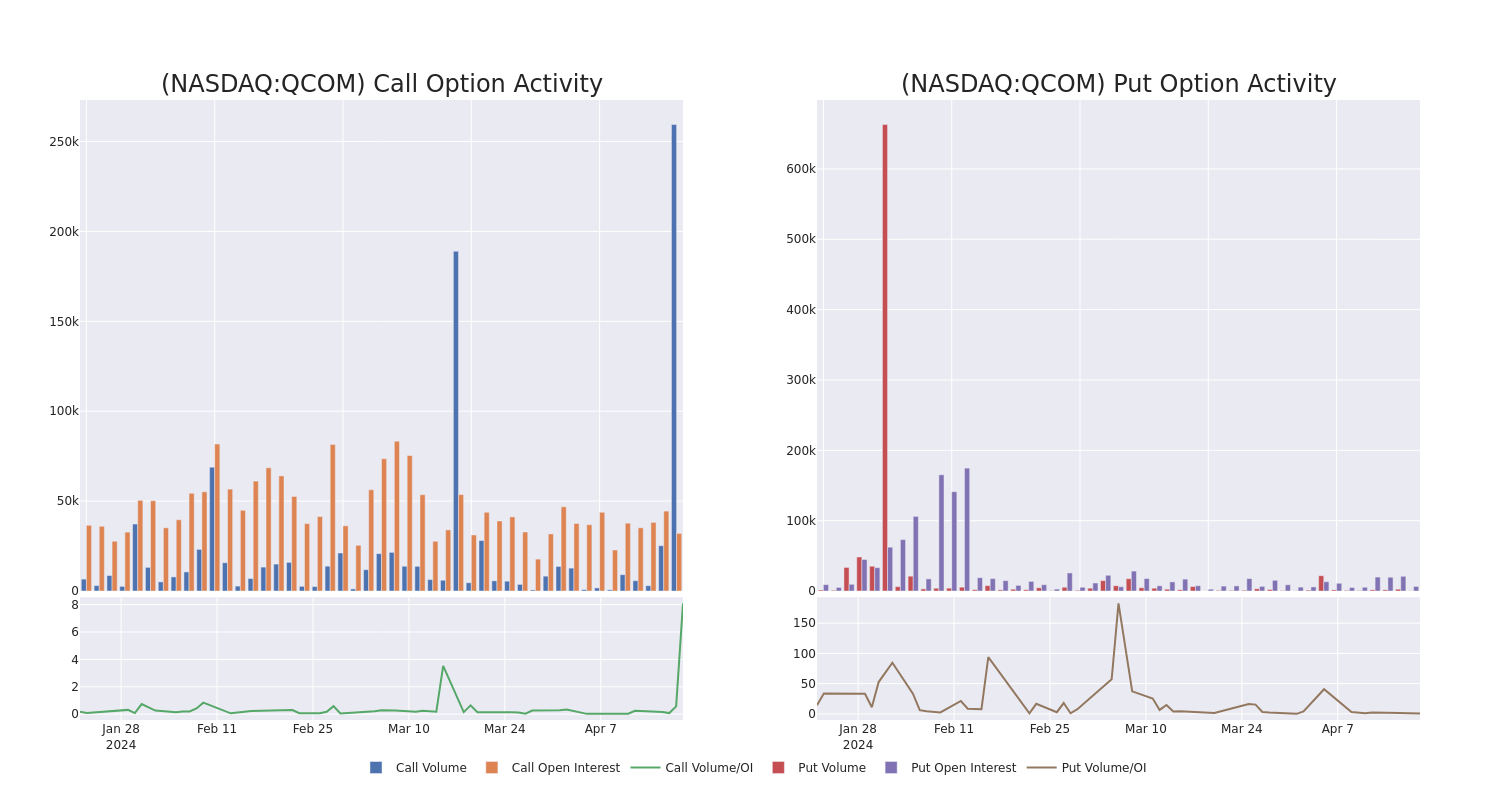

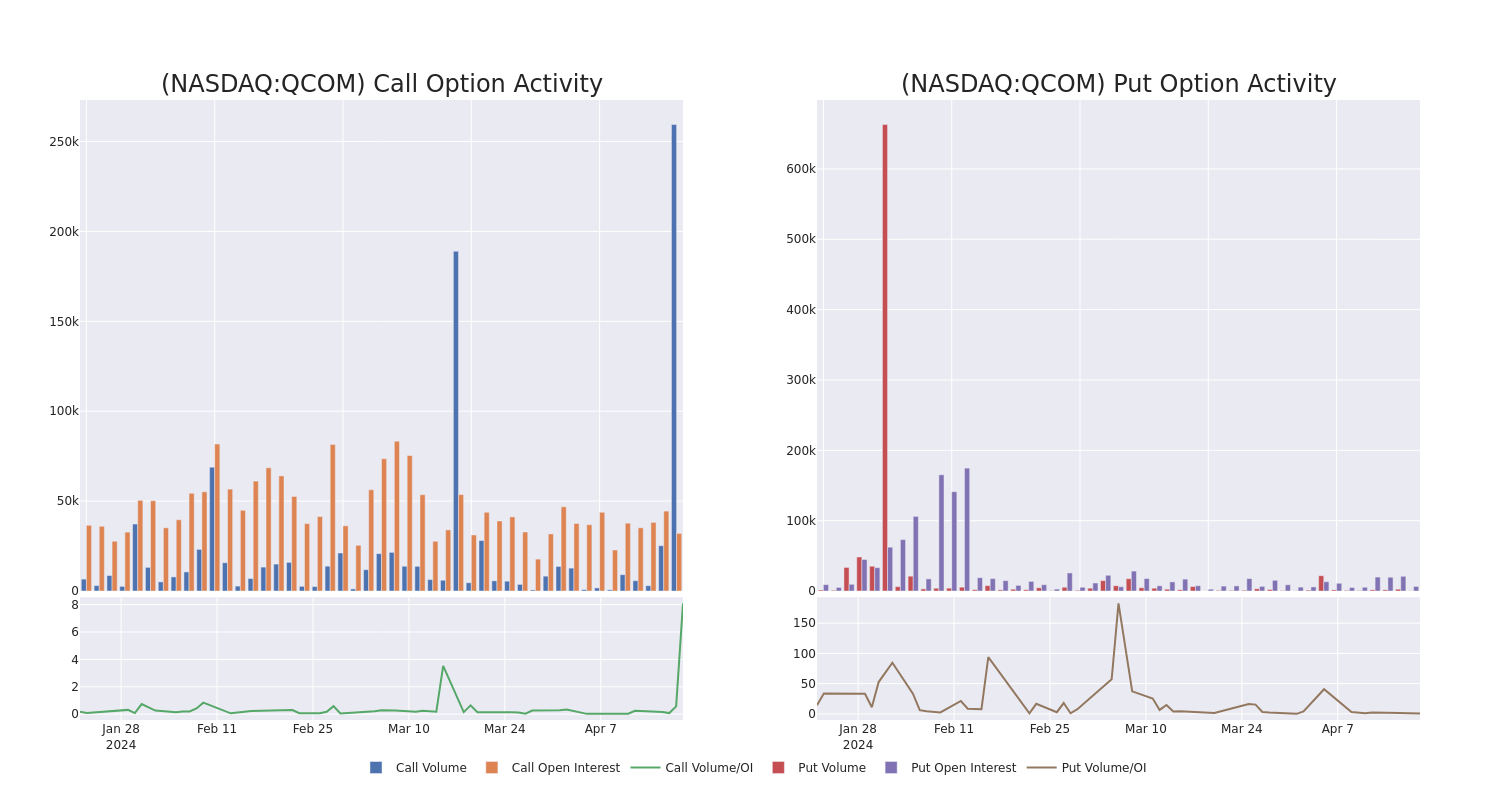

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Qualcomm options trades today is 2412.75 with a total volume of 259,779.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Qualcomm's big money trades within a strike price range of $115.0 to $210.0 over the last 30 days.

Qualcomm Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| QCOM |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$5.4 |

$5.25 |

$5.25 |

$210.00 |

$525.0K |

7.0K |

3.0K |

| QCOM |

CALL |

TRADE |

BULLISH |

01/17/25 |

$5.15 |

$5.1 |

$5.15 |

$210.00 |

$514.4K |

7.0K |

4.4K |

| QCOM |

CALL |

SWEEP |

BULLISH |

01/17/25 |

$5.1 |

$4.95 |

$4.95 |

$210.00 |

$513.4K |

7.0K |

6.5K |

| QCOM |

CALL |

SWEEP |

NEUTRAL |

01/17/25 |

$5.3 |

$5.25 |

$5.3 |

$210.00 |

$442.0K |

7.0K |

1.8K |

| QCOM |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$5.35 |

$5.3 |

$5.35 |

$210.00 |

$367.5K |

7.0K |

992 |

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

In light of the recent options history for Qualcomm, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Qualcomm

- With a trading volume of 2,902,941, the price of QCOM is down by -2.31%, reaching $157.71.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 12 days from now.

Professional Analyst Ratings for Qualcomm

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $194.25.

- Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Neutral rating on Qualcomm with a target price of $190.

- An analyst from Evercore ISI Group downgraded its action to In-Line with a price target of $177.

- An analyst from Keybanc persists with their Overweight rating on Qualcomm, maintaining a target price of $205.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Qualcomm with a target price of $205.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Qualcomm, Benzinga Pro gives you real-time options trades alerts.

Posted In: QCOM